Medicover And 2 Swedish Exchange Stocks With High Insider Ownership Poised For Growth

Amidst a backdrop of fluctuating global markets, with Europe grappling with rising inflation and policy uncertainties, Sweden's market presents a unique landscape for investors. In this context, companies like Medicover that boast high insider ownership may offer an intriguing stability and growth potential, aligning closely with broader economic resilience and investor confidence in such environments.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

BioArctic (OM:BIOA B) | 35.1% | 50.5% |

Sileon (OM:SILEON) | 33.3% | 109.3% |

InCoax Networks (OM:INCOAX) | 18% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

Yubico (OM:YUBICO) | 37.5% | 42.5% |

SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Medicover

Simply Wall St Growth Rating: ★★★★☆☆

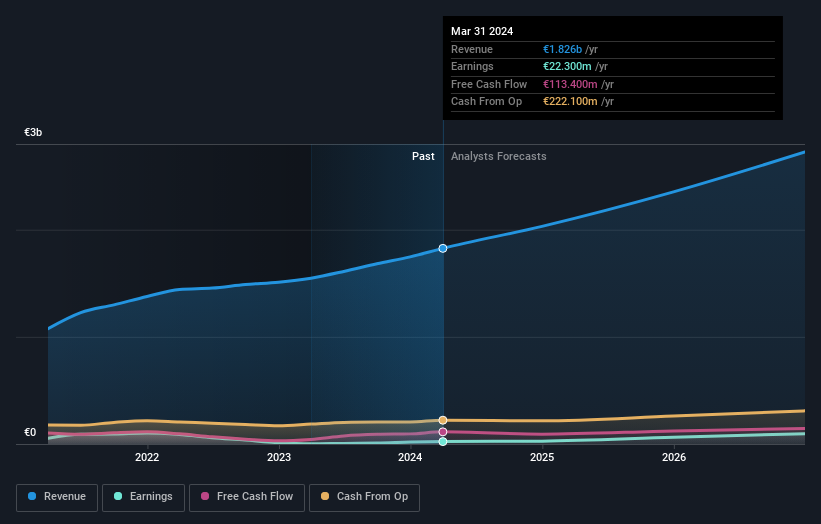

Overview: Medicover AB (publ) operates in the healthcare and diagnostic sectors across Poland, Sweden, and other international markets, with a market capitalization of approximately SEK 29.91 billion.

Operations: The company generates revenue primarily through two segments: Diagnostic Services at €585.20 million and Healthcare Services at €1.26 billion.

Insider Ownership: 11.1%

Medicover, a Swedish growth company with high insider ownership, has shown robust financial performance with first-quarter sales rising to €498.8 million from €419.3 million year-over-year and net income increasing to €6.2 million from €1.5 million. Despite challenges in covering interest payments with earnings, Medicover forecasts significant organic revenue growth exceeding €2.2 billion by 2025 and anticipates earnings to grow by 38.2% annually, outpacing the Swedish market's average.

Click here to discover the nuances of Medicover with our detailed analytical future growth report.

Upon reviewing our latest valuation report, Medicover's share price might be too optimistic.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

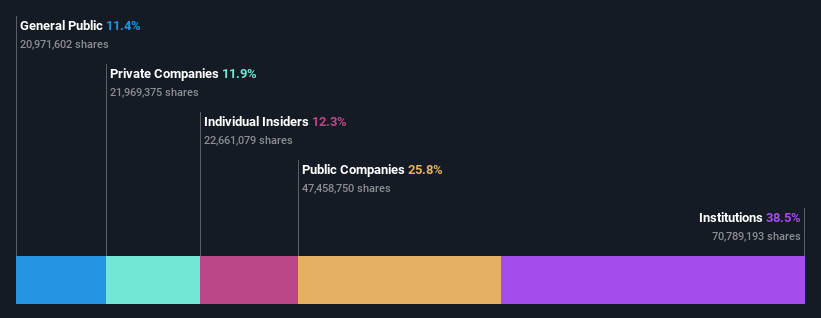

Overview: Pandox AB, a Swedish hotel property company, specializes in owning, operating, and leasing hotel properties with a market capitalization of approximately SEK 34.86 billion.

Operations: The company generates revenues primarily through two segments: own operation, which brings in SEK 3.24 billion, and rental agreements, contributing SEK 3.76 billion.

Insider Ownership: 12.3%

Pandox, a Swedish company with substantial insider ownership, reported a significant turnaround in its Q1 2024 earnings with sales reaching SEK 812 million and net income of SEK 447 million, recovering from a net loss the previous year. Despite this recovery, the company faces challenges as its dividends are not well covered by earnings and interest payments strain financial stability. However, Pandox is trading at good value relative to peers and expects revenue growth slightly above the Swedish market average at 2.2% annually.

Navigate through the intricacies of Pandox with our comprehensive analyst estimates report here.

Our valuation report here indicates Pandox may be undervalued.

Wallenstam

Simply Wall St Growth Rating: ★★★★☆☆

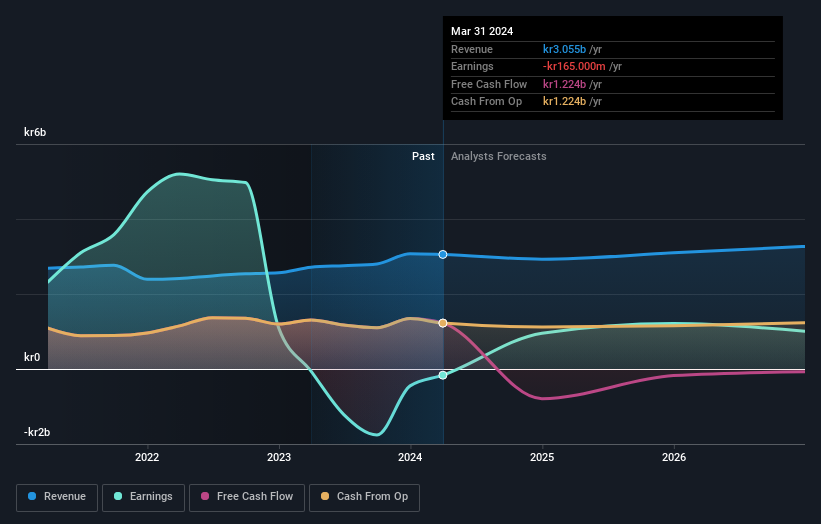

Overview: Wallenstam AB (publ) is a Swedish property company with a market capitalization of approximately SEK 34.92 billion.

Operations: The company generates its revenue primarily from two key Swedish cities, with SEK 1.89 billion from Gothenburg and SEK 0.92 billion from Stockholm.

Insider Ownership: 35%

Wallenstam, a Swedish growth company with high insider ownership, recently reported a substantial increase in Q1 2024 earnings with SEK 333 million net income, up from SEK 48 million the previous year. Despite this growth, the company's dividend was reduced to SEK 0.50 per share for 2023. Wallenstam's revenue is expected to grow at 3% annually, slightly above the market average of 2.1%. However, its financial position is strained as interest payments are not well covered by earnings.

Dive into the specifics of Wallenstam here with our thorough growth forecast report.

The valuation report we've compiled suggests that Wallenstam's current price could be inflated.

Make It Happen

Click this link to deep-dive into the 82 companies within our Fast Growing Swedish Companies With High Insider Ownership screener.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:MCOV B OM:PNDX B and OM:WALL B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance