Is Now The Time To Put Grange Resources (ASX:GRR) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Grange Resources (ASX:GRR). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Grange Resources

How Fast Is Grange Resources Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Grange Resources has grown EPS by 50% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Grange Resources shareholders can take confidence from the fact that EBIT margins are up from 20% to 43%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

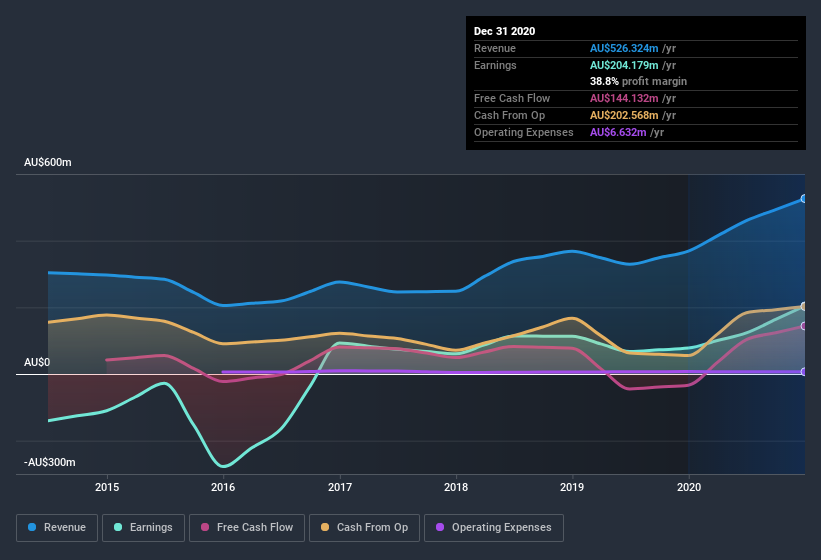

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Grange Resources Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first; I didn't see insiders sell Grange Resources shares in the last year. But the really good news is that CEO, MD & Executive Director Honglin Zhao spent AU$293k buying stock stock, at an average price of around AU$0.23. Big buys like that give me a sense of opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Grange Resources bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$48m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 8.5% of the company; visible skin in the game.

Should You Add Grange Resources To Your Watchlist?

Grange Resources's earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Grange Resources belongs on the top of your watchlist. However, before you get too excited we've discovered 2 warning signs for Grange Resources that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Grange Resources, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance