Nokia (NOK) Solutions to Power Charter's Network Connectivity

Nokia Corporation NOK announced that Charter Communications, Inc. CHTR has opted for its AirScale portfolio to ensure premium 5G connectivity for spectrum mobile customers. The agreement highlights the extension of Charter’s decades-old business collaboration with Nokia.

Charter is the second-largest cable operator in the United States and has 6 million customers with a presence in 41 states. The rapidly-growing mobile services provider currently relies on the leased mobile network, and with ever-increasing mobile traffic, it is looking for a reliable, fast connectivity solution for increased coverage.

Per the agreement, Nokia will supply Charter with industry-leading AirScale equipment, including 5G RAN (Radio Access Network) products, baseband units and newly developed 5G CBRS Strand Mount Small Cells to provide best-in-class 5G experience to end users. These are likely to be deployed in Citizens Broadband Radio Service (CBRS) spectrum, for which cable operators invested more than $1 billion to ensure high-speed wireless connectivity and reduce pressure from leased mobile networks.

Nokia’s cost-effective solution eliminates the need of constructing additional cell sites, enabling the operators to utilize their existing infrastructure. Additionally, its compact and lightweight design streamlines the deployment process and ensures greater resource optimization.

Nokia boasts a rich history of innovation and is a prominent supplier of 5G technologies in the United States. This is the first project of large-scale 5G deployment in multiple system operator space that the company secured, and the agreement is likely to further solidify its footprint in the country.

Nokia is witnessing healthy momentum in its focus areas of software and enterprise, which augurs well for the licensing business. It is poised to benefit from increased fiber deployments of passive optical networking. It is the only global supplier that offers O-RAN with commercial 5G Cloud-RAN networks.

The company intends to accelerate strategy execution, sharpen customer focus and reduce long-term costs. At the same time, it is focused to build a strong scalable software business and expand it to structurally attractive enterprise adjacencies. Nokia’s C-Band portfolio supports 5G standalone and non-standalone networks, cloud-based implementations and Open RAN products.

The company is well-positioned in the ongoing technology cycle, given the strength of its end-to-end portfolio. Nokia’s deal win rate is encouraging, with notable successes in the key 5G markets of the United States and China. Its installed base of high-capacity AirScale products, which enable customers to quickly upgrade to 5G, is growing fast.

Leveraging state-of-the-art technology, Nokia is transforming the way people communicate and connect with each other. These include a seamless transition to 5G technology, ultra-broadband access, IP and Software Defined Networking, cloud applications and Internet of Things.

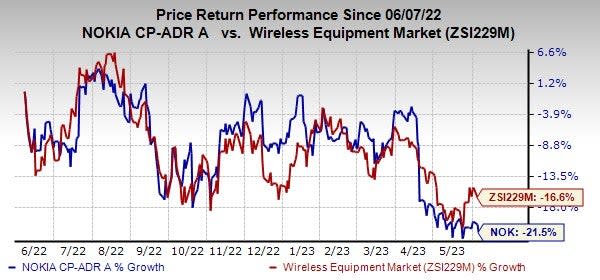

The stock has declined 21.5% in the past year compared with the industry’s fall of 16.6%.

Image Source: Zacks Investment Research

Nokia currently has a Zacks Rank #3 (Hold).

InterDigital, Inc. IDCC, currently sporting a Zacks Rank #1 (Strong Buy), delivered an earnings surprise of 170.89%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 579.03%. You can see the complete list of today’s Zacks #1 Rank stocks here.

It is a pioneer in advanced mobile technologies that enable wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular and wireless 3G, 4G and IEEE 802-related products and networks.

Akamai Technologies, Inc. AKAM, sporting a Zacks Rank #1 at present, delivered an earnings surprise of 4.86%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 6.06%.

It is a global provider of content delivery network and cloud infrastructure services. The company’s solutions accelerate and improve the delivery of content over the Internet, enabling faster response to requests for web pages, streaming of video & audio, business applications, etc. Its offerings are intended to reduce the impact of traffic congestion, bandwidth constraints and capacity limitations on customers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nokia Corporation (NOK) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Charter Communications, Inc. (CHTR) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance