MarineMax Inc (HZO) Reports Modest Revenue Growth Amid Market Challenges, Misses Earnings ...

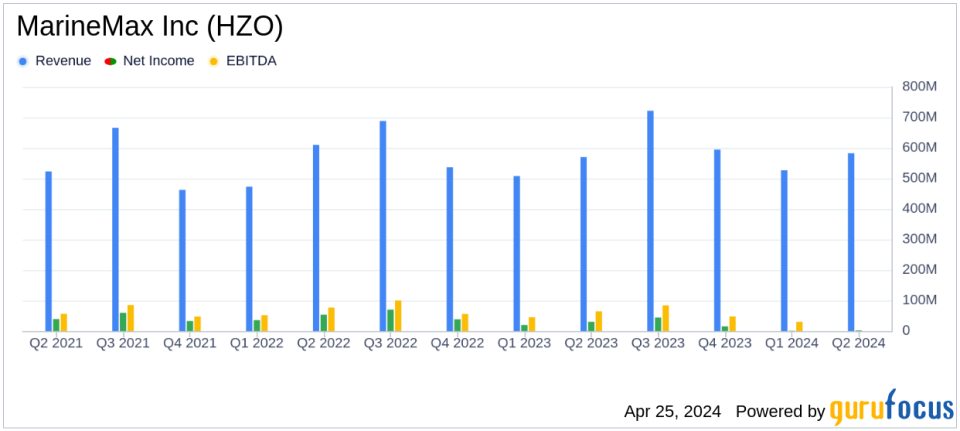

Revenue: Reported at $582.9 million, marking a 2% increase year-over-year, slightly below estimates of $590.19 million.

Net Income: Recorded at $1.6 million, significantly below the estimated $17.30 million.

Earnings Per Share (EPS): Achieved $0.07 per diluted share, falling short of the estimated $0.66.

Gross Profit Margin: Declined to 32.7% from 35.2% in the prior year, reflecting increased promotional activities and challenging market conditions.

Adjusted EBITDA: Totaled $29.6 million, a decrease from $57.4 million in the comparable period last year.

Same-Store Sales Growth: Reported a modest increase of 2%.

Financial Guidance: Revised fiscal 2024 guidance with adjusted net income expected to range between $2.20 to $3.20 per diluted share.

On April 25, 2024, MarineMax Inc (NYSE:HZO) disclosed its financial results for the second quarter of fiscal year 2024 through its 8-K filing. The company, a leading retailer of recreational boats and yachts, reported a revenue of $582.9 million, marking a 2% increase year-over-year but falling short of analyst expectations of $590.19 million. Notably, the earnings per share (EPS) stood at $0.07, significantly below the estimated $0.66, reflecting the ongoing challenges in the marine market.

Company Overview

MarineMax Inc operates primarily in the United States, offering new and used recreational boats under premium brands along with related marine products such as engines, parts, and accessories. The company's operations extend to repair, maintenance, and storage services, boat financing, insurance, brokerage sales of boats and yachts, and a yacht charter business. The Retail Operations segment, which includes the sale of new and used boats, generates the majority of the company's revenue.

Financial Performance and Market Challenges

The modest increase in revenue was driven by heightened boat sales, reflecting a resilient customer interest in boating. However, the company's net income plummeted to $1.6 million from $30.0 million in the previous year, influenced by higher interest expenses and increased promotional activities needed to stimulate consumer purchases amid economic pressures such as elevated interest rates and persistent inflation. Gross profit margin also saw a decline, dropping from 35.2% to 32.7% due to these promotional efforts.

Strategic Initiatives and Adjusted Financial Guidance

Amidst these challenges, MarineMax has been proactive in its strategic initiatives, including the acquisition of Williams Tenders USA, enhancing its distribution exclusivity in the U.S. and Caribbean markets. This move aligns with the company's strategy to focus on higher-margin businesses. Furthermore, MarineMax has revised its fiscal 2024 guidance, now expecting an adjusted EPS of $2.20 to $3.20 and an adjusted EBITDA of $155 million to $190 million, reflecting the ongoing adjustments to the market dynamics.

Management Commentary

"Although we continue to operate in a challenging market environment, we drove an increase in sales in the second quarter. Our gross margin also remains strong as a direct result of the strategic growth in our higher-margin businesses," said Brett McGill, CEO and President of MarineMax.

McGill also highlighted the company's efforts to reduce expenses and align costs with the current economic environment, which are expected to bolster MarineMax's financial position and readiness for future market improvements.

Conclusion

While MarineMax Inc (NYSE:HZO) navigates through a tough market landscape, its strategic acquisitions and focus on high-margin segments demonstrate a clear strategy to maintain growth and profitability. Investors and stakeholders will likely keep a close watch on how these strategies unfold in the coming quarters, particularly in light of the revised financial forecasts and ongoing economic uncertainties.

For more detailed financial analysis and future updates on MarineMax Inc (NYSE:HZO), stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from MarineMax Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance