Merit Medical's (MMSI) Latest Launch to Boost Patient Care

Merit Medical Systems, Inc. MMSI recently announced the U.S. commercial release of the basixSKY Inflation Device. The device is available as a standalone solution and in kits with Merit Medical’s Angioplasty Packs, configured to offer complementing AccessPLUS, Honor, and PhD hemostasis valves.

The basixSKY is the latest addition to Merit Medical’s comprehensive inflation device portfolio, which includes both digital and analog devices.

The inflation device portfolio belongs to Merit Medical’s Vascular – Cardiac product line of the broader Cardiac Intervention (CI) business. The CI business is a component of the broader Cardiovascular segment.

Significance of the Launch

Per Merit Medical’s estimates, 1.79 million coronary balloon and stent placement procedures will be performed in the United States in 2024. The basixSKY, which has been designed with ease of use in mind, is expected to create an efficient approach to inflation.

Management believes that the versatile analog device will likely offer fast inflation and ease of use, thereby streamlining patient care.

Industry Prospects

Per a report by Market Data Forecast, the global inflation devices market was valued at $663.1 million in 2023 and is anticipated to reach $854.8 million by 2028 at a CAGR of 5.2%. Factors like the increasing number of cases of cardiovascular diseases and the rising popularity of minimally-invasive surgical procedures are likely to drive the market.

Given the market potential, the latest launch is expected to provide a significant boost to Merit Medical’s business in the niche space.

Recent Developments

This month, Merit Medical received the FDA’s 510(k) clearance for its Siege Vascular Plug. The company also announced the launch of its Bearing nsPVA Express Prefilled Syringe in the United States and Australia.

Last month, Merit Medical reported its first-quarter 2024 results, wherein it registered a solid revenue uptick in its CI product line and the broader Cardiovascular segment both on a reported basis and at constant exchange rate.

In March, Merit Medical announced the commercial release of its FDA-cleared Micro ACE Advanced Micro-Access System. The company also intends to file Micro ACE for CE mark designation.

Price Performance

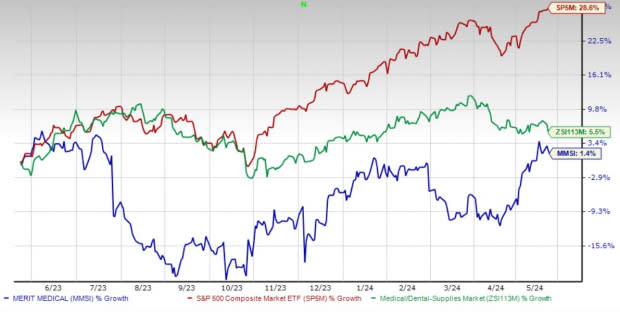

Merit Medical stock has gained 1.4% over the past year compared with the industry’s 5.5% rise and the S&P 500's 28.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Merit Medical carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Boston Scientific Corporation BSX and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 40.4% compared with the industry’s 24.5% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average being 7.5%.

Boston Scientific has gained 46.9% compared with the industry’s 1.4% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 40.1% against the industry’s 7.2% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance