How much?? Bank of Mum and Dad lending ‘billions’ to offsprings

Bank of Mum and Dad is no longer just a byword for rich kids indulgent lifestyles -– parents of Generation Y are forking our billions to their beleaguered offspring.

In fact, long-suffering parents are one the biggest lenders outside the main banks, new research shows, stumping up $65 billion annually.

The ever generous Bank of Mum and Dad is the eleventh largest lender in Australia – ahead of money majors AMP Bank, HSBC and most credit unions and mutuals, a survey by Digital Finance Analytics shows.

Also read: 9 things NOT to say in a job interview

Aussie parents are owed a whopping $16 billion by their indebted children – to help pay for a deposit on a house purchase or the stamp duty.

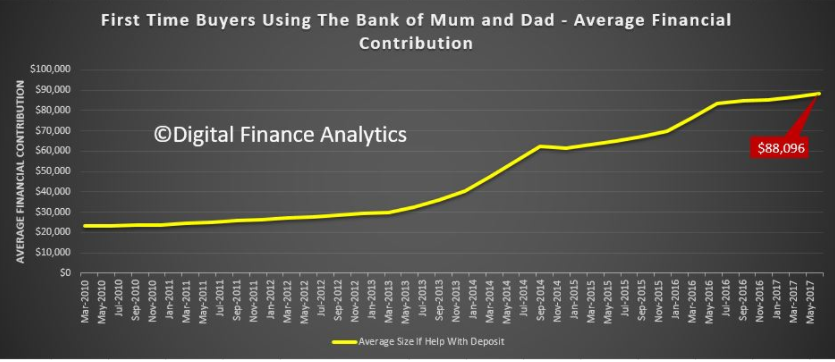

On average, Mum and Dad hand over $88,000 to kids to purchase their home – and that figure is rising, the research also indicated.

More than half (54.7%) of all Australian first-time homebuyers received a helping hand from Mum and Dad – in the form of a cash gift or loan.

Parents also help out with heavy mortgage repayments, childcare costs, university fees plus college accommodation. Gap years and cars are also featured on parents loan books – depending on the wealth of the family.

Also read: 5 ways to grow wealth

Bank of Mum and Dad is active across Australia but is most prominent in New South Wales, where house prices are sweltering and is also a rising lender in Victoria.

However, parents should proceed with caution if they help their children get onto the housing ladder and make sure they’re not seen as walking, talking ATM’s, financial experts warn.

Buy-in

If you do decide to help your children with a deposit, there are several ways to do so – without putting yourself in financial strife, according to financial advisor and author Melissa Browne. Here are her tips to parents:

Lending or gifting the price of a house deposit or unlocking the equity in your home and using this for a deposit.

You could even opt to co-own a property with them, Brown says, which teaches your kids the value of money rather than doling out free cash.

“If you do decide to unlock your equity or co-own a property it’s really important to ensure your children ‘buy-in’ to the project and understand your risk.

“It is unhelpful to everyone concerned if you assist your children with a deposit and they subsequently find the mortgage repayments burdensome, so it’s important not to over-extend on borrowing and to make sure from the outset that the loan can be repaid at an interest rate of 8%.”

However, if you have three children, you may not be in a position to help all of them especially in the current frothy property market in the big cities.

Teaching your children about money is also an invaluable education, according to Yahoo7 Finance columnist Stephen Koukoulas.

“Education is paramount. Teach your kids from a young age to spend less than they earn, and put some money aside for the future.”

“Getting onto the housing ladder has always been a challenge, and therefore some young people may need to adjust their expectations of what their first home might look like,” he added.

However, done conservatively and in the right circumstances paying off a home from a young age can be a fantastic way to use compound growth in your favour to establish your financial security.

The unregulated Bank of Mum and Dad also skews the household debt figures and may suggest that the overall housing debt is even higher than official statistics.

Yahoo Finance

Yahoo Finance