Methanex's (MEOH) Earnings and Sales Surpass Estimates in Q4

Methanex Corporation MEOH logged a profit (attributable to shareholders) of $41 million or 59 cents per share in fourth-quarter 2022, down from $201 million or $2.51 per share in the year-ago quarter.

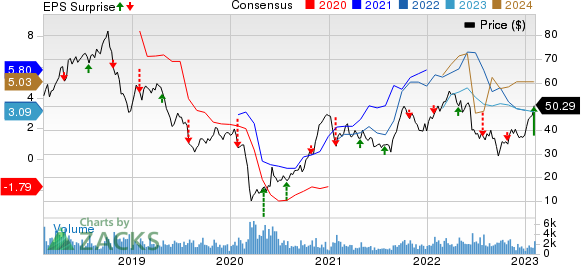

Adjusted earnings per share (barring one-time items) in the reported quarter were 73 cents, topping the Zacks Consensus Estimate of 46 cents.

Revenues fell around 21% year over year to $986 million in the quarter. The top line, however, beat the Zacks Consensus Estimate of $925.6 million.

Adjusted EBITDA in the reported quarter fell around 53% year over year to $160 million. The results in the reported quarter were hurt by lower average realized prices and sales volumes on a year-over-year basis.

Methanex Corporation Price, Consensus and EPS Surprise

Methanex Corporation price-consensus-eps-surprise-chart | Methanex Corporation Quote

Operational Highlights

Production in the quarter totaled 1,526,000 tons, down around 21% year over year. Production was, however, higher compared with the sequentially prior quarter which was affected by planned turnarounds in Egypt and New Zealand and seasonal gas restrictions in Chile.

Total sales volume in the fourth quarter totaled 2,647,000 tons, down roughly 6% year over year.

The average realized price for methanol was $373 per ton in the quarter, down roughly 16% from $445 per ton in the prior-year quarter.

FY22 Results

Earnings for full-year 2022 were $4.86 per share compared with $6.13 per share a year ago. Net sales went down around 2% year over year to $4,311 million.

Financials

Cash and cash equivalents were $857.7 million at the end of 2022, down around 8% year over year. Long-term debt at the end of the year was $2,136.4 million, down around 0.5% year over year.

Cash flow from operating activities was $978 million for 2022, down around 2% year over year.

The company returned $43 million to shareholders through dividends and share repurchases in the reported quarter. It also returned $297 million through dividends and share repurchases in 2022.

Outlook

Methanex said that it is seeing continued balanced supply/demand fundamentals in 2023. It also expects the high energy price environment to support the methanol cost curve and demand.

It forecasts production for 2023 to be roughly 1.3-1.4 million tons in New Zealand. The company also projects production in 2023 to be 0.8-0.9 million tons in Chile.

The construction of the Geismar 3 project is progressing and is expected to start methanol production in the fourth quarter of 2023.

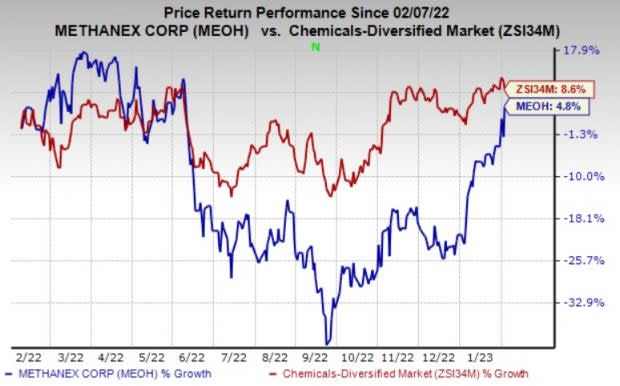

Price Performance

Shares of Methanex have gained 4.8% in the past year against an 8.6% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Methanex currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Commercial Metals Company CMC and Agnico Eagle Mines Limited AEM.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 25.2% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has rallied around 120% in a year.

Commercial Metals currently carries a Zacks Rank #1. The consensus estimate for CMC's current-year earnings has been revised 10% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 16.7%, on average. CMC has gained around 66% in a year.

Agnico Eagle currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for AEM’s current-year earnings has been revised 0.4% upward in the past 60 days.

Agnico Eagle beat Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 26.4% on average. AEM’s shares have gained roughly 7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance