The Non-Executive Chairman of RMA Global Limited (ASX:RMY), David Williams, Just Bought A Few More Shares

Whilst it may not be a huge deal, we thought it was good to see that the RMA Global Limited (ASX:RMY) Non-Executive Chairman, David Williams, recently bought AU$110k worth of stock, for AU$0.20 per share. Nevertheless, it only increased their shareholding by a minuscule percentage, and it wasn't a massive purchase by absolute value, either.

See our latest analysis for RMA Global

The Last 12 Months Of Insider Transactions At RMA Global

In fact, the recent purchase by Non-Executive Chairman David Williams was not their only acquisition of RMA Global shares this year. They previously made an even bigger purchase of AU$173k worth of shares at a price of AU$0.19 per share. That implies that an insider found the current price of AU$0.19 per share to be enticing. That means they have been optimistic about the company in the past, though they may have changed their mind. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. Happily, the RMA Global insider decided to buy shares at close to current prices. David Williams was the only individual insider to buy during the last year.

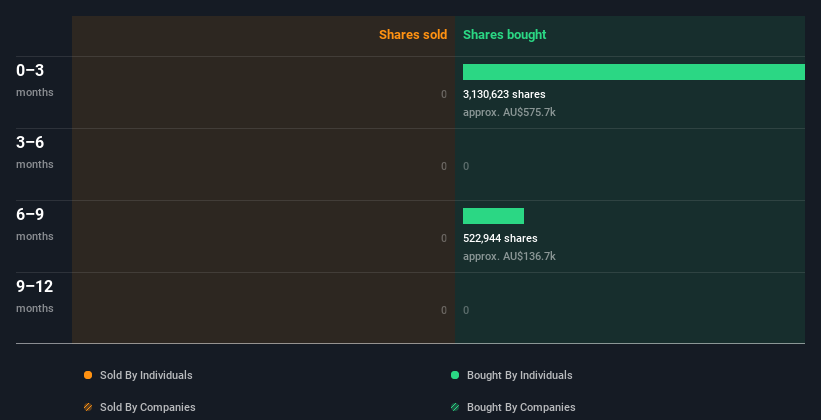

David Williams purchased 3.65m shares over the year. The average price per share was AU$0.20. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does RMA Global Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. RMA Global insiders own 56% of the company, currently worth about AU$51m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The RMA Global Insider Transactions Indicate?

It is good to see the recent insider purchase. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. Once you factor in the high insider ownership, it certainly seems like insiders are positive about RMA Global. One for the watchlist, at least! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing RMA Global. Every company has risks, and we've spotted 2 warning signs for RMA Global you should know about.

But note: RMA Global may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance