LPL Financial (LPLA) Up 2.9% on Q1 Earnings & Revenue Beat

Shares of LPL Financial’s LPLA gained 2.9% since the release of its first-quarter 2023 results late last week. Adjusted earnings of $4.49 per share handily surpassed the Zacks Consensus Estimate of $4.35. The bottom line reflects a substantial jump from $1.95 in the prior-year quarter. Our estimate for adjusted earnings per share was $4.52.

Results benefited from robust improvement in revenues, partly offset by an increase in expenses. LPLA recorded marginal growth in brokerage and advisory assets, which acted as a tailwind.

After considering certain non-recurring charges, net income was $338.9 million or $4.24 per share, up substantially from $133.7 million or $1.67 per share.

Revenues & Expenses Rise

Total net revenues of $2.42 billion grew 17% year over year. The top line also surpassed the Zacks Consensus Estimate of $2.39 billion. We had projected the metric to be $2.41 billion.

Total expenses increased 4% to $1.97 billion. The rise was mainly due to higher compensation and benefits costs and interest expenses on borrowings. Our estimate for total expenses was $1.95 billion.

As of Mar 31, 2023, LPL Financial’s total brokerage and advisory assets were $1,175.2 billion, up 1%.

In the first quarter, total net new assets were $24.5 billion, up from $17.6 billion in the prior-year quarter. Total client cash balances declined 12% to $54.6 billion.

Balance Sheet Position Solid

As of Mar 31, 2023, total assets were $9.2 billion, down 3% on a sequential basis. As of the same date, cash and cash equivalents totaled $469.8 million, down 45%.

Total stockholders’ equity was $2.2 billion as of Mar 31, 2023, up 1%.

Share Repurchase Update

In the reported quarter, the company repurchased shares for $275 million.

Our View

LPL Financial’s recruiting efforts and solid advisor productivity will likely continue aiding advisory revenues. Strategic buyouts, including Boenning & Scattergood’s private client group business and Financial Resources Group Investment Services in January 2023, will keep supporting financials. However, mounting expenses and deteriorating operating backdrop remain major near-term concerns for the company.

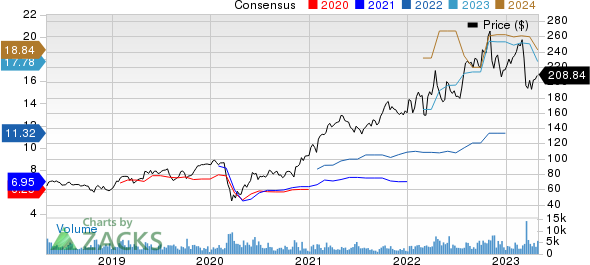

LPL Financial Holdings Inc. Price and Consensus

LPL Financial Holdings Inc. price-consensus-chart | LPL Financial Holdings Inc. Quote

Currently, LPL Financial carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Brokerage Firms

Charles Schwab’s SCHW first-quarter 2023 adjusted earnings of 93 cents per share beat the Zacks Consensus Estimate of 90 cents. The bottom line also grew 21% from the prior-year quarter. Our estimate for adjusted earnings was the same as the consensus number.

SCHW’s results benefited from higher rates, which led to a rise in net interest income (NII). Thus, revenues improved despite lower bank deposit fees and higher volatility hurting trading income. Also, the absence of fee waivers and solid brokerage account numbers acted as tailwinds during the quarter. However, higher expenses were an undermining factor.

Interactive Brokers Group’s IBKR first-quarter 2023 adjusted earnings per share of $1.35 missed the Zacks Consensus Estimate of $1.40. However, the bottom line reflects a rise of 64.6% from the prior-year quarter. Our estimate for adjusted earnings was also $1.35.

Results were primarily hurt by an increase in expenses. A fall in daily average revenue trades was another headwind. Nevertheless, an improvement in revenues was a tailwind for IBKR. Also, the company’s capital position was strong.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance