What Can We Learn About Imugene's (ASX:IMU) CEO Compensation?

Leslie Chong became the CEO of Imugene Limited (ASX:IMU) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Imugene

Comparing Imugene Limited's CEO Compensation With the industry

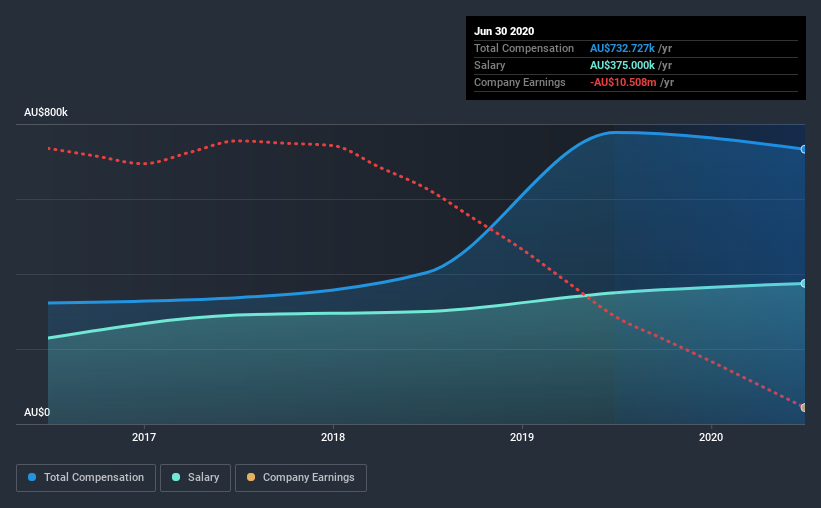

At the time of writing, our data shows that Imugene Limited has a market capitalization of AU$215m, and reported total annual CEO compensation of AU$733k for the year to June 2020. That's a slightly lower by 5.7% over the previous year. We note that the salary portion, which stands at AU$375.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between AU$137m and AU$550m had a median total CEO compensation of AU$1.6m. Accordingly, Imugene pays its CEO under the industry median. What's more, Leslie Chong holds AU$1.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$375k | AU$350k | 51% |

Other | AU$358k | AU$427k | 49% |

Total Compensation | AU$733k | AU$777k | 100% |

Speaking on an industry level, nearly 63% of total compensation represents salary, while the remainder of 37% is other remuneration. In Imugene's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Imugene Limited's Growth Numbers

Over the last three years, Imugene Limited has shrunk its earnings per share by 31% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

Overall this is not a very positive result for shareholders. And the flat revenue hardly impresses. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Imugene Limited Been A Good Investment?

Most shareholders would probably be pleased with Imugene Limited for providing a total return of 223% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As we noted earlier, Imugene pays its CEO lower than the norm for similar-sized companies belonging to the same industry. And although the company is suffering from declining EPS growth over the past three years, shareholder returns remain strong. So, while it would be nice to have better EPS growth, our analysis suggests CEO compensation is quite modest.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 6 warning signs (and 1 which makes us a bit uncomfortable) in Imugene we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance