Ligand (LGND) Q4 Earnings & Revenues Top Estimates, Stock Up

Ligand Pharmaceuticals Incorporated LGND reported fourth-quarter 2019 adjusted earnings of 71 cents per share, which beat the Zacks Consensus Estimate of 68 cents. The company had reported adjusted earnings of $1.70 in the year-ago quarter. Fourth-quarter adjusted earnings exclude the impact of non-cash charge of $8.5 million related to Ligand’s investment in Viking Therapeutics, stock-based compensation and non-cash charges.

Total revenues decreased to $27 million from $59.6 million in the year-ago quarter mainly due to lower royalty revenues. However, the top line surpassed the Zacks Consensus Estimate of $24.9 million.

Shares of Ligand were up 2.4% in after-hours trading on Feb 6, following the earnings release. The company’s shares have declined 20.7% in the past year compared with the industry’s 0.1% decrease.

Quarterly Highlights

Royalty revenues were $11 million in the fourth quarter compared with $40.2 million in the year-ago quarter. Ligand primarily earns royalties on sales of Amgen's AMGN Kyprolis and CASI Pharmaceuticals' CASI Evomela, which were developed using its Captisol technology. The significant decline in royalty revenues was due to loss of royalties from sales of Novartis’ NVS blockbuster drug, Promacta. In March 2019, Ligand sold Promacta rights, including royalty rights to worldwide net sales, to privately-held Royalty Pharma for $827 million.

Please note that excluding Promacta royalties recorded in the year-ago quarter, royalty revenues increased year over year in the fourth quarter.

License fees, milestones and other revenues were $8.8 million in the fourth quarter compared with $9.3 million a year ago. Material sales were $7.1 million, down 29.7%.

Full-Year Results

Ligand’s adjusted earnings per share were $3.09 per share for the full year compared with $7.15 per share in 2018. Full- year revenues declined 52.2% to approximately $120.3 billion.

Business Developments

In 2019, Ligand entered into nine agreements related to its OmniAb technology platform. Moreover, 12 OmniAb-based partnered drugs are in pivotal stage of development. Currently, the company has 13 approved partnered drugs developed using its Captisol technology, generating royalties for the company.

The company entered into worldwide OmniAb license agreement with privately-held Pandion Therapeutics last month. In December 2019, it entered into another license agreement with France-based pharma giant, Sanofi, related to use of OmniAb technology platform.

2020 Guidance

Ligand provided guidance for its sales and earnings for 2020. The company expects total revenues and earnings for 2020to be approximately $121 million and $3.40, indicating organic growth of 14% and 35%, respectively. The Zacks Consensus Estimate for revenues and earnings is pegged at $118.59 million and $3.25 per share, respectively.

Guidance for total revenues includes approximately $38 million in royalties, approximately $35 million from material sales and license fees and milestones of approximately $48 million.

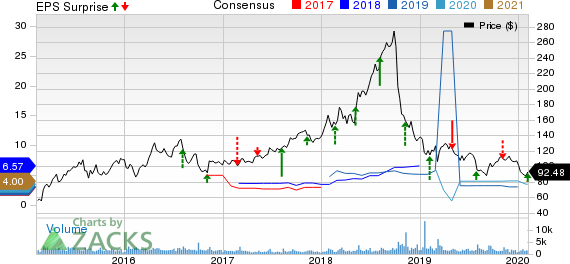

Ligand Pharmaceuticals Incorporated Price, Consensus and EPS Surprise

Ligand Pharmaceuticals Incorporated price-consensus-eps-surprise-chart | Ligand Pharmaceuticals Incorporated Quote

Zacks Rank

Ligand currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance