MGM Resorts (MGM) Q3 Earnings Beat, Revenues Miss Estimates

MGM Resorts International MGM reported third-quarter 2019 results, wherein earnings topped the Zacks Consensus Estimate but revenues lagged the same.

Adjusted earnings of 31 cents per share beat the consensus estimate of 29 cents by 6.9% and improved 34.8% from the prior-year quarter.

Total revenues were $3,314.4 million, missing the consensus mark of $3,370 million by 1.7%. Nonetheless, the top line increased 9.4% year over year. This improvement was backed by robust performance of MGM China and Regional Operations.

MGM China

MGM China’s net revenues increased 21.7% year over year to $737.8 million, owing to net revenue contribution of $364 million from MGM Cotai.

The opening of 25 new-to-market tables at MGM Cotai facilitated a 47% year-over-year increase in main floor table game wins. VIP table game wins also increased 5% from the prior-year quarter, primarily driven by the opening of VIP gaming areas in September 2018 at MGM Cotai.

MGM China’s adjusted property EBITDA (earnings before interest, taxes and amortization) increased 40% to $182 million from $130 million in the prior-year quarter. Moreover, adjusted property EBITDA margin was 24.7%, marking an increase of 320 basis points (bps) from the year-ago figure.

Domestic Operations

MGM Resorts owns and operates several properties in Las Vegas. It also owns several assets in Mississippi and Michigan.

Net revenues at Las Vegas Strip Resorts were $1.5 billion, up 3.7% year over year. Moreover, adjusted property EBITDA increased 5% year over year and EBITDA margin expanded 41 bps.

Net revenues of $935 million from the company's regional operations increased 20.3% from the prior-year number, driven by revenues of $76 million from MGM Springfield and $52.1 million from Empire City Casino, and net revenues of $64.4 million from MGM Northfield Park's operations. Adjusted property EBITDA was $264 million, mirroring a 27% increase from the year-ago quarter, with notable strength at MGM National Harbor and Borgata. Adjusted Property EBITDA margin also expanded 152 bps year over year.

Casino revenues in the quarter under review decreased 3% year over year at the company's Las Vegas Strip Resorts due to a 11% decline in table game wins. However, the same increased 26% at its Regional Operations, owing to the full-quarter contribution from MGM Springfield, the acquisition of Empire City Casino and the merger of MGM Northfield Park's operations.

At the Las Vegas Strip Resorts, food and beverage revenues rose 9% from the prior-year quarter, backed by the opening of new outlets at Park MGM as well as NoMad Las Vegas.

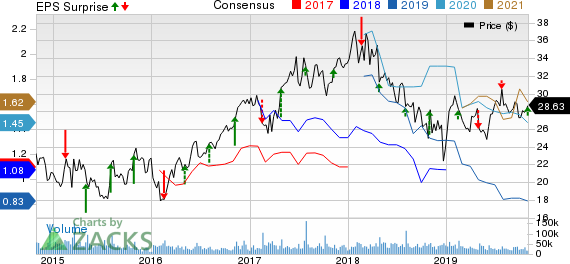

MGM Resorts International Price, Consensus and EPS Surprise

MGM Resorts International price-consensus-eps-surprise-chart | MGM Resorts International Quote

Balance Sheet

MGM Resorts ended the third quarter with cash and cash equivalents of $1,233.6 million as of Sep 30, 2019 compared with $1,526.8 million on Dec 31, 2018.

On Oct 30, 2019, the company's board of directors approved a quarterly dividend of 13 cents per share, totaling $67 million.

It expects the robust Las Vegas market and successful implementation of MGM 2020 to drive EBITDA and free cash flow growth. Meanwhile, proceeds generated from its asset light strategy will be utilized to strengthen balance sheet, reduce shares outstanding and invest in select growth initiatives.

Zacks Rank

MGM Resorts — which shares space with Wynn Resorts WYNN, Caesars Entertainment Corporation CZR and Las Vegas Sands Corp. LVS in the Zacks Gaming industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

Caesars Entertainment Corporation (CZR) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance