May 2024 SEHK Growth Leaders With High Insider Ownership

As of May 2024, the Hong Kong market is experiencing a notable upswing, with the Hang Seng Index climbing 2.64% recently, reflecting positive investor sentiment amid recovery hopes fueled by robust holiday spending and trade data. This buoyant backdrop sets an intriguing stage for examining growth companies in Hong Kong that boast high insider ownership—a factor often linked with strong corporate governance and aligned interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Fenbi (SEHK:2469) | 32.1% | 43% |

Meitu (SEHK:1357) | 38% | 34.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 91.5% |

Beijing Airdoc Technology (SEHK:2251) | 26.4% | 83.9% |

Zhejiang Leapmotor Technology (SEHK:9863) | 14.2% | 74% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Let's uncover some gems from our specialized screener.

Ocumension Therapeutics

Simply Wall St Growth Rating: ★★★★★☆

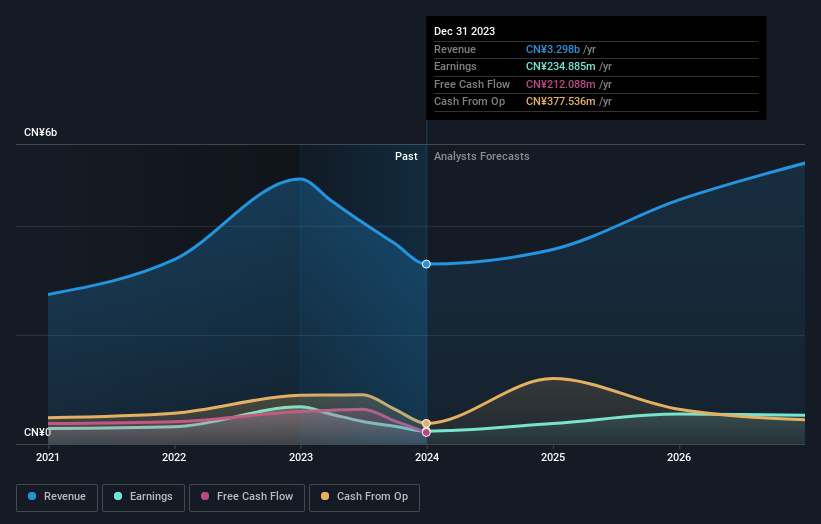

Overview: Ocumension Therapeutics operates as an ophthalmic pharmaceutical platform company in the People's Republic of China, with a market capitalization of approximately HK$4.82 billion.

Operations: The company generates revenue primarily from discovering, developing, and commercializing ophthalmic therapies, amounting to CN¥246.37 million.

Insider Ownership: 17.7%

Revenue Growth Forecast: 35.2% p.a.

Ocumension Therapeutics, a growth-oriented company with high insider ownership, has demonstrated promising developments in its product pipeline. Recent successful phase III trials of OT-502 and OT-702 indicate potential market expansions in China's ophthalmic sector. Despite a net loss of CNY 379.79 million in 2023, revenue increased to CNY 246.37 million from CNY 158.96 million the previous year. The company is expected to become profitable within three years, with revenue growth projected at a robust rate of 35.2% per year, outpacing the Hong Kong market average significantly.

Shanghai INT Medical Instruments

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai INT Medical Instruments Co., Ltd. is a company that operates in the medical instruments sector with a market capitalization of approximately HK$4.82 billion.

Operations: The company generates revenue primarily from its Cardiovascular Interventional Business, which accounted for CN¥641.32 million.

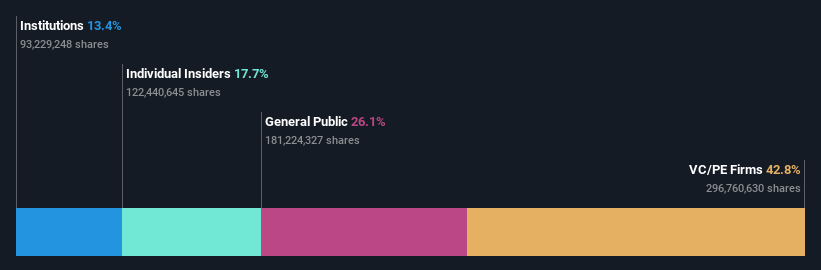

Insider Ownership: 29.8%

Revenue Growth Forecast: 26% p.a.

Shanghai INT Medical Instruments, while trading at a substantial discount to its estimated fair value, has shown robust performance with earnings and revenue growth outpacing the Hong Kong market significantly. Over the past year, earnings increased by 16.7%, with forecasts predicting further annual growth of 25.41%. Despite shareholder dilution last year, the company's revenue is expected to grow by 26% annually. Recently, it reported a rise in sales to CNY 752.84 million and net income to CNY 156.46 million for FY2023.

Adicon Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited, with a market cap of HK$6.44 billion, operates medical laboratories across the People’s Republic of China.

Operations: The company generates CN¥3.30 billion in revenue from its healthcare facilities and services segment.

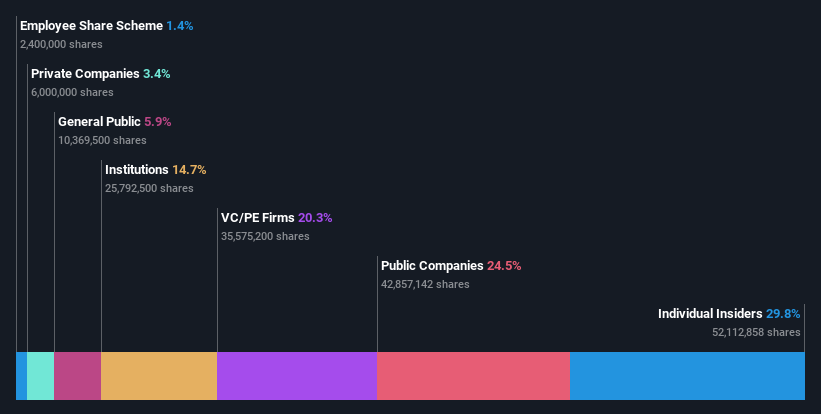

Insider Ownership: 22.3%

Revenue Growth Forecast: 15.2% p.a.

Adicon Holdings, despite a decline in profit margins to 7.1% from last year's 14%, is poised for substantial growth with earnings expected to increase by 29.58% annually. This growth rate surpasses the Hong Kong market's average of 12.1%. Additionally, revenue forecasts indicate a yearly rise of 15.2%, also outpacing the market expectation of 8.1%. Analyst consensus suggests a potential stock price increase of approximately 75.4%. However, there is no recent insider trading activity to report.

Next Steps

Discover the full array of 52 Fast Growing SEHK Companies With High Insider Ownership right here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1477 SEHK:1501 and SEHK:9860.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance