Moog Inc. (MOG.A) Surpasses Analyst Expectations with Strong Q2 2024 Performance

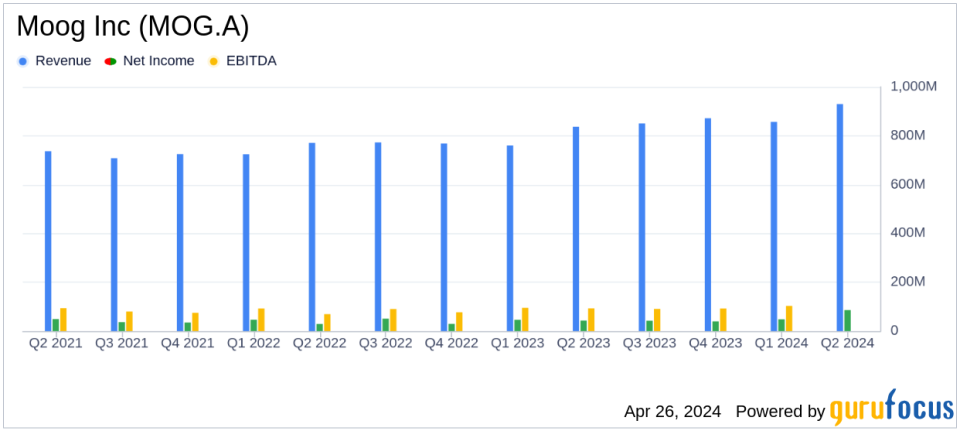

Reported Revenue: $930 million, marking an 11% increase year-over-year, surpassing estimates of $873.58 million.

Diluted EPS: $1.86, up 39% from $1.34 in the previous year, exceeding the estimated $1.70.

Adjusted Diluted EPS: $2.19, reflecting a 54% increase from $1.42, significantly above the estimated $1.70.

Operating Margin: Improved to 12.0% from 10.0% last year, a 200 basis point increase.

Adjusted Operating Margin: Rose to 13.6% from 10.4%, a 320 basis point improvement, driven by strong business performance and benefits from the Employee Retention Credit.

Free Cash Flow: Improved by $17 million despite a negative free cash flow of $84 million, better than the previous year's negative $101 million.

Backlog: Reached a record $2.5 billion, up 9% due to growth across aerospace and defense businesses.

On April 26, 2024, Moog Inc. (NYSE: MOG.A and MOG.B), a leader in precision motion and fluid controls systems for aerospace and defense, released its 8-K filing showcasing a significant outperformance in its fiscal second quarter results. The company reported a diluted earnings per share (EPS) of $1.86 and an adjusted EPS of $2.19, both surpassing the analyst's EPS estimate of $1.70.

Moog Inc., renowned for its high-performance systems in the aerospace and defense sectors, continues to demonstrate financial growth and operational excellence. With a strategic presence in both domestic and international markets, Moog serves a significant portion through U.S. government contracts, making its performance crucial for investors watching the defense and aerospace sectors.

Financial and Operational Highlights

For Q2 2024, Moog reported net sales of $930 million, an 11% increase year-over-year, driven by robust sales across all segments, particularly a 26% increase in Commercial Aircraft. The company's operating margin improved to 12.0%, up 200 basis points from the previous year, reflecting effective margin enhancement strategies and operational efficiencies.

Significant improvements were also noted in the adjusted operating margin, which saw a 320 basis point increase to 13.6%. This was attributed to strong underlying business performance and benefits from the Employee Retention Credit under the CARES Act. Moog's focus on operational excellence and strategic initiatives continues to yield high profitability and cash flow improvements, with free cash flow showing a positive change, improving by $17 million despite a challenging environment.

Detailed Financial Performance

The increase in net sales was accompanied by a comprehensive improvement in operating margins across various sectors. The Space and Defense segment, in particular, saw a notable margin increase of 460 basis points, reaching 15.8%. This improvement was largely due to enhanced performance on space vehicle programs and additional benefits from fiscal incentives.

Despite facing some challenges such as higher restructuring and impairment charges, particularly in the Military Aircraft and Industrial segments, Moog managed to navigate these with strategic adjustments, as reflected in the robust growth figures and margin expansions.

Looking Ahead: 2024 Financial Guidance

Looking forward, Moog's CFO, Jennifer Walter, provided an optimistic financial outlook for 2024. The company expects net sales to reach approximately $3,550 million, with an adjusted operating margin expansion of 150 basis points and an 18% increase in adjusted EPS. These targets underscore Moog's confidence in its operational strategy and market position.

Investor Implications

Moog's impressive second-quarter performance, characterized by record sales and margin expansions, not only beats analyst expectations but also sets a positive tone for its fiscal year prospects. Investors and stakeholders can likely anticipate continued growth and robust financial health, making Moog Inc. a noteworthy consideration in the aerospace and defense sectors.

Moog Inc.'s strategic maneuvers, such as margin enhancement initiatives and a focus on high-growth areas, are pivotal in understanding the companys trajectory and its potential impact on investment portfolios. As Moog continues to exceed expectations and strengthen its market position, it remains a significant player in the aerospace and defense industry landscape.

For detailed financial figures and future projections, stakeholders are encouraged to view the full earnings report and listen to the earnings call, available on the Moog website.

Explore the complete 8-K earnings release (here) from Moog Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance