Macroeconomic Headwinds Take a Toll on Semiconductor Sales

According to the latest report by Semiconductor Industry Association (SIA), global semiconductor industry sales were $40 billion in April, reflecting a monthly increase of 0.3% but a 21.6% decline from $50.9 billion in the year-ago period.

SIA president and CEO, John Neuffer cited cyclical downturns and sluggish macroeconomic conditions being the reasons behind the year-over-year decline. He also stated that “the month-to-month sales ticked up for the second consecutive month in April, perhaps foreshadowing a continued rebound in the months ahead.”

Despite modest month-to-month growth, the semiconductor industry continues to get negatively impacted by interrelated issues like rising prices, geopolitical tensions and pandemic aftereffects. These elements influence consumer spending, and result in macroeconomic uncertainty and swings in semiconductor demand. Also, currency fluctuations and fears of global recession continue to unfavorably impact the industry.

Nonetheless, the long-term prospects remain strong for the industry as semiconductors are the backbone of the current-day technology-driven economy. Digitization across industries, the adoption of cloud computing, and the integration of artificial intelligence and machine learning are likely to fuel demand for semiconductors.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to propel further growth. Apart from this, blockchain, the Internet of Things, autonomous vehicles, augmented reality/virtual reality and wearables are other growth prospects.

In May, the World Semiconductor Trade Statistics (WSTS) projected global annual semiconductor sales to decline from $574.1 billion in 2022 to $515.1 billion in 2023. However, the same is expected to rebound strongly in 2024 and reach $576.0 billion, which would be the market’s highest ever. The semiconductor market registered growth of 3.3% to reach an all-time high in 2022 from $555.9 billion in 2021, according to a report released by SIA on Mar 27, 2023. Owing to robust demand, 2022 has so far been one of the best years for the market.

Considering the long-term bright prospects of the industry, it is wise to stay invested in semiconductor stocks like NVIDIA Corporation NVDA, Nova Limited NVMI, Allegro MicroSystems ALGM and Photronics PLAB. All these stocks sport a Zacks Rank #1 (Strong Buy) and have witnessed positive estimate revisions. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Watch

NVIDIA is a global leader in visual computing technologies and the inventor of the graphic processing unit (GPU). The company’s GPU success can be attributed to its parallel processing capabilities supported by thousands of computing cores, which are necessary to run deep learning algorithms. Its GPU platforms are playing a major role in developing multi-billion-dollar end-markets like robotics and self-driving vehicles.

NVIDIA is a dominant name in the Data Center, professional visualization and gaming markets where Intel and Advanced Micro Devices are playing a catch-up role. The company’s partnerships with almost all major cloud service providers and server vendors are a key catalyst. Its GPUs are also witnessing rapid adoption in diverse fields, ranging from radiology to precision agriculture. The company is gaining from strong growth of artificial intelligence, high-performance computing and accelerated computing, which is boosting its Compute & Networking revenues, at present.

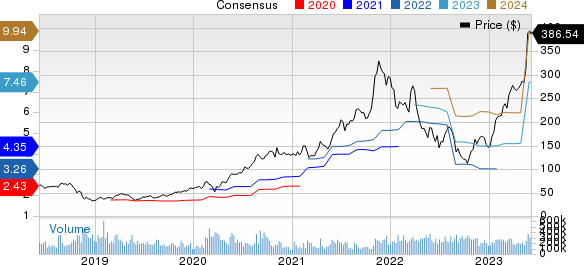

NVIDIA Corporation Price and Consensus

NVIDIA Corporation price-consensus-chart | NVIDIA Corporation Quote

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2024 earnings has been revised upward by 93 cents to $1.97 per share over the past 30 days, suggesting a 286.3% year-over-year increase. For fiscal 2024, the consensus mark for earnings has improved by 66.5% to $7.46 per share over the past 30 days, indicating a 123.4% year-over-year surge.

Nova Ltd. is a provider of metrology solutions for advanced process control used in semiconductor manufacturing. The company's product portfolio combines hardware and cutting-edge software.

The company’s advanced multidisciplinary dimensional metrology technologies combine complex optomechanical hardware with advanced optics and cutting-edge algorithms for effective process control throughout the semiconductor fabrication life cycle.

Nova Ltd. Price and Consensus

Nova Ltd. price-consensus-chart | Nova Ltd. Quote

The Zacks Consensus Estimate for Nova’s second-quarter 2023 earnings is pegged at $1.00 per share, having moved northward by 10 cents in the past 30 days. However, the estimated figure implies a 19.4% year-over-year decline. The consensus mark for 2023 earnings is pegged at $4.18, which inched up by 31 cents over the same time frame. The estimated figure indicates a 17.6% year-over-year decrease.

Allegro MicroSystems is a designer, developer, fabless manufacturer and marketer of sensor integrated circuits (ICs) and application-specific analog power ICs enabling emerging technologies in the automotive and industrial markets. Its diverse product portfolio provides solutions for the electrification of vehicles, automotive advanced driver assistance systems safety features, automation for Industry 4.0 and power-saving technologies for data centers and green energy applications.

The company’s fourth-quarter fiscal 2023 performance benefited from increased demand for e-Mobility applications, including xEV and ADAS and magnetic sensor and power IC product portfolios. Allegro gained from an increase in the internal supply of wafers and die-banks, which improved lead times for customers and reduced backlog. Revenues came in at $240.53 million in the fiscal fourth quarter, up 20.1% year over year.

Allegro MicroSystems, Inc. Price and Consensus

Allegro MicroSystems, Inc. price-consensus-chart | Allegro MicroSystems, Inc. Quote

The Zacks Consensus Estimate for Allegro’s first-quarter fiscal 2024 earnings has been revised upward by 7 cents to 37 cents over the past 30 days. The estimated figure indicates a decline of 54.2% year over year. For fiscal 2024, the consensus mark for ALGM’s earnings has been revised upward by 9 cents to $1.40 per share over the past 30 days, suggesting a 9.4% increase.

Photronics is a leading worldwide manufacturer of photomasks. A key element in the manufacture of semiconductors and flat panel displays, photomasks are used to transfer circuit patterns onto semiconductor wafers and flat panel substrates during the fabrication of integrated circuits, a variety of flat panel displays and, to a lesser extent, other types of electrical and optical components.

Photronics produces photomasks in accordance with product designs provided by customers at strategically located manufacturing facilities in Asia, Europe and North America.

Photronics, Inc. Price and Consensus

Photronics, Inc. price-consensus-chart | Photronics, Inc. Quote

PLAB has a Zacks Rank #1. The Zacks Consensus Estimate for Photronics’ third-quarter fiscal 2023 earnings has been revised upward by 9 cents to 53 cents per share over the past 30 days, indicating a 3.9% increase. For fiscal 2023, the consensus mark for PLAB’s earnings has been revised upward by 19 cents to $2.01 per share over the past 30 days, suggesting 3.6% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Photronics, Inc. (PLAB) : Free Stock Analysis Report

Nova Ltd. (NVMI) : Free Stock Analysis Report

Allegro MicroSystems, Inc. (ALGM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance