NY Times (NYT) Q1 Earnings Beat, Weak Ad Revenues a Concern

The New York Times Company NYT reported third straight quarter of positive earnings surprise in first-quarter 2020. However, total revenues marginally fell short the Zacks Consensus Estimate for the fifth quarter in row. While the top line increased, the bottom line declined year over year.

Notably, the company registered higher digital-only subscriptions during the quarter under review. However, we note that both print and digital advertising revenues showcased a decline from the year-ago period. Looking into the second quarter, management cautioned about sharp fall in advertising revenues, owing to coronavirus pandemic that compelled industries across the board to curtail marketing expenditures.

We note that this Zacks Rank #3 (Hold) stock has fallen 8.6% compared with the industry’s decline of 9.5% in the past three months.

Let’s Delve Deep

The company delivered adjusted earnings from continuing operations of 17 cents a share that beat the Zacks Consensus Estimate of 13 cents but declined 15% from the year-ago period. The newspaper publisher's total revenues of $443.6 million rose 1% year over year but came marginally below the Zacks Consensus Estimate of $444.1 million.

Subscription revenues improved 5.4% to $285.4 million principally due to increase in the number of subscriptions to the company’s digital-only products, which include news product, as well as Cooking, Crossword and audio products. Notably, the company has recently acquired a subscription-based audio app, Audm. Revenues from digital-only products jumped 18.3% to $130 million.

Management now projects second-quarter 2020 total subscription revenues to increase in the mid-to-high-single digits, while digital-only subscription revenues are projected to rise in the high-twenties.

Total advertising revenues came in at $106.1 million in the reported quarter, down 15.2% year over year. In the preceding quarter, total advertising revenues declined 10.7%. Total advertising revenues in the second quarter are estimated to decline approximately 50-55%.

Print advertising revenues fell 20.9% to $55 million in the quarter under review, following a decline of 10.5% in the preceding quarter. The fall in print advertising revenues was noticed in the the luxury, media, entertainment and financial categories.

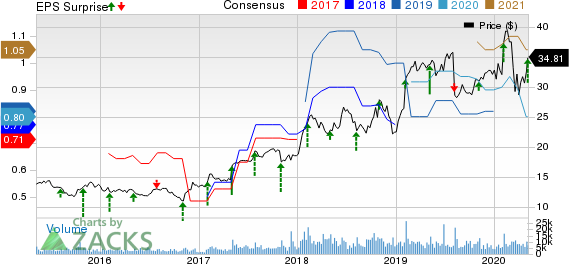

The New York Times Company Price, Consensus and EPS Surprise

The New York Times Company price-consensus-eps-surprise-chart | The New York Times Company Quote

Digital advertising revenues decreased 7.9% to $51.2 million, following a decline of 10.8% in the preceding quarter. The fall in digital advertising revenues were owing to strong comparisons with the prior year and reduced demand for direct-sold advertising due the pandemic. Management expects digital advertising revenues to decrease roughly 40-45% in the second quarter.

We note that other revenues surged 20.6% to $52.1 million during the quarter under review primarily driven by revenues earned from television series, The Weekly, and licensing revenues related to Facebook News. Management anticipates other revenues to decline approximately 10% in the second quarter.

Adjusted operating costs rose 3.3% to $399.3 million during the quarter. Management anticipates adjusted operating costs to be flat or down in the low-single digits in the second quarter. The company is deferring non-essential spending but intends to sustain investment into growing digital subscription business. Total adjusted operating profit fell 15.4% to $44.3 million during the quarter under review.

Other Financial Aspects

The New York Times Company ended the quarter with cash and marketable securities of about $686.9 million. The company has a $250 million revolving line of credit through 2024. As of Mar 29, 2020, there were no outstanding borrowings under the credit facility, and neither the company had other outstanding debt obligations. It incurred capital expenditures of about $12 million during the quarter. Management envisions capital expenditures of about $50 million in 2020.

Wrapping Up

The New York Times Company has come a long way from being a sole provider of news content and advertising on print publications. The company is no longer restricted to print. As readers swarmed to the Internet, advertisers followed suit and so did newspaper companies. Trimmed print operations paved way for online publications that led to the development of paywalls, as adopted by the company.

The company notified that the number of paid digital subscribers reached roughly 5,001,000 at the end of first quarter of 2020 – rising 587,000 sequentially and 1,399,000 year over year. Of the 587,000 total net additions, 468,000 came from the digital news product, while remaining came from Cooking, Crossword and audio products.

Key Picks

Eventbrite, Inc. EB, which carries a Zacks Rank #2 (Buy), reported a positive earnings surprise in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Netflix NFLX, which carries a Zacks Rank #2, has a long-term earnings growth rate of 30%.

Roku, Inc. ROKU has a long-term earnings growth rate of 11.5%. The stock carries a Zacks Rank #2.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix Inc (NFLX) : Free Stock Analysis Report

The New York Times Company (NYT) : Free Stock Analysis Report

Roku Inc (ROKU) : Free Stock Analysis Report

Eventbrite Inc (EB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance