Minerals Technologies Inc. Surpasses Analyst Earnings Expectations in Q1 2024

Earnings Per Share (EPS): Reported diluted EPS at $1.44, with $1.49 excluding special items, surpassing the estimated EPS of $1.28.

Net Income: Achieved $46.7 million, significantly exceeding the estimated $41.65 million.

Revenue: Posted $534.5 million, falling slightly short of the estimated $545.55 million.

Operating Income: Recorded a record $77 million excluding special items, representing 14.5% of sales.

Free Cash Flow: Generated $39.4 million in free cash flow from operations of $55.9 million after capital expenditures of $16.5 million.

Share Repurchases and Debt Repayment: Repurchased $15 million of shares and repaid $13 million in debt during the quarter.

Segment Performance: Consumer & Specialties segment saw sales of $297 million, up 4% on an underlying basis, while Engineered Solutions faced a 5% decline to $238 million due to slow market conditions.

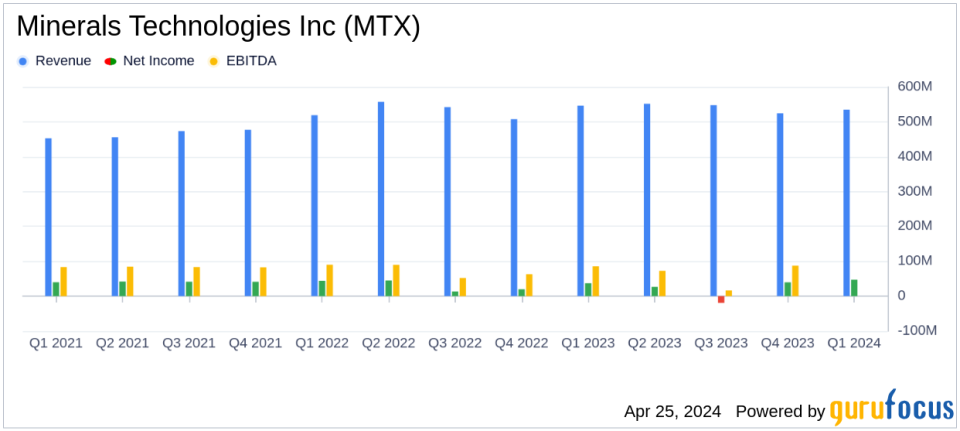

On April 25, 2024, Minerals Technologies Inc (NYSE:MTX) released its 8-K filing, announcing a robust start to the year with first-quarter earnings that exceeded analyst expectations. The company reported a diluted earnings per share (EPS) of $1.44, and $1.49 when excluding special items, surpassing the estimated EPS of $1.28. Net income for the quarter stood at $46.7 million, significantly higher than the anticipated $41.65 million. However, with a revenue of $534.5 million, MTX narrowly missed the forecasted $545.55 million.

Minerals Technologies Inc., headquartered in New York, is a prominent player in the specialty minerals industry. The company operates through various segments, including Specialty Minerals, Refractories, and Performance Materials, catering to diverse industries such as paper, building materials, automotive, and pharmaceuticals. The majority of its revenue is generated within the United States.

Quarterly Financial Highlights

The first quarter of 2024 saw MTX achieve a record operating income of $77 million, representing 14.5% of sales. This performance was bolstered by growth in higher margin products and strong operational execution across the company. The Consumer & Specialties segment reported a 4% increase in sales on an underlying basis, reaching $297 million, driven by robust demand for cat litter products and other consumer-oriented offerings. Conversely, the Engineered Solutions segment faced challenges, with sales declining by 5% to $238 million due to sluggish commercial construction markets in North America.

Chairman and CEO Douglas T. Dietrich commented on the results, stating,

We had a strong start to the year and delivered another record quarter. Growth in higher margin products and a strong operating performance across the company led to record operating income for MTI. This quarter demonstrates the power of our new organization, focused strategy, and robust business model. We continue to execute on our strategy and are on track to achieve our long-term growth and profitability targets."

Operational and Segment Performance

The Consumer & Specialties segment not only increased its sales but also improved its operating margin by 330 basis points to 14.1%, reflecting effective volume growth and cost control. The Engineered Solutions segment, despite a sales decline, saw its operating income increase by 9% to $39 million, with an operating margin of 16.2%, up 200 basis points from the previous year.

MTX's financial stability was further evidenced by its cash flow activities; the company generated $56 million in cash flow from operations and $39 million in free cash flow. Additionally, MTX demonstrated its commitment to shareholder returns by repurchasing $15 million of shares and repaying $13 million of debt during the quarter.

Looking Ahead

As MTX moves forward in 2024, the management remains focused on leveraging its diversified product portfolio and strategic initiatives to drive further growth and profitability. The company's ability to navigate market fluctuations while maintaining strong operational performance positions it favorably for sustained success in the competitive specialty minerals market.

Minerals Technologies will host a conference call on April 26, 2024, to discuss detailed quarterly results and provide insights into its future strategies. Interested parties can access the live webcast at Minerals Technologies Investor Relations.

For further details on MTX's financial performance and strategic initiatives, please visit www.mineralstech.com.

Explore the complete 8-K earnings release (here) from Minerals Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance