NZD/USD Rebound Eyes 0.7600- AUD/USD Remains Oversold

DailyFX.com -

Talking Points:

- AUD/USD Remains Oversold Despite China Rate Cut- RSI in Focus.

- NZD/USD Rebound to Gather Pace as Strong NZ Employment Curbs Bets for Rate Cut.

- USDOLLAR Fails to Benefit From Upbeat ISM Non-Manufacturing as Employment Component Slows.

For more updates, sign up for David's e-mail distribution list.

AUD/USD

Chart - Created Using FXCM Marketscope 2.0

AUD/USD outlook remains bearish as the Relative Strength Index (RSI) struggles to come off of oversold territory & retains the downward trend from back in June.

More monetary easing from China – Australia’s largest trading partner – may limit pressure on the Reserve Bank of Australia (RBA) to implement additional rate cuts, but looks as though Governor Glenn Stevens will retain the verbal intervention in the higher-yielding currency.

DailyFX Speculative Sentiment Index (SSI) may highlight a potential shift in retail positioning amid the string of lower-highs in the ratio, which currently stands at +1.01.

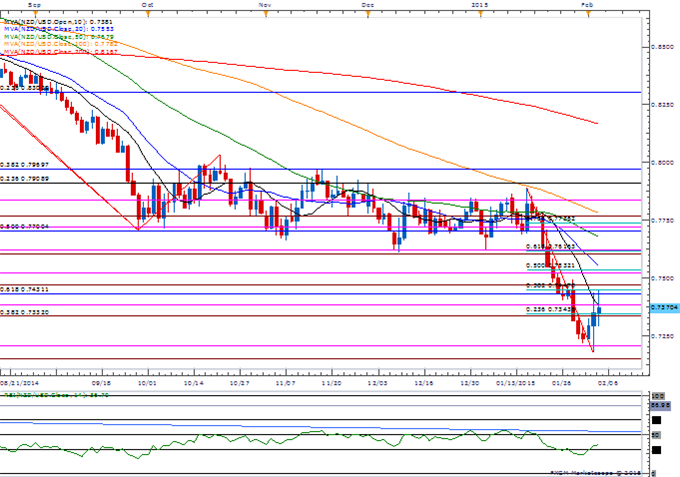

NZD/USD

NZD/USD may face a larger rebound as New Zealand’s Employment report shows discouraged workers returning to the labor force, which could limit the Reserve Bank of New Zealand’s (RBNZ) scope to reduce the benchmark interest rate.

May see higher milk-powder prices boost the appeal of the kiwi over the near-term as the drought spurs concerns of a supply-side threat.

As the RSI comes off of oversold territory, NZD/USD looks poised for a larger correction, with the key focus standing at the former support zone around 0.7600 (38.2% expansion) to 0.7620 (61.8% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: The Sterling Threshold

SPX500 - Neither Here Nor There

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11801.90 | 11808.8 | 11769.68 | 0.11 | 56.46% |

Chart - Created Using FXCM Marketscope 2.0

Dow Jones-FXCM U.S. Dollar may continue to face range-bound prices ahead of the highly anticipated Non-Farm Payrolls (NFP) report on another close above 11,774 (50% expansion).

Despite the better-than-expected headline reading for the ISM Non-Manufacturing survey, the employment component does not bode well for NFP as it slowed to 51.6 in January; marking the lowest reading since the contraction back in February 2014.

With the RSI coming off of oversold territory, will keep a close eye on the bullish RSI momentum as a break to the downside may highlight a larger correction for USDOLLAR; former resistance around 11,721 (38.2% expansion) remains in focus.

Join DailyFX on Demand for Real-Time SSI Updates!

Release | GMT | Expected | Actual |

MBA Mortgage Applications (JAN 30) | 12:00 | -- | 1.3% |

ADP Employment Change (JAN) | 13:15 | 223K | 213K |

Markit Purchasing Manager Index Services (JAN F) | 14:45 | 54.1 | 54.2 |

Markit Purchasing Manager Index Composite (JAN F) | 14:45 | -- | 54.4 |

ISM Non-Manufacturing (JAN) | 15:00 | 56.4 | |

Fed’s Jerome Powell Speaks on U.S. Economy | 15:00 | ||

Fed’s Loretta Mester Speaks on U.S. Economy | 17:45 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance