Moderna Shares Lose Momentum After Meteoric Rise: Here's Why

Shares of Moderna, Inc. MRNA were down 4.9% on Jul 2 following a report published on statnews.com on potential delay in initiating the phase III study on its mRNA-based coronavirus vaccine candidate, mRNA-1273.

The statnews.com report stated that Moderna is making changes to its phase III study protocol, according to some investigators. Investigators interviewed by statnews.com mentioned that changes to study design are common. However, delay in the timeline for Moderna’s study initiation due to its protocol changes is a concern.

Previously, the late-stage study was anticipated to start this week. Last week, Moderna and National Institutes of Health, which is funding the study, stated that they intend to start the study this month. A delay in the study initiation will automatically delay its completion, which in turn will push back potential approval to the vaccine.

Although ambiguity rose following the publication of the report on statnews.com, the rumored delay is unlikely to have any significant impact on the vaccine’s prospects. We expect major investors to likely focus on the ongoing phase II study data readout and preliminary data from phase III study, following its initiation.

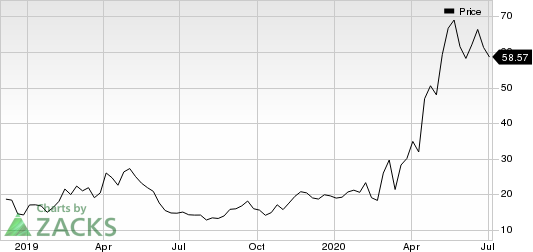

We note that Moderna’s shares skyrocketed 228.3% in the first six months of 2020 compared with the industry's increase of 9%. However, shares declined 4.4% last week.

The rumored delay in study initiation was one of the factors leading to decline in shares of Moderna last week. Meanwhile, competition is rising in the field of coronavirus vaccine development with several big pharma companies making their entry. These companies have significantly higher resources compared to Moderna to support large-scale manufacturing capacities. Higher vaccine production will lead to higher revenue recognition for a company following its successful development and launch. Per a Reuters report, some investors are now favoring large pharma companies over biotechs like Moderna, which have soared significantly so far.

Pfizer PFE is a large pharma company developing four mRNA-based vaccines for COVID-19. The company announced encouraging preliminary results last week on one of its vaccine candidates currently being evaluated in a phase I/II study. A phase IIb/III study is anticipated to start by end of July. With similar technology and timeline for a late-stage study, Pfizer’s vaccine candidate seems to be strong competition for mRNA-1273. Following the announcement, shares of rival biotechs including Moderna were down. This could be another reason for Moderna’s shares taking a hit last week.

Other large pharma companies involved in developing a vaccine for COVID-19 include AstraZeneca in collaboration with Oxford University, Sanofi SNY in collaboration with Glaxo and J&J JNJ.

Moreover, SEC filings show that a few Moderna executives are cashing in on the significant rise in the company’s share price by selling a portion of their holdings. This can also be a factor for recent slowing growth rate in Moderna’s share price.

Zacks Rank

Moderna currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Click to get this free report Johnson Johnson (JNJ) : Free Stock Analysis Report Sanofi (SNY) : Free Stock Analysis Report Pfizer Inc. (PFE) : Free Stock Analysis Report Moderna, Inc. (MRNA) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance