MGM Resorts (MGM) Down 3% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for MGM Resorts International MGM. Shares have lost about 3% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is MGM due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

MGM Resorts Q1 Earnings & Revenues Beat Estimates

MGM Resorts reported adjusted earnings of 34 cents for the first quarter of 2018. The Zacks Consensus Estimate was pegged at earnings of 31 cents. The company had reported earnings of 36 cents in the prior-year quarter.

Total revenues of $2.82 billion surpassed the consensus estimate of $2.80 billion by 0.7% and increased 3.9% year over year. The improvement was backed by higher revenues at MGM China.

The company also announced that CityCenter Holdings — a prominent venture between MGM Resorts and Infinity World Development — entered into a definitive agreement to sell the Mandarin Oriental Las Vegas and adjacent retail parcels for approximately $214 million in cash. The deal is expected to close in summer this year.

MGM China

MGM China’s net revenues increased 25% year over year to $596 million, courtesy of $85 million net revenue contribution from recently opened, MGM Cotai.

Opening of MGM Cotai also facilitated a 20% year-over-year increase in Main floor table games win. VIP table games win rose 26% from the prior-year quarter primarily driven by a 24% increase in turnover at MGM Macau.

MGM China’s adjusted property EBITDA (earnings before interest, taxes, and amortization) increased 5% to $152 million from $145 million in the prior-year quarter. However, adjusted property EBITDA margin came in at 25.5%, a decline of 500 basis points (bps) from the year-ago quarter. Operating margin was 9.2% in the quarter.

Domestic Operations

MGM Resorts owns and operates several properties in Las Vegas. It also owns a number of assets in Mississippi and Michigan.

Net revenues of $2.1 billion from the company's domestic resorts declined 1% from the prior-year quarter. Notably, casino revenues rose 2%, owing to a 6% increase in table games win and a 2% increase in slots win, which again was driven by an increase in slots volume at MGM National Harbor.

Room revenues fell 5% due to a 4.3% decrease in RevPAR (revenue per available room) at the company's Las Vegas Strip resorts. Las Vegas Strip RevPAR decreased 4.5% in the quarter with average daily rate (ADR) declining 2.3%. Occupancy dipped 200 bps.

Operating income at the company's wholly owned domestic resorts deteriorated 5.3% to $451 million. The decline in operating income was due to a decrease in room revenues and food and beverage revenues owing to a decline in occupied room nights and lower convention base at the company's Las Vegas Strip resorts.

Also, adjusted EBITDA decreased 5% year over year to $616 million.

Income from Unconsolidated Affiliates — CityCenter Holdings

MGM’s urban complex, CityCenter operates through two segments — Resort and Residential. Currently, the company has two properties — Aria and Vdara — under the Resort operations.

Net revenues from CityCenter declined 3% year over year to $304 million due to a decrease in casino revenues.

Operating income from resort operations was $40 million in the quarter, compared with $58 million in the prior year quarter. Adjusted EBITDA from resort operations was $93 million, marking a 16% year-over-year decrease.

Balance Sheet

MGM Resorts ended the quarter with cash and cash equivalents of $1.52 billion as of Mar 31, 2018, compared with $1.49 billion as of Dec 31, 2017.

On Apr 25, 2018, the company's board of directors approved a quarterly dividend of 12 cents per share, totaling $67 million. The dividend will be payable on Jun 15, 2018 to holders of record as of Jun 8, 2018. During the first quarter, MGM Resorts repurchased 10 million shares of its common stock at $36.24 per share for a total aggregate amount of $362.4 million.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been four revisions lower for the current quarter.

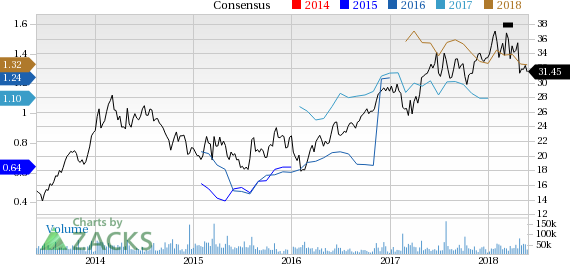

MGM Resorts International Price and Consensus

MGM Resorts International Price and Consensus | MGM Resorts International Quote

VGM Scores

Currently, MGM has a nice Growth Score of B, though it is lagging a lot on the momentum front with a D. Charting a somewhat similar path, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. It's no surprise MGM has a Zacks Rank #4 (Sell). We expect a below average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance