Navigating Economic Shifts With Bill Holdings

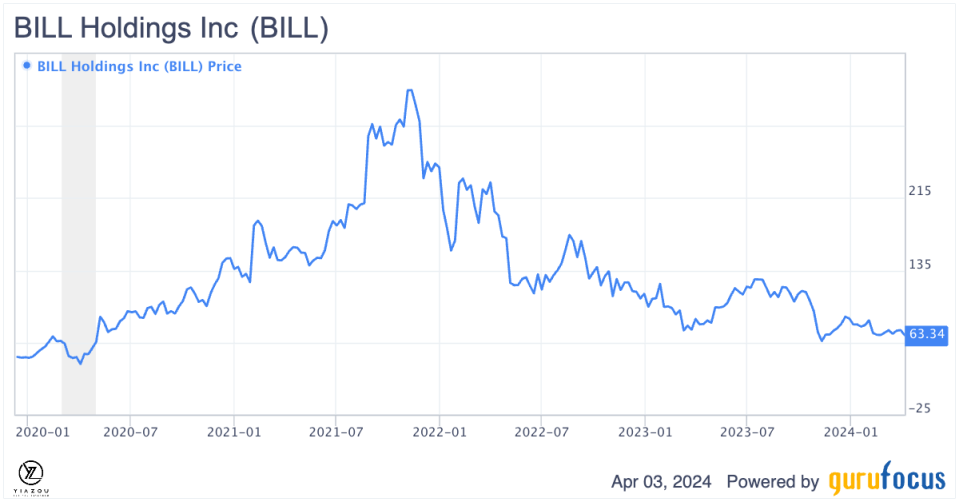

Bill Holdings Inc. (NYSE:BILL) was one of the breakthrough technology companies that became prominent as the Covid-19 pandemic sent shockwaves in early 2020.

After going public in 2019, the mid-cap software applications company saw its fortunes improve as interest rates dropped to record lows, fueling spending among small and medium-sized businesses.

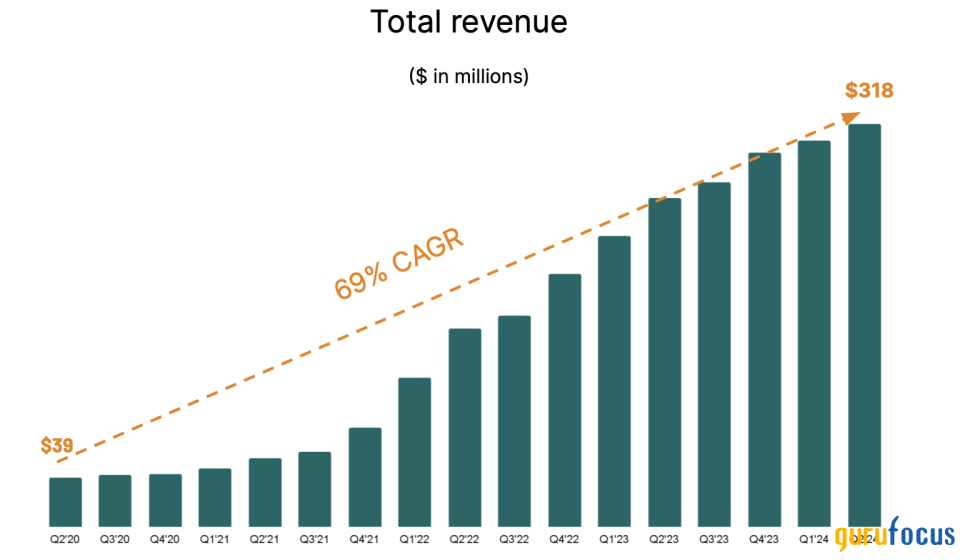

In less than two years, the stock gained over 1,500%, rallying to record highs of $334 a share. The rally came amid exceptional growth during the pandemic, depicted by 69% compound annual revenue growth.

Amidst a challenging landscape marked by surging interest rates and intense competitive pressure, a leading payment processing company finds its growth prospects dimmed. Hence, the stock has already lost over 80% of its market value from its high-flying days.

With its recent financial outlook adjustment falling short of analyst expectations and historical performance, this narrative unfolds against the backdrop of an ever-evolving economic environment, highlighting the critical interplay between macroeconomic forces and corporate fortunes.

BILL Data by GuruFocus

High interest rates and fierce competition dampen growth prospects

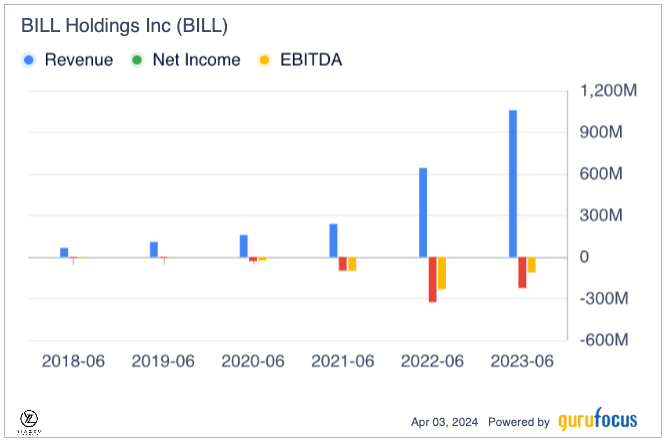

The payment processing company rattled the market by lowering its guidance outlook from a prior view of $1.29 billion to $1.31 billion, representing 22% to 24% revenue growth, to between $1.20 billion and $1.24 billion in revenue, or 14% to 18% year-over-year growth. It was nowhere close to the revenue of $1.3 billion that analysts projected for the year.

The outlook represented a sharp drop from a company that was used to generating upward growth of 60%. The markets continued to push the stock lower amid growing concerns about macroeconomic pressure that could affect growth multiples.

Additionally, management cited high interest rates as one of the factors contributing to challenging macroeconomics. With interest rates at 22-year highs of 5.25%, small and medium-sized businesses no longer spend as much on the company's payment solutions as they used to.

Given that much of the company's revenue comes from transaction fees, it is susceptible to a high-interest rate environment.

Source: Bill.com

High interest rates affect how small and medium-sized businesses can acquire cheap capital, let alone spend money. As most of them resort to cost cuts to stay afloat, it becomes difficult for Bill Holdings to sign deals for its payment solutions. Some of the company's more prominent businesses have become more selective in their payment choices as others scale back on spending, eating into Bill Holdings' revenue base.

The provider of cloud-based financial operations platforms has also seen its outlook take a hit amid soaring competition. More than ever, Bill Holdings is feeling the brunt of stiff competition from Intuit (NASDAQ:INTU) with QuickBooks, which is significantly eating into its target market.

In addition, payment giants like Visa (NYSE:V) are also launching payment solutions targeting these businesses. Consequently, its revenue base has come under immense pressure and is no longer growing as it did at the height of the pandemic.

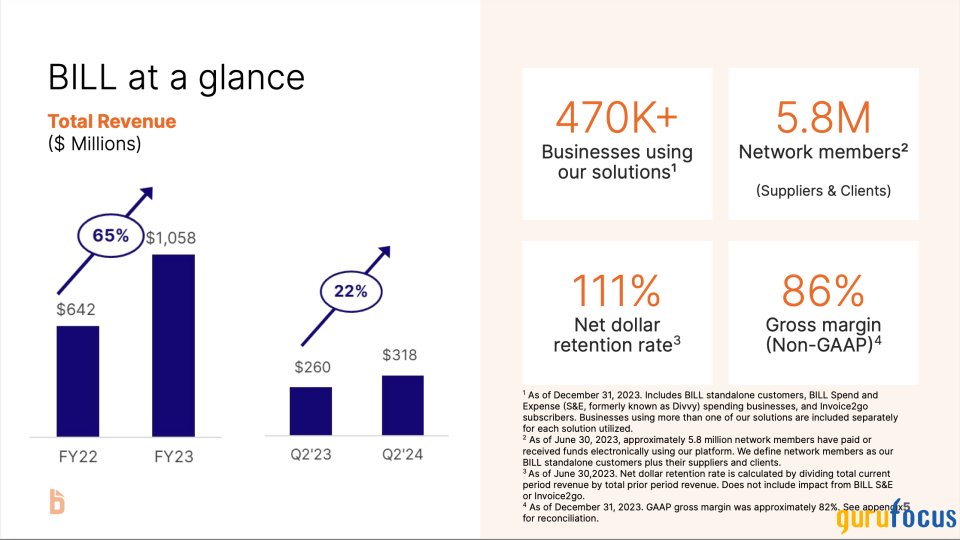

Despite the stock's underperformance, Bill Holdings continues to register as a booming business that provides automation software. The company counts more than 470,000 clients currently using its software as a payment service plan. In addition, its network connects over 5.80 million members or companies that carry out transactions on its platform.

Source: Bill.com

Bill Holdings' client portfolio includes over 7,000 accounting firms, underscoring its credibility in the payment sector. Additionally, it has succeeded in attracting interest from big banks, including JPMorgan (NYSE:JPM), Wells Fargo (NYSE:WFC), American Express (NYSE:AXP) and KeyBank.

Backed by a massive customer base, the financial services company continued to drive innovation while automating the financial operations of more than 470,000 businesses in its fiscal fourth quarter.

Revenue for the second quarter of 2024 increased by 22% year over year to $318.50 million. Core revenue, which consists of subscription and transaction fees, was up 19% to $275 million. The increase came as the company served 473,500 businesses using its payment solutions. The total payment volume handled stood at $75 billion as the company saw the number of transactions increase by 23% to 6 million.

Subscription revenue, which tends to be much more stable than other revenue streams, only grew by 3% to $63.30 million. The slow growth is a point of concern due to underlying problems in the company that attract new deals.

Additionally, transactional revenue, the most variable portion of the company's business and susceptible to macroeconomic conditions, was up by 25% to $211.60 million.

Management has already acknowledged that, due to interest rates and tighter credit markets, capital and cash will become less affordable and available to small and medium-sized businesses, which could see float revenue decelerate.

The net loss for the quarter more than halved to $40.4 million, or 38 cents per share, compared to a net loss of $95.10 million, or 90 cents per share, delivered in the second quarter of 2023. The loss from operations fell to $67.70 million, compared to $112.5 million in the prior-year period.

Lastly, Bill Holdings ended the quarter with a solid gross margin of over 80%, underscoring a low-cost increase needed to serve new customers. The company can also earn some interest on the money it holds for customers, which was $43.50 million.

Massive SMB opportunity

Even though Bill Holdings appears to be experiencing slow growth amid deteriorating macroeconomics, it continues to focus on innovation combined with the strength of its business model to help millions of businesses. With its exposure, it has a broader target market with a set of unique financial and payment solutions.

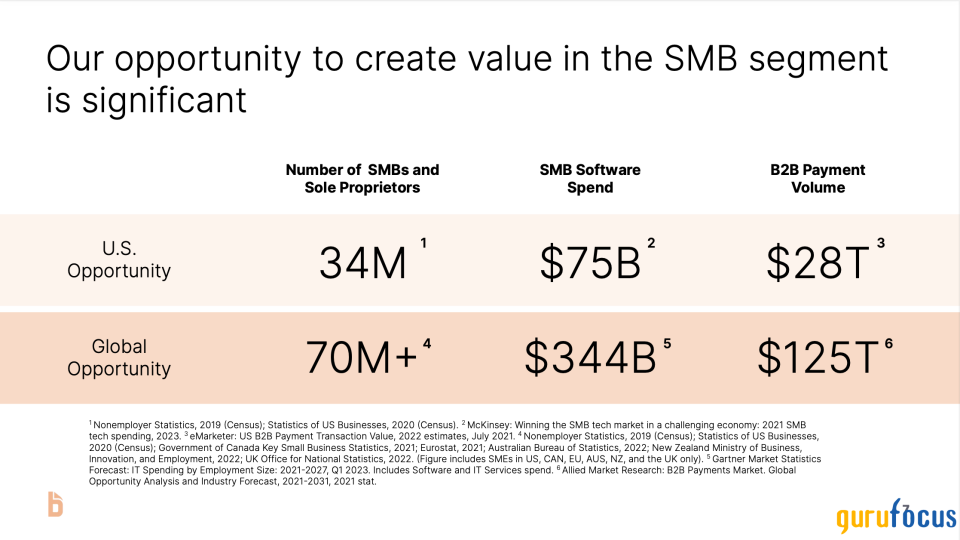

While nearly 34 million small businesses and entrepreneurs need payment solutions in the U.S., millions of other small businesses use manual payment processing systems, affirming the massive addressable market.

These businesses spend nearly $75 billion annually on payment solutions. Additionally, the business-to-business payment volume in the U.S. stands at over $28 trillion, underscoring the massive opportunity.

Bill Holdings is also staring at a massive opportunity on the global scene, given the more than 70 million small and medium-sized businesses in need of payment solutions. Hence, these businesses spend nearly $344 billion on payment solutions, presenting a $125 trillion target market for business-to-business payment volume.

Source: Bill.com

Risks and challenges

Competition remains the most significant risk to Bill Holdings as it tries to bounce back to robust growth. Intuit's QuickBooks is standing in the way of the company achieving significant growth rates. The fact that QuickBooks is a dominant player among small businesses and has started copying some of Bill.com's product suites presents one of the most extensive challenges.

By all standards, Bill Holdings is a much smaller player than QuickBooks. Therefore, the prospect of many Bill.com customers ending up using QuickBooks solutions for general accounting management could significantly eat into its revenue streams. The fact QuickBooks also enjoys widespread adoption means it can add new products to existing customers and upsell them on new services as one way of fending off Bill Holdings.

In addition to QuickBook's growing competition, Bill Holdings could also come under pressure after the U.S. government introduced a new instant payment solution, FedNow. The new solution, becoming a hit with small businesses, could pose significant risks to Bill Holdings even as it faces competition from instant payments from more prominent players like Visa.

Valuation

After bouncing back late last year, Bills Holdings is yet again under pressure. The stock is already down by about 18% for the year, a sell-off that has seen its valuation drop significantly.

Additionally, Bills Holdings recorded 65% year-over-year sales growth for fiscal 2023, which ended June 30. Its sales only increased by 22% for the remainder of the year. Management is projecting sales growth of 17% for fiscal 2024.

The numbers show Bill's sales growth is slowing, and the company is under increasing competitive pressure from QuickBooks and other mainstream payment providers. Amid this slowing sales growth, Bill's valuation has declined to its lowest level.

The company boasts a price-sales ratio of 5.60. The stock trades at about $63 a share with a market cap of about $6.62 billion, a net of $2.65 billion in cash and about $1.84 billion in debt. That translates to an enterprise value of about $5.81 billion.

Lastly, going by its latest revenue outlook of $1.20 billion for fiscal 2024, the stock trades at an enterprise value-to-revenue multiple of $4.84. That is relatively low for a company whose revenue grew by 22% in the recent quarter.

Takeaway

There is no doubt Bill Holdings has underperformed the overall market over the past 12 months; its outlook was hurt mainly by deteriorating macroeconomics. Nevertheless, the company has succeeded in achieving significant growth, with gross margins of over 80%.

The company's success in maneuvering the macro challenges amid the high-interest rate environment signals it is well positioned to bounce back should the U.S. Federal Reserve come through on interest rate cuts.

Interest rate cuts should bolster the business environment, especially for small and medium-sized businesses. In addition, there is a significant addressable market in the U.S. and the global scene that the company can target with its payment solutions, even as it comes under pressure from competitors.

Therefore, the stock looks like a bargain, especially after an 80% pullback on improving underlying fundamentals. However, investors may consider waiting until the company's outlook significantly improves, offering clearer visibility into its future direction.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance