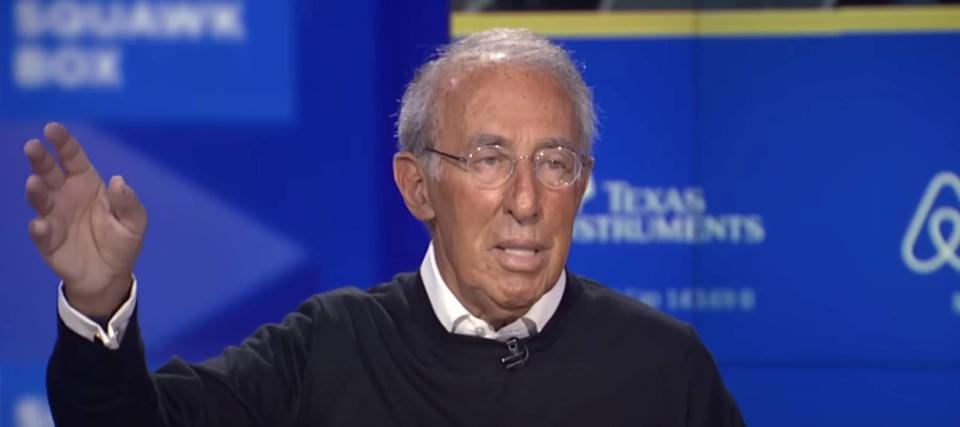

‘Now is the bottom’: Ron Baron says Tesla to ‘go up huge now’ and all cars will be electric in 10-15 years

Tesla (TSLA) remains one of the most volatile names in the stock market. Year to date, its shares have fallen by 32%, yet they have surged by nearly 900% over the past five years.

Billionaire investor Ron Baron is unfazed by the recent pullback in the electric vehicle company’s share price. During a recent interview with CNBC, the Baron Capital founder expressed his unwavering optimism about the stock’s potential.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

“It’s going to go up huge, now,” he said, adding that “now is the bottom.”

Low-cost model to the rescue?

There are many reasons why a stock may rise or fall. Baron has his own explanation for why Tesla shares tumbled this year.

“When I think about the reason the stock is down, it’s because people were concerned that Tesla CEO Elon Musk was going to abandon the idea of having a low-cost car and go all into robotaxis,” he suggested.

Musk isn’t abandoning that idea. Previously, Tesla expected to start production of new affordable EV models in the second half of 2025. However, during Tesla’s latest earnings conference call, Musk updated the timeline, stating, “we expect it to be more like the early 2025, if not late this year.”

Tesla shares surged following Musk’s remarks, despite the quarter itself being less than stellar.

In Q1, the EV company generated $21.3 billion in revenue, down 9% year over year. Adjusted earnings came in at 45 cents per share for the quarter, compared to 85 cents per share in the year-ago period. Both figures fell short of Wall Street’s expectations.

Read more: Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

All cars to become electric?

Baron envisions a rapid timeline for the U.S. automotive industry's shift from internal combustion engines to battery-powered EVs.

“Electric cars, I think, is going to be all the cars 10-15 years from now,” he said.

And even hybrids won’t endure the transition, according to the billionaire investor. He described hybrids as “too expensive,” “not effective enough” and therefore, they will not be “part of the mix.”

Tesla is leading the charge in this transition. Data from Kelley Blue Book indicates that 55% of the EVs purchased by Americans in 2023 were Tesla products.

"While that figure is down from 65% in 2022, Tesla's aggressive campaign of price cuts helped it retain its top position in 2023. The price cuts brought Tesla's two most affordable cars – the Model Y SUV and Model 3 sedan – into closer reach for more Americans. In fact, one out of every three EVs sold in 2023 was a Tesla Model Y," said the press release.

Baron has already made a fortune for himself and his clients from his Tesla investment. How much higher can the stock go?

Last year, Baron told MarketWatch that he expects Tesla to achieve a market cap of $4 trillion within 10 years. Tesla currently has a market cap of around $527 billion.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Jeff Bezos, Mark Zuckerberg, and Jamie Dimon are selling out of US stocks in a big way — here's how to diversify into private real estate within minutes

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance