Would you like to access your pay as you earn it? Here’s how.

When Josh Vernon was in high school, one of his friends moved out of home only to find his expenses were now greater than his income.

So his friend turned to a payday loan, and it took him nearly 18 months to break free of the loan cycle.

It got Vernon thinking – what if my friend didn’t have to turn to a payday loan? What if he could just access the pay he’d earned as he earned it?

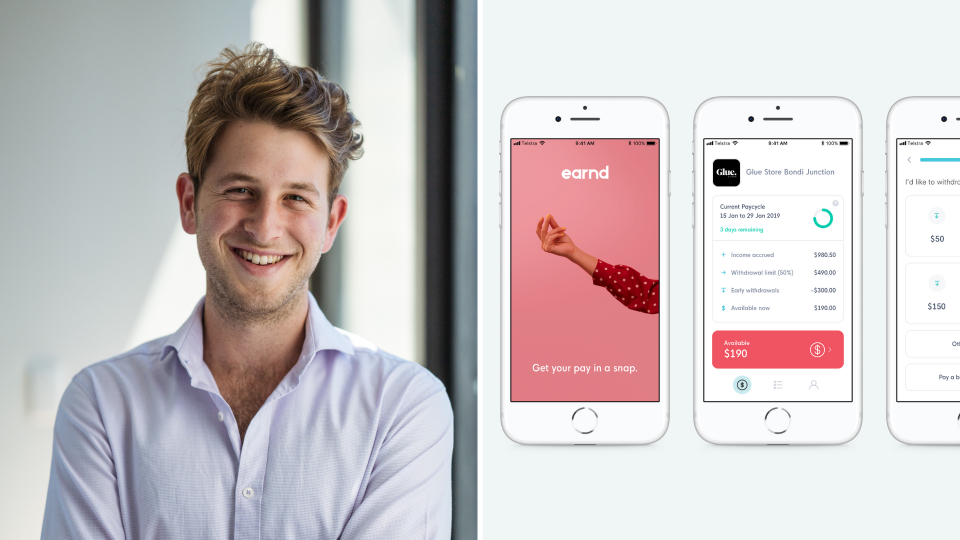

These questions led to the birth of Earnd: a platform allowing Australians to access their pay as they earn it and financial wellness booster.

“We saw that there was a huge potential to help people avoid situations like that,” Vernon, now the CEO of Earnd, told Yahoo Finance.

“It happens to a huge amount of people in Australia where your expenses are greater than your income in a given month and your options… might end up putting you in a worse financial situation than if you had just been able to ride it out or been able to find credit at a more friendly rate.”

The platform, backed by Nab Ventures and BPAY CEO John Banfield, has raised $2.5 million in funding with plans to expand the service to other employment sectors.

Some employers in hospitality and retail already offer the service to their employees.

It’s never compulsory – Vernon emphasised – but employees need to have their employers signed up to the service to access it.

An extension of on-demand services

Vernon explained that Australians are increasingly expecting services on demand including, food, entertainment and transport.

The ability to access your pay as you earn it is a logical extension of this and also offers a lifeline.

“Situations [like what occurred to his friend] can lead to ongoing debt spirals simply because of the short term credit crisis that they’ve found themselves in and there’s a huge amount of research that shows that if you’re able to support someone with a safety net of their own income at pretty much no cost or at an extremely low cost, you’re supporting them to avoid getting into worse situations.”

Monthly vs on-demand pay

But as a monthly or bi-weekly pay day can help facilitate responsible budgeting and saving, it begs the question as to whether on-demand pay could lead to poor spending and saving habits.

“Paychecks have become one of the most powerful budgeting tools in the world,” Vernon acknowledged. But, he added, if there is no flexibility around budgeting it can lead people to more dangerous forms of finance like payday loans.

However, Earnd users are also limited to accessing a maximum 50 per cent of their accrued income through Earnd in a bid to support responsible spending.

In the end, choosing how to spend and receive a paycheck comes down to education, Vernon said. A holistic approach to financial wellness is part of this.

While Australian employees and employers increasingly value wellness, financial wellness is still overlooked.

“Employees no longer come to work just for a paycheck,” he said. Workers also want wellness included in their workplace and their benefits. Vernon believes programs like Earnd go a long way towards achieving this goal.

“We know that if you’re able to improve financial wellness it has the biggest impact on someone’s working life.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Now read: Opera House contractor wins job back after drinking too much at work function

Now read: Visa rules relaxed to boost job shortage on farms

Now read: Aussie home loan borrowers shouldn’t expect much relief from RBA rate cuts

Yahoo Finance

Yahoo Finance