MercadoLibre's (MELI) Q1 Earnings Beat, Revenues Rise Y/Y

MercadoLibre MELI reported first-quarter 2024 earnings of $6.78 per share, which beat the Zacks Consensus Estimate by 2.1%. The bottom line increased 70.8% year over year.

Revenues surged 36% on a year-over-year basis (94% on a FX-neutral basis) to $4.33 billion. The top line surpassed the Zacks Consensus Estimate by 9.9%.

Total revenues were driven by accelerating commerce and fintech revenues, which grew 48.9% and 21.7% year over year to $2.5 billion and $1.84 billion, respectively.

Revenues from MELI’s advertising services grew 64% on a year-over-year basis and were equivalent to almost 1.9% of gross merchandise volume (GMV) at the end of the first quarter.

Increasing total payments volume (TPV), courtesy of the robust Mercado Pago, aided the company. MercadoLibre’s rising GMV remained another positive. Strong momentum across Brazil and Mexico also contributed well to the reported results.

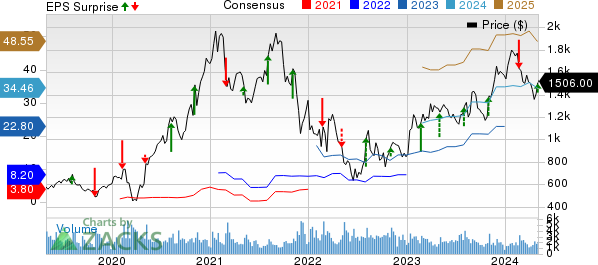

MercadoLibre, Inc. Price, Consensus and EPS Surprise

MercadoLibre, Inc. price-consensus-eps-surprise-chart | MercadoLibre, Inc. Quote

Quarter in Detail

Brazil: Net revenues in the first quarter came in at $2.57 billion (59.3% of the total revenues), rising 56.9% year over year.

Argentina: The market generated revenues of $615 million (14.2% of the top line), which declined 21.9% year over year.

Mexico: Net revenues in the reported quarter were $971 million (22.4% of the total revenues), which soared 59.2% year over year.

Other countries: The markets generated revenues of $176 million (4.1% of the total revenues), reflecting an increase of 17.3% on a year-over-year basis.

Key Metrics

GMV of $11.4 billion jumped 71% on an FX-neutral basis year over year. The figure missed the consensus mark by 3.9%.

The number of successful items sold was 385 million, up 24.6% year over year. The number of successful items shipped rose 25.5% year over year to $379 million.

TPV surged 86% year over year on a FX-neutral basis to $40.73 billion. This was driven by the strong performance of Mercado Pago. The figure missed the Zacks Consensus Estimate by 20.4%.

Total payment transactions increased 55.5% year over year to $2.42 billion.

Fintech monthly active users totaled 49 million, up 37.6% year over year.

Operating Details

For the first quarter, the gross margin was 46.7%, contracting 396 basis points (bps) year over year.

Operating expenses were $1.5 billion, which increased 25.1% year over year. As a percentage of revenues, the figure contracted 300 bps year over year to 35% in the reported quarter.

The operating margin was 12.2%, which contracted 90 bps year over year.

Balance Sheet

As of Mar 31, 2024, cash and cash equivalents were $2.58 billion, up from $2.56 billion as of Dec 31, 2023.

Short-term investments were $3.67 billion as of Mar 31, 2024, up from $3.48 billion as of Dec 31, 2023.

Zacks Rank & Stocks to Consider

Currently, MercadoLibre has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the retail-wholesale sector are The Gap GPS, DICK'S Sporting Goods DKS and Target TGT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Gap has lost 3.6% in the year-to-date period. The long-term earnings growth rate for GPS is currently estimated at 12%.

DICK'S Sporting Goods shares have gained 37.8% in the year-to-date period. DKS’s long-term earnings growth rate is currently projected at 35.5%.

Target has gained 12.8% in the year-to-date period. The long-term earnings growth rate for TGT is currently anticipated at 11.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance