Mohawk's (MHK) Q1 Earnings Likely to Decline: Factors to Note

Mohawk Industries, Inc. MHK is scheduled to report first-quarter 2024 results on Apr 25, after market close.

In the last reported quarter, the company’s adjusted earnings topped the Zacks Consensus Estimate by 6% and increased 48.5% year over year. Net sales beat the consensus estimate by 1.3% but dropped 1.5% from the year-ago quarter’s levels.

MHK’s earnings surpassed expectations in each of the trailing four quarters, with an average of 12.5%.

Trend in Estimate Revision

The Zacks Consensus Estimate for Mohawk’s first-quarter 2024 earnings is pegged at $1.69 per share, indicating a 3.4% fall from the prior-year reported figure of $1.75. The estimated figure moved down from $1.75 per share in the past 60 days.

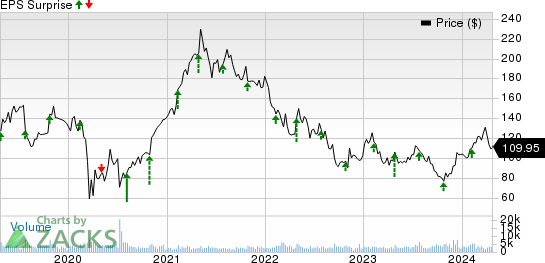

Mohawk Industries, Inc. Price and EPS Surprise

Mohawk Industries, Inc. price-eps-surprise | Mohawk Industries, Inc. Quote

The consensus estimate for net sales is pegged at $2.69 billion, suggesting a 4.1% decline from the year-ago reported figure of $2.81 billion.

Factors to Note

Mohawk’s top and the bottom line are expected to have declined in first-quarter 2024, due to difficult year-over-year comparison in the residential sector owing to persistently high mortgage rates.

Also, weakness in the remodeling projects are likely to have ailed the results to some extent. Higher interest rates and inflationary pressure have been moderating demand for homes, thereby impacting consumer discretionary spending.

We expect net sales in the Global Ceramic to decline 2.4% year over year to $1.03 billion, Flooring North America (NA) to fall 4.7% year over year to $908.5 million, and Flooring Rest of World (ROW) to be down 8.1% year over year to $729 million.

The company expects first-quarter adjusted earnings (excluding restructuring, acquisition and other charges) in the range of $1.60-$1.70 per share. This indicates a decline from the year-ago figure of earnings of $1.75.

Our expectation for adjusted operating income for the Global Ceramic and Flooring ROW businesses suggests a decline of 37.8% and 15.7%, respectively, from the year-ago period’s figures. However, Flooring NA business’ adjusted operating income is pegged at $37.9 million compared with $5 million reported in the year-ago quarter.

On the other hand, strategic investments in new products and enhanced merchandising & marketing activities are likely to have aided sales. MHK continues to invest in innovative products to increase sales and mix.

MHK has undertaken certain actions across the enterprise to reduce costs. The company is minimizing expenses, reducing overhead and restructuring to adapt to present conditions. Initiatives are being implemented to enhance processes and reduce the impact of inflation.

In the to-be-reported quarter, our model predicts the adjusted cost of goods sold to decline 5.7% year over year to $2 billion.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Mohawk this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below.

MHK has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks Poised to Beat Earnings Estimates

Here are some stocks from the Zacks Consumer Discretionary sector, which, according to our model, have the right combination of elements to post an earnings beat:

MGM Resorts International MGM has an Earnings ESP of +37.96% and a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

MGM is expected to register a 34.1% increase in earnings for the to-be-reported quarter. It reported better-than-expected earnings in each of the trailing four quarters, the average surprise being 271.5%.

DraftKings Inc. DKNG currently has an Earnings ESP of +36.22% and a Zacks Rank of 3.

DKNG’s earnings for the to-be-reported quarter are expected to increase 67.8%. It reported better-than-expected earnings in two of the trailing four quarters and missed on the other two occasions, the average negative surprise being 57.1%.

AMC Entertainment Holdings, Inc. AMC presently has an Earnings ESP of +25.70% and a Zacks Rank of 3.

AMC’s earnings for the to-be-reported quarter are expected to increase 37.7%. It reported better-than-expected earnings in the trailing four quarters, the average surprise being 50.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance