NCR Issues Senior Notes to Fund Cardtronics Acquisition

NCR Corporation NCR recently announced the pricing of a senior unsecured notes offering worth $1.1 billion. The notes carry an annualized interest rate of 5.125% and will mature in 2029.

The company stated that senior notes would be sold at 100% of the principal amount. The offering is anticipated to close on Apr 6.

NCR intends to use the net proceeds, along with borrowings under its senior secured credit facilities and available cash balance to fund the acquisition of Cardtronics Plc CATM. Notably, in late January, NCR entered into a definitive agreement to acquire Cardtronics for $2.5 billion.

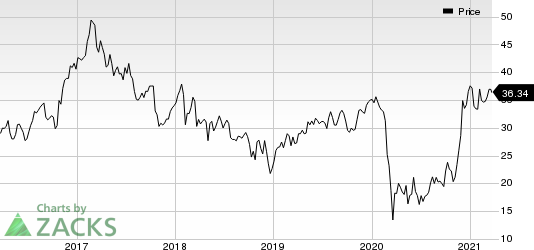

NCR Corporation Price

NCR Corporation price | NCR Corporation Quote

Why is NCR Buying Cardtronics?

Cardtronics processes value-added payment transactions and provides ATM solutions to financial service providers in a bid to aid in-store traffic and retail transactions. Moreover, it enables cash transactions at more than 285,000 ATMs across 10 countries. It also provides a retail-based surcharge-free ATM network through its Allpoint Network across more than 55,000 locations.

Markedly, the proposed acquisition is anticipated to drive the acceleration of the NCR-as-a-service strategy. Cardtronics’ robust debit network will further expand NCR’s payments platform and help it connect to retail and bank customers, thereby facilitating customer acquisition.

Further, the integration will give the company access to Cardtronics’ installed base of ATM network across multiple regions. This will enable the company to enhance its scale of business and boost cash flows. It will also help the company capitalize on the ongoing transition of the banking industry toward outsourcing of ATM operations and branch rationalization.

Apart from these, the buyout bodes well for NCR’s steady focus to advance its software and services revenue mix, and drive margin expansion by increasing the company’s recurring revenues.

NCR believes the acquisition of Cardtronics would be accretive to its adjusted EPS in the first full year following the transaction’s conclusion. In addition, the Zacks Rank #3 (Hold) company projects achieving $100-$120 million in operating cost synergies by the end of 2022.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

NCR Takes Advantage of Low Interest Rates

Borrowing costs continue to be low, enabling companies to obtain easy financing. With the U.S. treasuries offering low rates, corporate bonds and borrowings from banks are now witnessing high demand.

In August 2020, NCR borrowed $1.1 billion through issuing two different unsecured senior notes offerings to redeem its old senior notes. The company had stated that the offerings, along with redemption of old debts, would reduce its annual interest expense by $19 million.

In the past few months, several companies have issued senior notes to improve liquidity. Earlier this month, Twilio TWLO raised $1 billion through issuing senior notes to enhance its financial flexibility. Beyond Meat BYND has also borrowed $1 billion through issuing 0% convertible senior notes.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardtronics PLC (CATM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance