Mosaic Repays $400M Drawn From Revolving Credit Facility

The Mosaic Company MOS recently announced that it has repaid $400 million drawn from its revolving credit facility in March. After the repayment, Mosaic stated that it has roughly $3 billion in liquidity, including around $1 billion in cash and $2 billion in unutilized committed revolving credit capacity.

The company also stated that it originally accessed its credit line to build its cash balance to nearly $1 billion due to uncertainty stemming from the coronavirus outbreak.

Considering its business performance to date as well as the impact of some cash management activities, Mosaic noted that it is now able to fully repay the outstanding balance under its revolver while keeping a solid liquidity position.

Shares of Mosaic have lost 36.6% in the past year compared with the industry’s 20.3% decline.

On its first earnings call, Mosaic stated that it expects depreciation, depletion and amortization of $910-$920 million for 2020. Moreover, it anticipates net interest expenses of $180-$190 million for 2020.

Also, the company anticipates capital expenditures of nearly $1.2 billion for 2020.

Mosaic also expects to receive cash proceeds of up to $170 million from tax refunds and unwinding of an interest rate swap in 2020. The company also noted that it expects to achieve $50 million in Mosaic Fertilizantes' transformational savings for 2020.

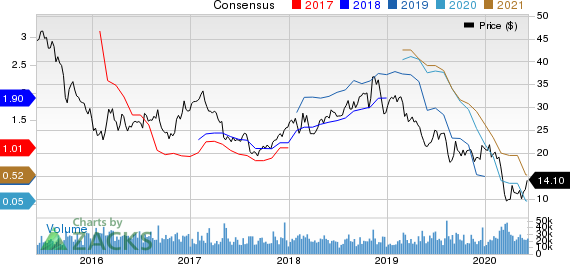

The Mosaic Company Price and Consensus

The Mosaic Company price-consensus-chart | The Mosaic Company Quote

Zacks Rank & Stocks to Consider

Mosaic currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space are Agnico Eagle Mines Limited AEM, Franco-Nevada Corporation FNV and Barrick Gold Corporation GOLD.

Agnico Eagle currently sports a Zacks Rank #1 (Strong Buy) and has a projected earnings growth rate of 74.2% for 2020. The company’s shares have gained 26.9% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has an expected earnings growth rate of 19.2% for 2020. The company’s shares have surged 67.6% in the past year. It currently has a Zacks Rank #2 (Buy).

Barrick has a projected earnings growth rate of 64.7% for the current year. The company’s shares have rallied around 73% in a year. It currently has a Zacks Rank #2.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FrancoNevada Corporation (FNV) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance