The $593 penalty 3.4 million Aussies don’t know about

Some Australians have just one week left to avoid paying the Lifetime Health Cover Loading penalty - a fee 3.4 million of them don’t actually know they’ll pay.

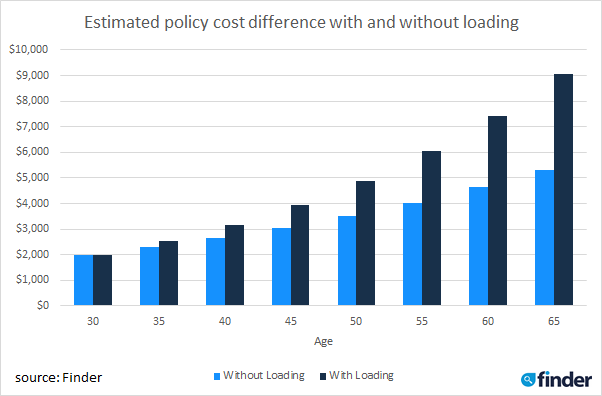

The Lifetime Health Cover Loading is a fee that kicks in when you turn 31, and adds an extra 2 per cent to your private hospital cover for every year you don’t take it out.

The average cost of single hospital cover in 2020 is $1,977 per year, Finder research reveals.

So, if you waited until you were 45 years old to take out health insurance for the first time, the Lifetime Health Cover Loading would add an extra 30 per cent to the price of your policy - or an extra $593 to your policy each year.

Over 10 years of the loading period, that’s an extra $5,931.

What’s more, 61 per cent of Gen Y (those born between 1981 and 1996), which is the equivalent of 3.4 million Australians, don’t actually understand the loading fee, Finder data showed.

“The research shows that more education is needed,” Kate Browne, personal finance expert at Finder said.

“The government sends out a yearly reminder, but that’s not enough and unfortunately many Australians are still unaware.”

But 31-year-olds yet to take out cover could save themselves the fee if they took out cover within the next week, Browne said.

“You only need to take out a basic hospital policy to avoid the penalty – it doesn’t apply to extras cover,” she said.

“A bronze hospital policy starts from $100 a month on average across Australia.”

But the payment would be dwarfed by the Lifetime Health Cover Loading, which can add up to 70 per cent on top of your premium.

“For some this might mean thousands of dollars extra on their health insurance later in life. And at 30 while many of us might be fit and well, you may need that cover as you get older and may not be working.”

But if you’re thinking of signing up now, you should look at ongoing costs, rather than promotions on offer around tax time, Browne said.

“At this time of year many insurers are trying to entice new customers with waived waiting periods and months free,” Browne said.

“Health insurance is a big expense so don’t be tempted by these offers into signing up for a policy you won’t be able to afford in the long run.”

Is private health cover worth it?

Australians have been ditching private healthcare due to the high out-of-pocket costs for medicines, hospital stays and specialist fees.

Over the 2017-18 financial year, Aussies spent $1,568 on average on out-of-pocket expenses – which equates to around 2.5 per cent of their average annual income.

And according to iSelect, annual premiums for the average hospital and extras policy in 2019 for a family were $4,359, $4,780 for couples and $2,014 for singles (before any government rebate is applied).

And Grattan Institute health economist Stephen Duckett predicted more young Australians would continue to drop their cover if premiums continued to rise.

Duckett suggested the government undertake urgent policy reform, as the system was “riddled with inconsistencies and perverse incentives”.

But there are many things to consider when deciding whether to take out or cover or not, like whether you genuinely want the choice of your own doctor or hospital, or mind waiting longer for elective surgeries.

Are you a millennial or Gen Z-er interested in joining a community where you can learn how to take control of your money? Join us at The Broke Millennials Club on Facebook!

Yahoo Finance

Yahoo Finance