Mach Natural Resources LP Aligns with EPS Projections and Reports Strong Year-End Reserves

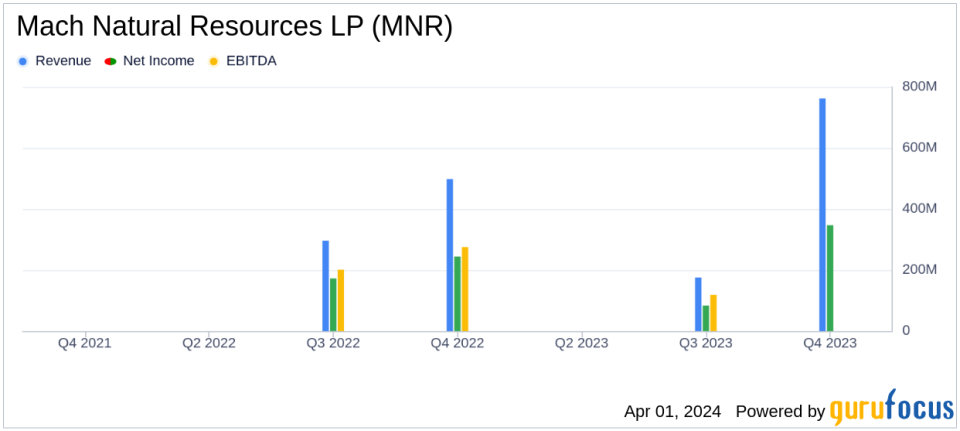

Revenue: MNR reported total revenues of $762 million for the year-ended December 31, 2023.

Net Income: The company generated a net income of $347 million, aligning with the estimated net income of $80.8213 million for the quarter.

Earnings Per Share (EPS): MNR's reported EPS aligned with the analyst's quarterly estimate of $0.8013.

Production: The company averaged a total net production of 50,440 barrels of crude oil equivalent (Boe) per day.

Acquisitions: MNR closed the acquisition of Paloma Partners IV, LLC for $815 million, bolstering its asset base.

Proved Reserves: Year-end 2023 estimated proved reserves were robust, underpinning the company's future growth prospects.

Guidance: MNR reaffirmed its guidance for 2024, with a capital expenditure plan of $250 million to $275 million.

Mach Natural Resources LP (NYSE:MNR) released its 8-K filing on April 1, 2024, unveiling its financial and operating results for the year-ended December 31, 2023. The independent upstream oil and gas company, which focuses on the acquisition, development, and production of oil, natural gas, and NGL reserves in the Anadarko Basin region, has reported a transformative year marked by significant achievements.

MNR completed its initial public offering (IPO) and closed a substantial acquisition, positioning itself for future growth. The company's financial performance for the year was notable with total revenues reaching $762 million and net income standing at $347 million. These figures are particularly impressive when considering the quarterly net income estimate of $80.8213 million, indicating that MNR has consistently performed well throughout the year.

The company's production profile was healthy, with an average daily production of 50,440 Boe, consisting of 29% oil, 54% natural gas, and 17% NGLs. The average realized prices for its products were $77.57 per barrel of crude oil, $24.52 per barrel of NGLs, and $2.52 per Mcf of natural gas, contributing to the strong revenue figures.

CEO Tom L. Ward emphasized the company's strategic objectives, which include maximizing distributions, disciplined acquisitions, maintaining low leverage, and a strategic reinvestment rate of less than 50% to optimize distributions. These objectives align with the value investors' focus on financial discipline and return on investment.

MNR's financial achievements are significant in the oil and gas industry, where volatility can greatly impact performance. The company's ability to generate substantial net income and maintain a strong production rate amidst market fluctuations demonstrates its operational efficiency and strategic planning.

Looking forward, MNR has reaffirmed its 2024 guidance, with a capital expenditure plan of $250 million to $275 million, primarily focused on drilling and completion activities. The forecast for total production is expected to range between 81.3 to 86.4 Mboe per day, suggesting a positive outlook for the company's growth trajectory.

The company's year-end 2023 proved reserves, evaluated by independent reserve engineer Cawley, Gillespie & Associates Inc., highlight the strength of MNR's asset base and its potential for sustained production and revenue generation.

For investors and industry analysts, MNR's financial results and strategic positioning offer a compelling narrative of a company poised for continued success in the oil and gas sector. The company's focus on maximizing cash distributions and maintaining a low reinvestment rate underscores its commitment to delivering value to unitholders.

Value investors interested in the energy sector may find MNR's performance and strategic outlook indicative of a potentially attractive investment opportunity. With a solid foundation laid in 2023 and a clear plan for the future, Mach Natural Resources LP stands out as a company worth watching in the coming years.

For further information and detailed financial statements, investors and interested parties are encouraged to visit MNR's investor relations website at www.ir.machnr.com.

Explore the complete 8-K earnings release (here) from Mach Natural Resources LP for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance