Such Is Life: How Chant West Holdings (ASX:CWL) Shareholders Saw Their Shares Drop 55%

While not a mind-blowing move, it is good to see that the Chant West Holdings Limited (ASX:CWL) share price has gained 13% in the last three months. But that doesn't change the fact that the returns over the last three years have been disappointing. Regrettably, the share price slid 55% in that period. So it is really good to see an improvement. After all, could be that the fall was overdone.

View our latest analysis for Chant West Holdings

Chant West Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Chant West Holdings saw its revenue grow by 4.5% per year, compound. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 23% for the last three years. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. After all, growing a business isn't easy, and the process will not always be smooth.

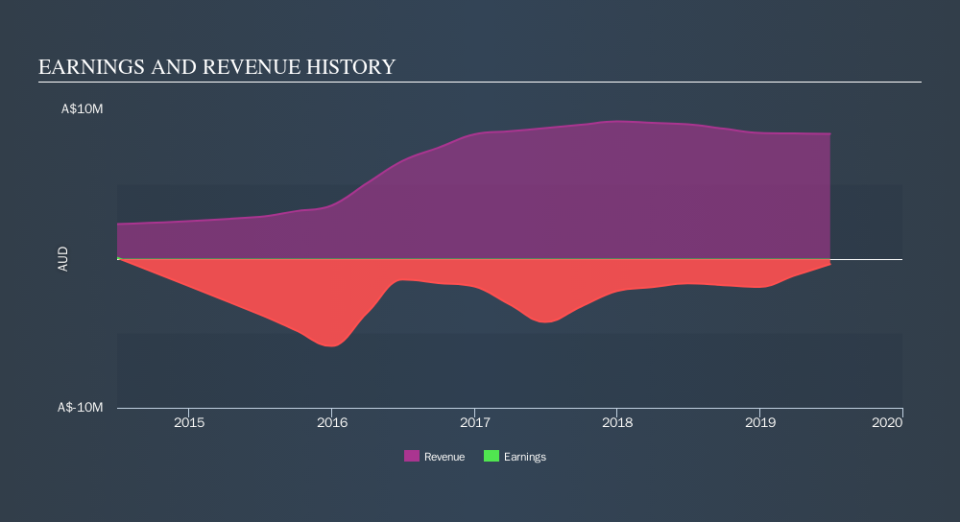

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Chant West Holdings's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Chant West Holdings shareholders have gained 26% (in total) over the last year. What is absolutely clear is that is far preferable to the dismal 23% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Chant West Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance