Now is the time to convert your leftover holiday money into a spare $184

Aussies who are strapped for cash could make hundreds of dollars by turning foreign cash left over from overseas holidays into Australian currency.

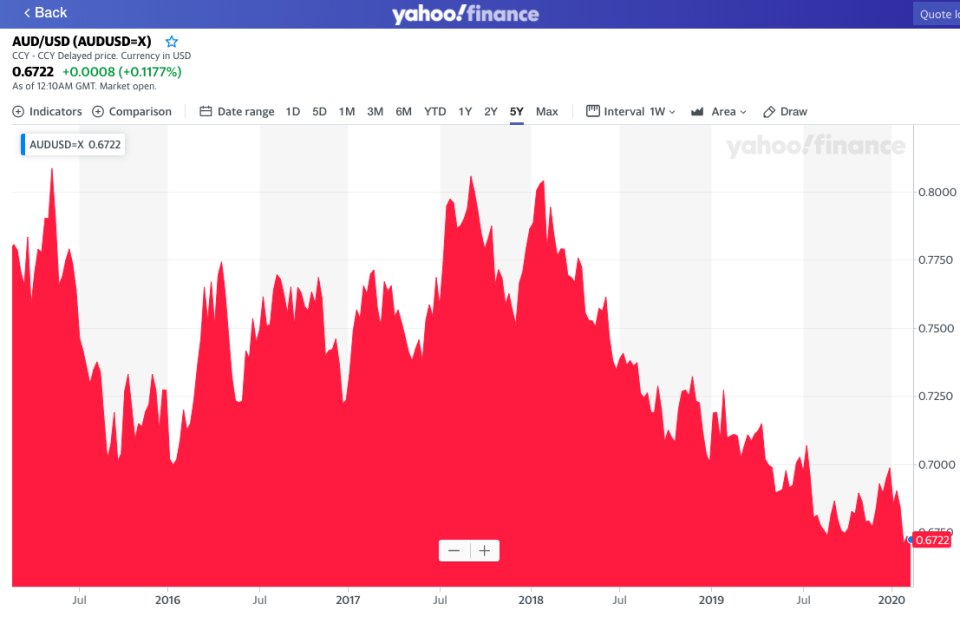

The Australian dollar has dropped to an 11-year low, trading at roughly US$0.6735 at the time of writing.

And the low dollar also means now is a great time to exchange your foreign currency, according to currency provider Travel Money Oz.

Related story: How to get the most bang for your buck overseas

Related story: The one overseas travel mistake leaving Aussies hundreds out of pocket

Related story: How I saved on conversion fees while travelling overseas

“On average, Australian travellers return home with $184 in unused foreign currency from overseas holidays – that’s a total of more than $2 billion of forgotten overseas currency sitting in our back pockets right now,” said Travel Money OZ general manager Scott McCullough.

“Now is the perfect opportunity to sell back your foreign currency for the best bang-for-your-buck.”

US$50 would be about AU$74.50, while 1,000 in the Chinese renminbi would be AU$214.

£30 would nearly double and become an extra AU$57.83 in your back pocket, while €100 would give you AU$162.

The cheapest way to exchange your currency

When exchanging your foreign currency to AUD, there are a few tips to follow to ensure you’re getting value for money.

“In general, you’ll get more bang for your buck when exchanging money if you steer clear of your bank, as they tend to add the biggest margins,” Finder money expert Bessie Hassan told Yahoo Finance.

To find the best place to exchange your money, online calculators like Finder’s currency exchange comparison can help you see which exchange provider to go with.

But before picking one, get a sense of the mid-market exchange rate by using Google or a currency conversion site like XE, said Hassan.

“You can then use this to work out how much of a markup the service is charging on the currency you want to buy.”

And if you’re exchanging money in person, don’t just look at the exchange rate: be sure to enquire about any fees, too.

“Even if a provider claims to offer ‘no-fee’ exchanges, remember that they will add a hidden margin to the exchange rate,” she said.

And whatever you do, avoid exchanging money at the airport – where they’ll likely charge higher fees and offer lower exchange rates – or use an ATM, which again may attract high fees but poor exchange rates.

What if I have a lot of foreign currency in coins?

Unfortunately, currency buybacks typically only accept notes.

But if you have lots of foreign cash in coins, you can put it to good use by donating it to Travel Money Oz and UNICEF’s Small Change, Big Difference foreign exchange program, which collects this foreign money and donates all of it to help disadvantaged children.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, and LinkedIn.

Yahoo Finance

Yahoo Finance