Louis Moore Bacon's Strategic Exit from CONX Corp

Overview of the Recent Transaction

On April 29, 2024, the investment firm managed by Louis Moore Bacon (Trades, Portfolio) executed a significant transaction involving CONX Corp (NASDAQ:CONX), a shell company listed in the USA. The firm sold all its holdings in CONX, totaling 1,500,000 shares, at a price of $10.56 per share. This move resulted in a sell-out of the firm's position, reflecting a -0.3% impact on its portfolio. Following the transaction, the firm no longer holds any shares in CONX Corp.

Profile of Louis Moore Bacon (Trades, Portfolio)

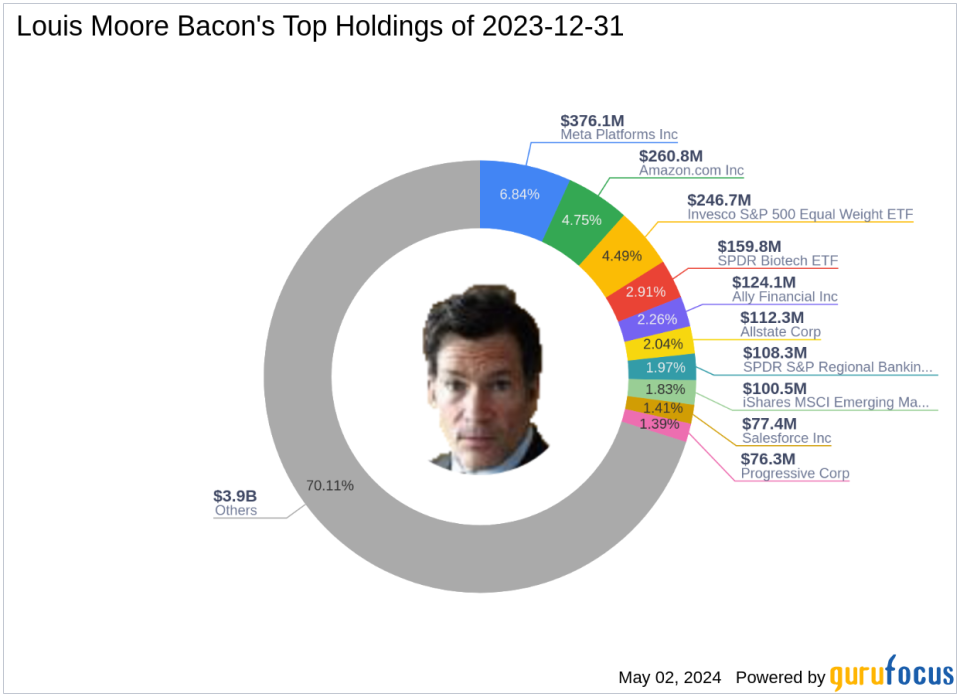

Louis Moore Bacon (Trades, Portfolio), an eminent American hedge fund manager, is known for his global macro strategy in market investments. Since founding Moore Capital Management in 1989, Bacon has been recognized among the top 100 traders of the 20th century. The firm transitioned in late 2019 to focus solely on Bacon's personal investments and a multi-asset alternatives platform. Bacon's investment philosophy emphasizes a bold, global approach, adapting to dynamic market conditions to optimize investment outcomes. The firm's top holdings include diverse sectors, with significant positions in financial services and technology.

Introduction to CONX Corp

CONX Corp, incorporated on December 21, 2020, operates as a shell company in the diversified financial services industry. With a market capitalization of approximately $192 million, CONX has been navigating the challenges typical of its sector. The stock currently trades at $9.20, reflecting a 12.88% decrease since the transaction date. The company's financial metrics such as profitability, growth, and balance sheet strength show mixed results, indicating potential areas for improvement.

Analysis of the Trade's Impact

The complete divestiture from CONX Corp by Bacon's firm suggests a strategic decision to reallocate resources possibly due to the stock's underperformance and the firm's portfolio management objectives. With a GF Score of 35/100, indicating poor future performance potential, and a significant drop in stock price post-IPO, the firm's exit might be seen as a move to mitigate risks associated with holding underperforming assets.

Financial Health and Market Performance of CONX Corp

CONX Corp's financial health is less than ideal, with a profitability rank of 3/10 and a growth rank of 0/10. The company's balance sheet received a moderate score of 5/10, while its Momentum Rank stands at 2/10, further indicating weak market performance. Additionally, the stock's interest coverage is exceptionally high, which could be misleading due to the nature of its operations as a shell company.

Sector and Market Context

The transaction occurs within a broader market context where Bacon's firm predominantly invests in financial services and technology sectors. The exit from CONX Corp might reflect a strategic shift or a realignment of the firm's investment portfolio, considering the ongoing fluctuations and trends within these sectors.

Implications for Investors

Investors observing Bacon's market moves might interpret this sell-out as a cautionary signal regarding CONX Corp or similar stocks within the sector. For value investors, understanding the reasons behind such strategic decisions can provide critical insights into potential risks and opportunities in the market.

This analysis not only sheds light on the specific transaction but also offers a broader understanding of market dynamics and investment strategies employed by seasoned investors like Louis Moore Bacon (Trades, Portfolio).

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance