Macy's (M) Q3 Earnings Top Estimates, Stock Falls on View Cut

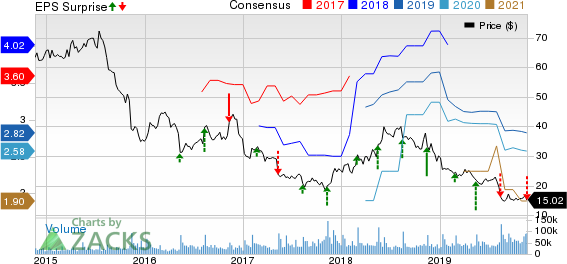

After a miss in the second quarter of fiscal 2019, Macy’s, Inc. M reported a positive earnings surprise in the third quarter. However, net sales fell short of the Zacks Consensus Estimate for the fourth quarter in a row. Moreover, both the top and the bottom line continued to decline year over year. Also, comparable sales slid after seven straight quarters of growth. Following the results, management trimmed fiscal sales and earnings guidance.

These were enough to dampen investor sentiments. Shares of this Cincinnati, OH-based company are down roughly 4% during the pre-market trading hours. We note that this Zacks Rank #4 (Sell) stock has plunged 31% compared with the industry's decline of 18% in the past three months.

Let’s Delve Deep

Macy’s posted third-quarter adjusted earnings of 7 cents a share that surpassed the Zacks Consensus Estimate of 1 cent. However, the quarterly earnings fell sharply from 27 cents reported in the year-ago period.

The department store chain generated net sales of $5,173 million that missed the Zacks Consensus Estimate of $5,310 million and decreased 4.3% year over year. Comparable sales (comps) on an owned plus licensed basis fell 3.5%, while on an owned basis, the metric decreased 3.9%.

Management highlighted that late arrival of cold weather, softness in international tourism and lower-than-expected performance in lower tier malls hurt the top line.

Adjusted EBITDA declined 20.1% to $325 million, while adjusted EBITDA margin contracted 120 basis points to 6.3%.

Other Financial Aspects

Macy’s ended the quarter with cash and cash equivalents of $301 million, long-term debt of $4,677 million, and shareholders’ equity of $6,057 million.

FY19 View

Following third-quarter sales performance, Macy’s now anticipates net sales decline of 2-2.5% with comps on an owned plus licensed basis to fall 1-1.5% for fiscal 2019. Comps on an owned basis are projected to be roughly 20 basis points below comps on an owned plus licensed basis.

The company had earlier projected net sales to be roughly flat with both comps on an owned plus licensed basis and comps on an owned basis projected to be flat to up 1%.

Management now envisions adjusted earnings between $2.57 and $2.77, down from the prior view of $2.85-$3.05 per share for fiscal 2019. The company had reported earnings of $4.18 in fiscal 2018. The Zacks Consensus Estimate for the fiscal year is pegged at $2.82, which is likely to witness downward revision in the coming days.

Check These 3 Trending Picks

Target TGT has a long-term earnings growth rate of 7.1% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Burlington Stores BURL has a long-term earnings growth rate of 15.7% and carries a Zacks Rank #2.

Costco COST has a long-term earnings growth rate of 8.5%. The stock carries a Zacks Rank #2.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Click to get this free report Target Corporation (TGT) : Free Stock Analysis Report Burlington Stores, Inc. (BURL) : Free Stock Analysis Report Costco Wholesale Corporation (COST) : Free Stock Analysis Report Macy's, Inc. (M) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance