Motorcar Parts of America (NASDAQ:MPAA shareholders incur further losses as stock declines 12% this week, taking three-year losses to 68%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Motorcar Parts of America, Inc. (NASDAQ:MPAA) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 68% share price collapse, in that time. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Motorcar Parts of America

Because Motorcar Parts of America made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

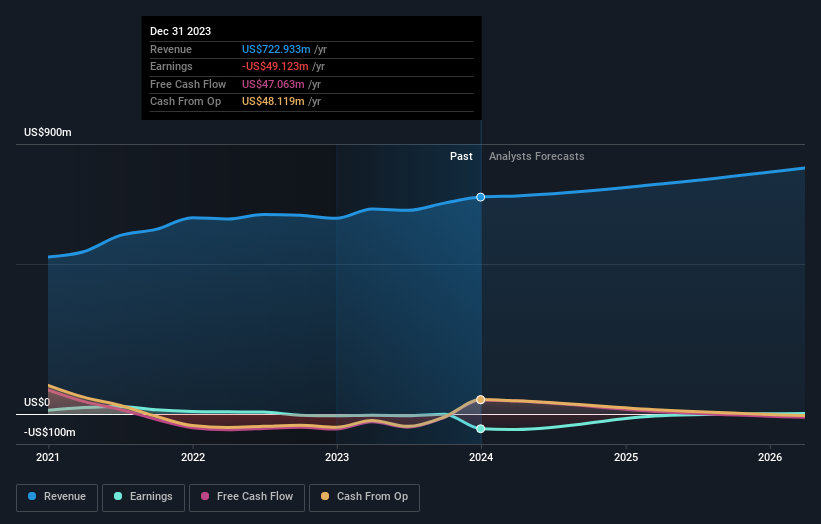

Over three years, Motorcar Parts of America grew revenue at 8.8% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 19% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Motorcar Parts of America

A Different Perspective

Motorcar Parts of America shareholders have received returns of 27% over twelve months, which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 11%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Motorcar Parts of America that you should be aware of.

Motorcar Parts of America is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance