Metals Exploration plc's (LON:MTL) Shares Bounce 26% But Its Business Still Trails The Industry

Despite an already strong run, Metals Exploration plc (LON:MTL) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 120% in the last year.

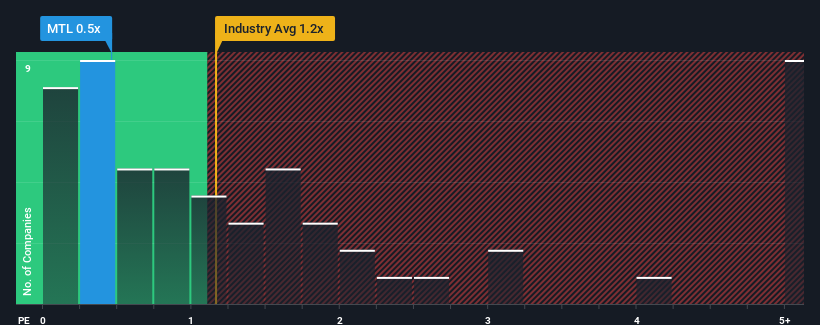

Even after such a large jump in price, Metals Exploration may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Metals and Mining industry in the United Kingdom have P/S ratios greater than 1.2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Metals Exploration

How Has Metals Exploration Performed Recently?

Metals Exploration certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Metals Exploration will help you uncover what's on the horizon.

Do Revenue Forecasts Match The Low P/S Ratio?

Metals Exploration's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Pleasingly, revenue has also lifted 46% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company are not good at all, suggesting revenue should decline by 7.3% over the next year. Meanwhile, the broader industry is forecast to moderate by 1.4%, which indicates the company should perform poorly indeed.

In light of this, it's understandable that Metals Exploration's P/S sits below the majority of other companies. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Metals Exploration's P/S?

Metals Exploration's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Metals Exploration's analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. With such a gloomy outlook, investors feel the potential for an improvement in revenue isn't great enough to justify paying a premium resulting in a higher P/S ratio. Typically when industry conditions are tough, there's a real risk of company revenues sliding further, which is a concern of ours in this case. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Metals Exploration (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance