Our Take On Nanosonics Limited's (ASX:NAN) CEO Salary

In 2013 Michael Kavanagh was appointed CEO of Nanosonics Limited (ASX:NAN). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Nanosonics

How Does Michael Kavanagh's Compensation Compare With Similar Sized Companies?

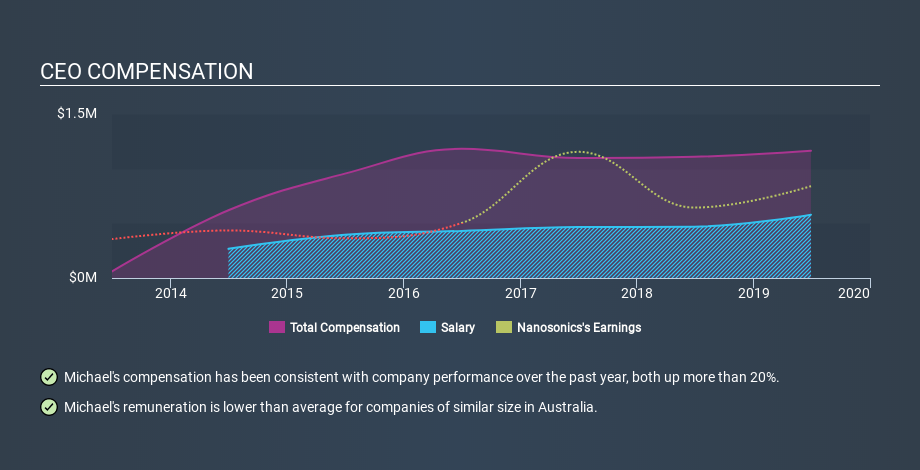

Our data indicates that Nanosonics Limited is worth AU$2.1b, and total annual CEO compensation was reported as AU$1.2m for the year to June 2019. While we always look at total compensation first, we note that the salary component is less, at AU$579k. When we examined a selection of companies with market caps ranging from AU$1.4b to AU$4.6b, we found the median CEO total compensation was AU$2.0m.

Most shareholders would consider it a positive that Michael Kavanagh takes less total compensation than the CEOs of most similar size companies, leaving more for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see a visual representation of the CEO compensation at Nanosonics, below.

Is Nanosonics Limited Growing?

Nanosonics Limited has reduced its earnings per share by an average of 15% a year, over the last three years (measured with a line of best fit). Its revenue is up 39% over last year.

As investors, we are a bit wary of companies that have lower earnings per share, over three years. But in contrast the revenue growth is strong, suggesting future potential for earnings growth. These two metric are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. You might want to check this free visual report on analyst forecasts for future earnings.

Has Nanosonics Limited Been A Good Investment?

Boasting a total shareholder return of 147% over three years, Nanosonics Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

It appears that Nanosonics Limited remunerates its CEO below most similar sized companies.

Michael Kavanagh is paid less than what is normal at similar size companies, and the total shareholder return has been pleasing over the last three years. Although we could see higher growth, we'd argue the remuneration is modest, based on these observations. Whatever your view on compensation, you might want to check if insiders are buying or selling Nanosonics shares (free trial).

If you want to buy a stock that is better than Nanosonics, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance