Momentum in Beer Business to Drive Constellation Brands (STZ)

Constellation Brands Inc. STZ continues to gain from strength in the beer business, as well as its premiumization strategy. The beer business has been gaining from the robust performances of Modelo Especial, the Modelo Chelada brands, Corona Extra and Pacifico.

STZ's beer business showcased an impressive performance, with notable growth in shipment volumes and depletions in fourth-quarter fiscal 2024, indicating a strong and consistent demand for its products. This achievement is particularly significant, as it represents the 56th consecutive quarter of growth in this area, highlighting a stable and growing market presence.

The performance of individual beer brands like Modelo Especial and Pacifico, which showed significant depletion growth, highlights its strong market acceptance and growing consumer base. The success of these brands significantly contributes to the company's overall performance and helps diversify its portfolio strength.

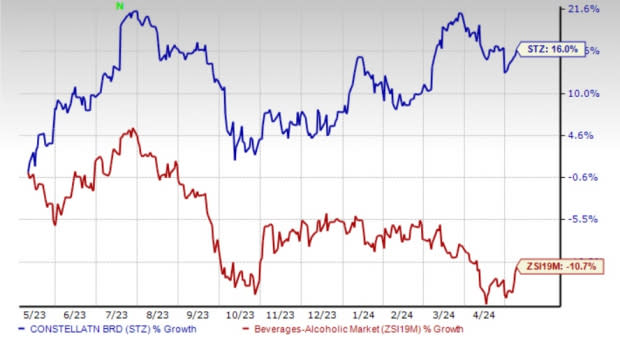

The Zacks Rank #3 (Hold) company has rallied 16% in the past year against the industry’s decline of 10.7%.

Image Source: Zacks Investment Research

Other Factors Placing STZ Well

Constellation Brands’ strategies reflect a strong focus on market growth, particularly in the beer segment, prudent financial management and a commitment to long-term shareholder value. Despite some challenges, particularly in the Wine & Spirits segment, the company is positioned well with a diverse portfolio, strategic investments and a clear vision for the future.

STZ demonstrated a balanced approach to capital allocation. Its execution of $900 million in share repurchases in fiscal 2024, while maintaining a stable net leverage ratio, illustrates a strategic balance between investing for growth and returning value to shareholders. This approach indicates financial prudence and a commitment to a healthy balance sheet.

Regarding investments, the company's focus on enhancing its brewery capacities, particularly with investments in the Obregon brewery and a new site in Veracruz, is a strategic move to prepare for future demand. This indicates a long-term perspective toward market expansion and meeting growing consumer needs.

Constellation Brands' premiumization strategy is playing out well, as evident by accelerated growth for the Power Brands, including The Prisoner Brand Family, Kim Crawford and Meiomi. In the Wine & Spirits business, the company is focusing on reshaping its portfolio toward higher-end brands, aligning with consumer trends toward premiumization. STZ is making investments to fuel growth of its power brands through innovation, capitalizing on priority, consumer trends, and successful product introductions.

Premiumization trends in the beer business are highlighted by growth in traditional beer and the flavors category, including seltzers, flavored beer, RTD spirits, and flavored malt beverages. The expansion into direct-to-consumer channels and international markets is a significant move to tap into new revenue streams and diversify STZ's market presence.

Moreover, the company’s commitment to delivering shareholder value is evident in its balanced capital allocation, prioritizing growth and shareholder returns. This approach, coupled with disciplined investment and share repurchase programs, demonstrates a focus on sustainable growth and shareholder interests.

Three Solid Picks

A few better-ranked stocks are Vita Coco Company COCO, PepsiCo, Inc. PEP and Coca-Cola FEMSA KOF.

Vita Coco, which develops, markets and distributes coconut water products, has a trailing four-quarter earnings surprise of 25.3%, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vita Coco’s current financial-year sales and earnings suggests growth of 1.8% and 24.3%, respectively, from the year-ago period's reported figures. COCO shares have risen 9.7% in the past year.

PepsiCo is one of the leading global food and beverage companies. It presently has a Zacks Rank #2 (Buy). PEP shares have declined 8.9% in the past year. The company has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 3.4% and 7.1%, respectively, from the year-ago period’s reported figures.

Coca-Cola FEMSA produces, markets and distributes soft drinks throughout the metropolitan area of Mexico City. It currently carries a Zacks Rank #2. KOF shares have gained 11.6% in the past year.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and EPS suggests growth of 10.7% and 25.1%, respectively, from the year-ago period’s reported figures. KOF has a trailing four-quarter negative earnings surprise of 1.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance