Luminex (LMNX) Q1 Earnings Miss Estimates, Revenues Beat

Luminex Corporation LMNX reported first-quarter 2020 adjusted earnings of 1 cent per share (EPS), missing the Zacks Consensus Estimate of 4 cents. Also, the bottom line plummeted 85.7% from the year-ago quarter.

Revenues came in at $90.4 million, surpassing the Zacks Consensus Estimate by 5.9%. Moreover, the top line improved 9.7% on a year-over-year basis.

Total sample-to-answer molecular diagnostics revenues grew 38% from the prior-year quarter.

Segmental Analysis

System Sales

Revenues at this segment totaled $12.1 million, declined 23.1% from the year-ago quarter.

Consumable Sales

This segment accounted for $12.8 million of revenues, up 19.3% year over year.

Royalty Revenues

Royalty revenues totaled $13.3 million, down 6.4% on a year-over-year basis.

Assay Revenues

This segment reported revenues worth $43.7 million, up 25.6% on a year-over-year basis.

Service Revenues

Revenues in the segment amounted to $5.5 million, up 2.4% from the year-ago quarter.

Other

Other revenues came in at $2.4 million, up 87.8% from the prior-year quarter.

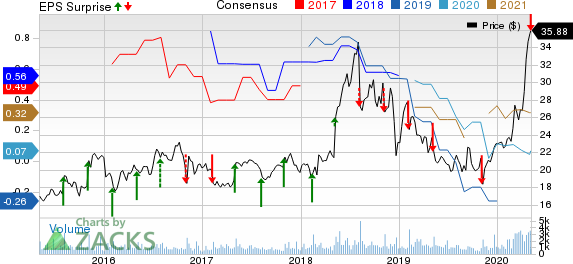

Luminex Corporation Price, Consensus and EPS Surprise

Luminex Corporation price-consensus-eps-surprise-chart | Luminex Corporation Quote

Financial Update

As of Mar 31, 2020, cash and cash equivalents totaled $43.1 million, down 27.2% from the year-end 2019.

Net cash used in operating activities for the three months ended Mar 31, 2020, came in at $7.2 million, compared with $7.1 million in the year-ago period.

Margins

Gross profit in the reported quarter was $50.3 million, up 9.9% year over year. Gross margin was 55.7%, expanding 10 (basis points) bps.

Research and development expenses totaled $11.9 million, down 20.8% year over year. Selling, general and administrative expenses in the first quarter were $33.9 million, up 7.8% year over year.

Total operating expenses amounted to $48.7 million, down 2.5% from the year-ago reported figure.

The company reported operating income of $1.6 million, against the year-ago quarter’s operating loss of $3.6 million.

2020 Guidance

Luminex projects second-quarter 2020 revenue to be at or above $105 million.

The company remains confident to surpass the high end of its current full-year revenue outlook of $362 million but is unable to issue an updated guidance range at this moment due to the uncertainties surrounding the COVID-19 pandemic.

The company expects to present and updated full-year revenue outlook in its second-quarter earnings release.

Wrapping Up

Luminex exited the first quarter on a strong note. The company continues to gain from its flagship ARIES and VERIGENE platforms that currently have a strong customer base. Revenues at Consumable sales, Assay, Service and Other revenues also improved significantly. Expansion in gross margin is a positive.

The company received Emergency Use Authorization from the FDA for its NxTAGCoV Extended Panel and ARIES SARS-CoV-2-Assay, supported by $1.2 million in BARDA funding. Moreover, the company has expanded its current manufacturing capacity to produce more than 500,000 tests per month and intends to expand to more than 800,000 tests per month by the end of second quarter.

Meanwhile, the company witnessed a decline in System sales and Royalty revenues in the reported quarter.

Zacks Rank

Currently, Luminex carries a Zacks Rank #2 (Buy).

Other Key Picks

Some other top-ranked stocks in the broader medical space are Exact Sciences Corporation EXAS, Aphria Inc. APHA and Pacific Biosciences of California, Inc. PACB, each carrying a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Exact Sciences’s first-quarter 2020 revenues is pegged at $350.2 million, suggesting a whopping year-over-year improvement of 116.1%. The same for EPS stands at a loss of 60 cents, indicating an improvement of 9.1% from the prior-year quarter.

The Zacks Consensus Estimate for Aphria’s fourth-quarter fiscal 2020 revenues is $100.3 million, suggesting growth of 4.4% from the year-earlier reported figure.

The Zacks Consensus Estimate for Pacific Biosciences’ first-quarter 2020 revenues is pegged at $20.1 million, suggesting year-over-year improvement of 22.3%. The same for loss stands at 15 cents, indicating year-over-year improvement of 25%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Luminex Corporation (LMNX) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Aphria Inc. (APHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance