NICE Q1 Earnings Top Estimates, Cloud Revenues Drive Top Line

Nice NICE reported adjusted earnings of $2.58 per share in first-quarter 2024, beating the Zacks Consensus Estimate by 5.31% and increasing 27% year over year.

Non-GAAP revenues of $659 million trumped the consensus mark by 0.69% and rose 15% year over year. The uptick was primarily driven by the continued strength of its cloud business and the ongoing expansion of its customer base.

Revenues in Americas were $559 million, up 18% year over year. The same in EMEA was $67 million in the reported quarter, up 7% year over year. APAC revenues declined 2% year over year to $33 million.

Top-Line Details

Cloud revenues (71% of revenues) of $468.4 million missed the Zacks Consensus Estimate by 0.02% but rose 27% year over year.

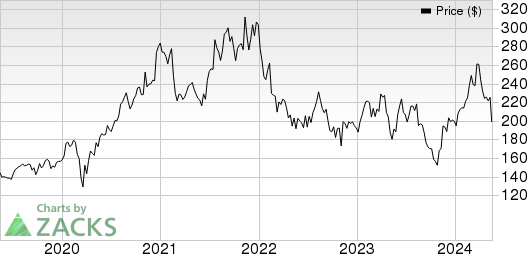

Nice Price, Consensus and EPS Surprise

Nice price-consensus-eps-surprise-chart | Nice Quote

The ongoing strength of NICE's organic cloud business, coupled with the acquisition of LiveVox, contributed to this year-over-year growth.

Product revenues (6.4% of revenues) of $42 million beat the consensus mark by 41.47% but declined 5.5% year over year.

Service revenues (22.6% of revenues) of $149 million missed the consensus mark by 4.93% and declined 6.8% year over year.

NICE's focus on its cloud offerings, particularly its CXone platform, has been a major growth driver.

In the first quarter, NICE's focus on AI innovation within CXone attracted a growing number of customers seeking advanced automation solutions for complex service scenarios.

The company also saw a remarkable 200% year-over-year increase in AI deals in the first quarter of 2024, highlighting the increasing demand for AI-driven CX solutions.

Customer Engagement revenues increased 17% year over year to $551 million.

Financial Crime & Compliance increased 8% year over year to $108 million. The increase in cloud revenues and strong on-premise product contribution drove the uptick.

Operating Details

On a non-GAAP basis, the gross margin contracted 70 basis points (bps) to 70.9% in the reported quarter. Product margin expanded 10 bps to 85%. Services margin inched down 120 bps to 70.6%.

Cloud margin contracted year over year at 20 bps to 69.8%.

Research & development (R&D) expenses, as a percentage of revenues, decreased 30 bps year over year to 13.3%. Sales & marketing (S&M) expenses, as a percentage of revenues, contracted 250 bps to 23.5%.

General & administrative (G&A) expenses, as a percentage of revenues, declined 40 bps on a year-over-year basis to 11%.

On a non-GAAP basis, operating expenses, as a percentage of revenues, contracted 250 bps year over year to 40.6%.

The operating margin expanded 170 bps on a year-over-year basis to 30.3%.

Balance Sheet & Other Details

As of Mar 31, 2024, NICE had cash and cash equivalents (including short-term investments) were $1.5 billion compared with $1.4 billion as of Dec 31, 2023.

Long-term debt, as of Mar 31, 2024, was $457.5 million compared with $457 million as of Dec 31, 2023.

The company’s cash flow from operations in the first quarter came in at $254.5 million compared with $180.5 million in the fourth quarter.

In the first quarter of 2024, $41.5 million was allocated for the repurchase of shares and $87.4 million was used for repayment of debt.

Guidance

For second-quarter 2024, NICE projects non-GAAP revenues to be between $657 million and $667 million, calling for 14% year-over-year growth at the midpoint.

Non-GAAP earnings are estimated in the $2.53-2.63 per share band, suggesting 21% year-over-year growth at the midpoint.

Zacks Rank & Stocks to Consider

Currently, Nice has a Zacks Rank #3 (Hold).

The company’s shares have dropped 0.4% year to date against the Zacks Computer & Technology sector’s rise of 15.8%.

CrowdStrike CRWD, NVIDIA NVDA and Intuit INTU are some better-ranked stocks that investors can consider in the broader sector.

NVIDIA sports a Zacks Rank #1 (Strong Buy), while CrowdStrike and Intuit carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CrowdStrike’s shares have surged 32.8% year to date. CRWD is scheduled to release first-quarter fiscal 2025 results on Jun 4.

NVIDIA has surged 90.6% year to date. NVDA is scheduled to release first-quarter fiscal 2025 results on May 22.

Intuit’s shares have inched up 4.5% year to date. INTU is set to report third-quarter fiscal 2024 results on May 23.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Nice (NICE) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance