Low Freight Volumes Hurt Union Pacific's (UNP) Q3 Earnings

United Pacific Corporation’s UNP third-quarter 2019 earnings of $2.22 per share fell short of the Zacks Consensus Estimate by 7 cents. However, the bottom line improved 3.3% on a year-over-year basis, primarily owing to lower costs.

Meanwhile, operating revenues came in at $5,516 million, missing the Zacks Consensus Estimate of $5,623.2 million. The top line also declined 7% year over year due to sluggish freight revenues (down 7%).

The year-over-year contraction in the top line was due to an 8% reduction in business volumes, measured by total revenue carloads. The underperformance on both the top- and the bottom-line front naturally disappointed investors. As a result, the stock shed value in pre-market trading.

Operating income in the third quarter dipped 2% year over year to $2.2 billion. Also, operating expenses declined 10% to $3.28 billion. Further, operating ratio (operating expenses as a percentage of revenues) improved to 59.5% from 61.7% a year ago, driven by this railroad operator’s efforts to control costs so as to offset the decline in shipments. Notably, lower the value of the metric, the better.

Moreover, this Zacks Rank #3 (Hold) company bought back 6.4 million shares worth $1.1 billion during the quarter. Effective tax rate in the period came in at 23.1% compared with 23.3% a year ago.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

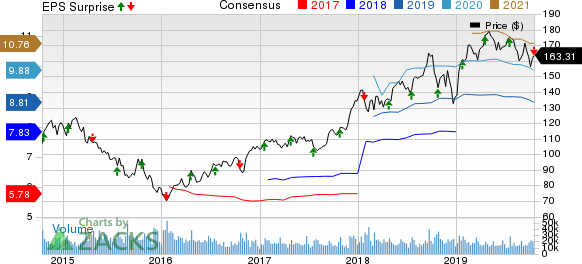

Union Pacific Corporation Price, Consensus and EPS Surprise

Union Pacific Corporation price-consensus-eps-surprise-chart | Union Pacific Corporation Quote

Segmental Performance

Freight revenues in the Agricultural Products were $1,123 million, down 1% year over year. Revenue carloads too slid 2% year over year. However, average revenue per car inched up 2%.

Freight revenues in the Energy division were $975 million, down 20% year over year. Also, revenue carloads fell 15% year over year. Moreover, average revenue per car decreased 5% year over year.

Industrial freight revenues totaled $1,485 million, down 1% year over year. However, revenue carloads increased 2% year over year but average revenue per car slipped 3%.

Freight revenues in the Premium division were $1,563 million, down 9% year over year. Moreover, revenue carloads dropped 11% year over year. However, average revenue per car rose 2% year over year.

Meanwhile, other revenues were flat at $370 million in the third quarter of 2019.

Liquidity

The company exited the quarter with cash and cash equivalents of $1,250 million compared with $1,273 million at the end of 2018. Debt (due after one year) totaled $24,314 million at the end of the quarter compared with $20,925 million at last-year end. Debt-to-EBITDA ratio (on an adjusted basis) deteriorated to 2.6 from 2.3 at 2018 end.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting third-quarter 2019 earnings reports from key players like Kansas City Southern KSU, JetBlue Airways JBLU and United Parcel Service UPS. While Kansas City Southern will report third-quarter earnings on Oct 18, JetBlue and UPS will announce the same on Oct 22.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JetBlue Airways Corporation (JBLU) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance