MSCI Inc. (MSCI) Q1 2024 Earnings: Solid Performance with Adjusted EPS Exceeding Analyst ...

Operating Revenues: Reported $680.0 million, up 14.8% year-over-year, slightly below the estimate of $684.13 million.

Net Income: Achieved $256.0 million, up 7.2% year-over-year, falling short of the estimated $273.71 million.

Diluted EPS: Recorded at $3.22, an 8.4% increase from the previous year, below the estimated $3.45.

Adjusted EPS: Reached $3.52, surpassing the estimated $3.45, reflecting a 12.1% increase year-over-year.

Dividends: Paid approximately $126.8 million in dividends; declared a quarterly dividend of $1.60 per share for Q2 2024.

Retention Rate: Reported at 92.8%, a decrease from 95.2% in the first quarter of 2023.

Free Cash Flow: Increased by 13.7% to $275.9 million, indicating strong cash generation capabilities.

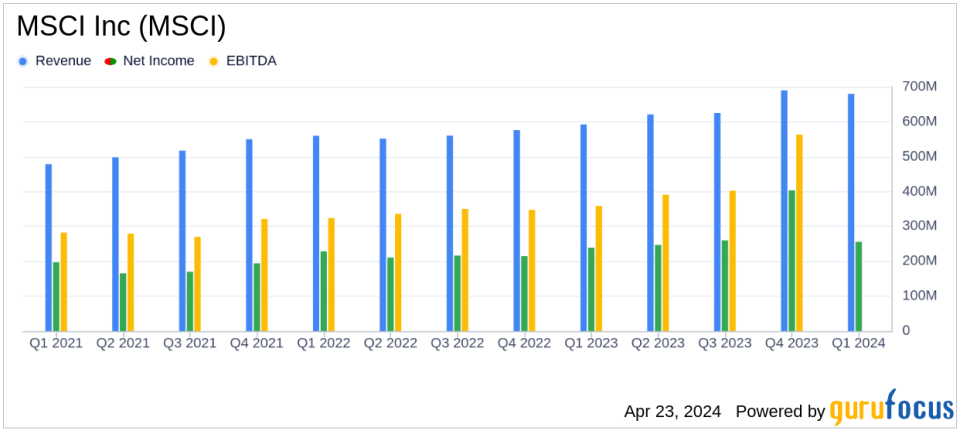

On April 23, 2024, MSCI Inc. (NYSE:MSCI) unveiled its financial results for the first quarter of 2024, demonstrating robust growth and operational resilience. The detailed earnings report, available in the company's 8-K filing, highlights significant achievements and strategic advancements.

Fiscal Performance Overview

MSCI reported operating revenues of $680.0 million for Q1 2024, marking a 14.8% increase year-over-year, slightly below the analyst estimate of $684.13 million. The company achieved an adjusted EPS of $3.52, surpassing the expected $3.45, driven by a solid increase in asset-based fees and recurring subscription revenues. Net income rose to $255.95 million, up 7.2% from the previous year, although slightly below the estimated $273.71 million.

Operational Highlights and Strategic Initiatives

Henry A. Fernandez, Chairman and CEO of MSCI, emphasized the company's ability to deliver strong earnings amidst operational challenges. Key growth drivers included record AUM balances in MSCI-linked index products and robust revenue growth from asset-based fees. The company also noted a retention rate of 92.8%, slightly down from 95.2% in the previous year, attributed to specific client events such as mergers among banking clients.

Fernandez highlighted the resilience in new recurring sales, particularly in the Analytics segment, which saw its highest first-quarter performance in a decade. MSCI's strategic acquisitions and product innovations were underscored as crucial elements poised to capitalize on long-term industry trends like portfolio indexation and the global sustainability revolution.

Segment Performance

The Index segment reported operating revenues of $373.9 million, up 10.2%, driven by increases in both asset-based fees and recurring subscription revenues. The Analytics segment also showed strong performance with revenues of $164.0 million, a rise of 11.5%, primarily due to growth in Multi-Asset Class and Equity Analytics products.

The ESG and Climate segment saw a 16.1% revenue increase, reaching $77.9 million, with significant contributions from Ratings, Climate, and Screening products. The Private Assets segment, incorporating Real Assets and Private Capital (Trades, Portfolio) Solutions, grew by an impressive 66.0%, reflecting robust subscription growth and favorable market conditions.

Financial Health and Capital Allocation

MSCI's balance sheet remains robust with cash and cash equivalents totaling $519.3 million. The company's strategic management of capital included paying dividends of approximately $126.8 million during the quarter and declaring a subsequent dividend of $1.60 per share for Q2 2024.

The firm's commitment to shareholder returns is evident in its active share repurchase program, with approximately $0.8 billion remaining under the current authorization. MSCI's total debt stood at $4.5 billion, with a prudent debt to adjusted EBITDA ratio of 2.9x, aligning with its targeted range of 3.0x to 3.5x.

Looking Ahead

While MSCI's guidance for full-year 2024 reflects cautious optimism, it is based on assumptions subject to macroeconomic and market volatility. The company remains focused on leveraging its diversified business model and strategic initiatives to sustain growth and profitability.

For further details on MSCI's financial performance and strategic directions, interested parties are encouraged to review the full earnings release and join the upcoming investor conference call.

For more insightful analyses and the latest financial news, keep following GuruFocus.com.

Explore the complete 8-K earnings release (here) from MSCI Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance