Navient (NAVI) Hurt by Lower Revenues & Higher Debt Level

Navient Corporation’s NAVI declining servicing revenues and high debt burden are major concerns. Additionally, its capital distribution activities seem unsustainable.

NAVI's growth opportunities seem limited. The firm transferred all its ED servicing contracts to Maximus after receiving the necessary approvals in October 2021. This has hurt its servicing revenues, evidenced by a year-over-year decline of $91 million and $13 million in 2022 and 2023, respectively. The metric was stable in first-quarter 2024 relative to the prior-year quarter.

Regulatory changes may result in higher-than-anticipated prepayment rates on the company's portfolio of loans. Also, if it fails to acquire new loans or expand or develop alternative sources of revenues, its fee income will likely be under pressure.

Navient's total debt of $55.27 billion is significantly higher than its cash and cash equivalents of $823 million as of Mar 31, 2024. Three credit agencies have provided a below-investment-grade rating to the company’s long-term unsecured debt. Given its high debt burden compared with available cash levels, NAVI appears poorly positioned in terms of liquidity and may struggle to meet its debt obligations.

Navient has a share repurchase program of up to $1 billion with no expiration date. In first-quarter 2024, NAVI repurchased shares of common stock for $43 million. As of Mar 31, 2024, there was $247 million of the remaining share-repurchase authority. The company declared a 7% hike in its quarterly dividend in January 2015. An unfavorable debt/equity ratio compared with the industry average and weak liquidity position make us question the sustainability of its capital distribution activities in the long term.

The company's 2024 earnings estimates have been revised 21.7% downward in the past month.

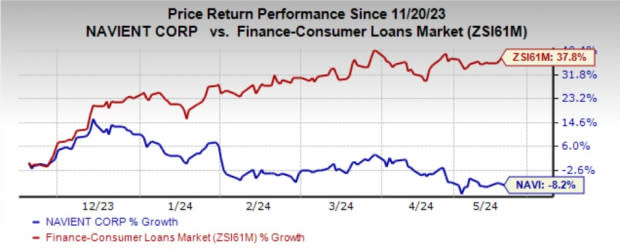

Navient currently carries a Zacks Rank #5 (Strong Sell). Over the past six months, shares of the company have lost 8.2% against the industry’s growth of 37.8%.

Image Source: Zacks Investment Research

Despite these headwinds, NAVI is well-positioned to grow organically, with its focus on improving in-school originations to drive its loan volumes. Further, the company’s recurring revenue business model will aid its top-line growth. Additionally, its efforts to improve operating efficiency by undertaking various cost-control initiatives will support its financials in the upcoming period.

Stocks to Consider

Some better-ranked major bank stocks worth considering are Mr. Cooper Group Inc. COOP and PROG Holdings, Inc. PRG, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for COOP’s 2024 earnings has been revised 5.2% upward in the past month. Shares of the company have jumped 41.5% over the past six months.

The Zacks Consensus Estimate for PRG’s current-year earnings has been revised 6% upward in the past 30 days. Shares of the company have climbed 27.1% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Navient Corporation (NAVI) : Free Stock Analysis Report

MR. COOPER GROUP INC (COOP) : Free Stock Analysis Report

Aaron's Holdings Company, Inc. (PRG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance