NZD/USD Technical Analysis: Top Below 0.71 Intact for Now

DailyFX.com -

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

NZD/USD Technical Strategy: Flat

Kiwi Dollar surge negates trend line break but top sub-0.71 intact for now

Waiting to re-establish short when another attractive opportunity emerges

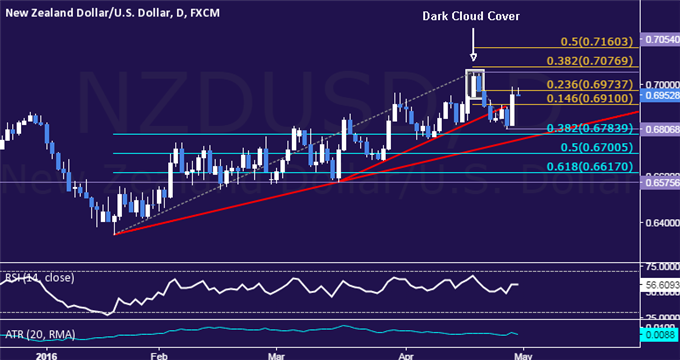

The New Zealand Dollar launched aggressively higher against its US counterpart, issuing the largest daily advance in nearly three months. Prices negated a break of monthly trend support from earlier in the week but the top established by a bearish Dark Cloud Cover candle pattern below 0.71 remains in place for now.

A daily close above the 23.6% Fibonacci expansion at 0.6974 exposes the 0.705477 area, marked by the April 19 high and the 38.2% level. Alternatively, a turn below the 14.6% Fib at 0.6910 paves the way for a test of the 0.6784-6807 area (38.2% Fib retracement, April 27 low).

We entered short NZD/USD at 0.6895. The trade hit its first objective after the FOMC rate decision and we booked partial profits. The remainder of the position was stopped out at breakeven after the RBNZ policy announcement. We will take to the sidelines from here, waiting for a new selling opportunity to emerge.

What do FXCM traders’ NZD/USD bets imply about the price trend? Find out here!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance