LivaNova PLC (LIVN) Surpasses Analyst Revenue Forecasts in Q1 2024

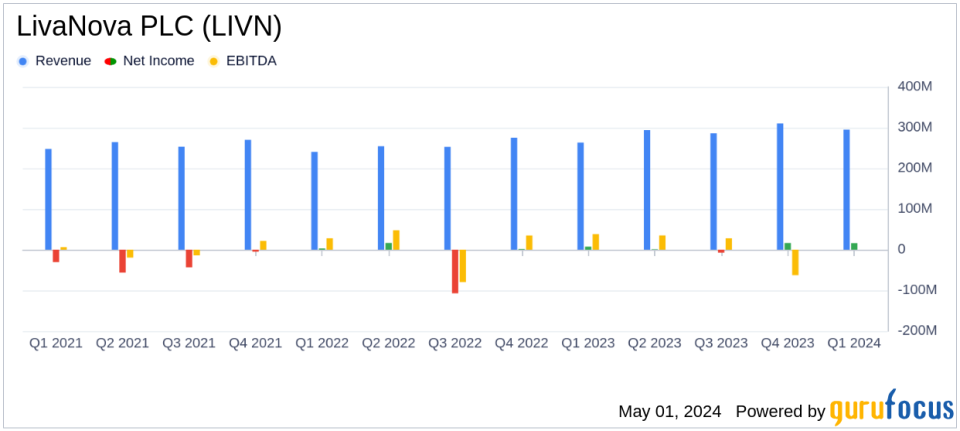

Revenue: Reported $294.9 million, a 12.0% increase year-over-year, exceeding estimates of $278.66 million.

Adjusted Earnings Per Share (EPS): Achieved $0.73, significantly surpassing the estimated $0.49.

Net Income: GAAP net loss was $41.9 million, contrasting sharply with the prior year's net income of $7.4 million.

Segment Performance: Cardiopulmonary revenue rose to $155.9 million, up 14.8% year-over-year; Neuromodulation revenue increased to $133.9 million, up 10.9%.

Operating Income: Adjusted operating income more than doubled to $53.1 million from $26.8 million in the prior year.

Full-Year Guidance: Adjusted diluted EPS for 2024 projected to be between $3.05 and $3.15, with revenue growth expected between 8% and 9% on a constant-currency basis, excluding ACS segment wind down.

Capital Management: Closed a private offering of $345.0 million 2.50% convertible senior notes due 2029 and repurchased $230.0 million 3.00% exchangeable senior notes due 2025.

LivaNova PLC (NASDAQ:LIVN), a leader in medical technology, disclosed its first-quarter results for 2024 on May 1, revealing significant revenue growth and a positive outlook for the year. The company reported first-quarter revenue of $294.9 million, a 12.0% increase on a reported basis and 12.4% on a constant-currency basis compared to the same period last year. This performance notably exceeds analyst expectations, which estimated revenue at $278.66 million. The detailed earnings can be viewed in LivaNova's 8-K filing.

LivaNova PLC, headquartered in London, operates primarily in the cardiovascular and neuromodulation sectors. The company has a significant presence in the US, which accounts for about half of its revenue, with Europe contributing another 21%, and the remaining revenue coming from other global markets.

Financial Performance and Market Impact

The company's adjusted diluted earnings per share (EPS) for the quarter stood at $0.73, showing a robust improvement from $0.43 in the first quarter of 2023. This figure also surpasses the analyst's EPS estimate of $0.49 for the quarter. The substantial growth in revenue and EPS is attributed to strong performance in both the Cardiopulmonary and Neuromodulation segments, with notable sales increases from the EssenzTM Perfusion System in the U.S. and Europe, and strong consumable demand worldwide.

CEO Vladimir Makatsaria expressed satisfaction with the quarter's outcomes, emphasizing the double-digit growth in revenue and operating income across key business segments. He highlighted the company's focus on execution, innovation, and talent development as drivers for improving patient outcomes and creating shareholder value.

Challenges and Forward-Looking Statements

Despite the positive performance, LivaNova faces challenges including potential volatility in global markets, regulatory changes, and competitive pressures in the medical technology industry. The company's forward-looking statements project revenue growth of 6-7% on a constant-currency basis for the full year 2024, adjusting for the wind-down of the Advanced Circulatory Support (ACS) segment. Adjusted diluted EPS is expected to be between $3.05 and $3.15.

Strategic Financial Moves

LivaNova also reported strategic financial activities during the quarter, including a private offering of $345.0 million 2.50% convertible senior notes due 2029 and the repurchase of $230.0 million 3.00% exchangeable senior notes due 2025. These moves are aimed at optimizing the company's capital structure and reducing financial risk.

The company's robust financial health is further evidenced by its operational achievements and strategic initiatives aimed at long-term growth. Adjusted operating income for the quarter was $53.1 million, a significant increase from $26.8 million in the prior year. This financial stability positions LivaNova to continue its growth trajectory and enhance its market presence in the medical technology sector.

Conclusion

LivaNova PLC's first-quarter results for 2024 reflect a strong start to the year, with performance exceeding analyst expectations in key financial metrics. The company's strategic focus on high-growth areas and operational efficiency continues to yield positive results, supporting an optimistic outlook for the remainder of the year. Investors and stakeholders may look forward to continued progress and innovation from LivaNova in its mission to deliver life-changing technologies to patients worldwide.

Explore the complete 8-K earnings release (here) from LivaNova PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance