Lantheus Holdings Inc (LNTH) Surpasses Q1 2024 Revenue and Earnings Estimates

Revenue: Reported $370.0 million, up 23.0% year-over-year, surpassing the estimate of $348.45 million.

GAAP Net Income: Achieved $131.1 million, a significant recovery from a net loss of $2.8 million in the prior year, exceeding the estimated net income of $108.87 million.

Earnings Per Share (EPS): GAAP fully diluted EPS was $1.87, a substantial increase from a net loss per share of $0.04 in the previous year, exceeding the estimated EPS of $1.54.

Adjusted Net Income: Reached $118.3 million, up 15.8% from $102.2 million in the previous year.

Free Cash Flow: Reported at $119.0 million, indicating strong cash generation capabilities.

Future Guidance: Increased full-year 2024 revenue guidance to $1.50 billion - $1.52 billion, and adjusted fully diluted EPS guidance to $7.00 - $7.20, reflecting positive business outlook.

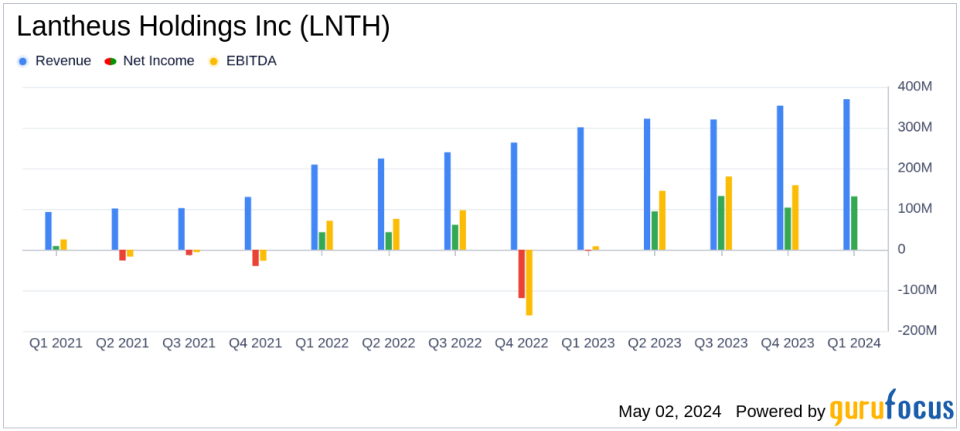

Lantheus Holdings Inc (NASDAQ:LNTH) reported a strong financial performance for the first quarter of 2024, with significant increases in revenue and earnings that exceeded analyst expectations. The company released its 8-K filing on May 2, 2024, detailing these results.

Lantheus Holdings, a leader in the radiopharmaceutical sector, focuses on diagnostic and therapeutic products that aid in the detection and treatment of diseases, particularly in oncology and cardiology. Their portfolio includes precision diagnostics, radiopharmaceutical oncology, and strategic partnerships.

Financial Highlights

For Q1 2024, Lantheus reported a worldwide revenue of $370 million, marking a 23% increase from the $300.8 million recorded in the first quarter of 2023. This growth was primarily fueled by the robust sales of PYLARIFY and DEFINITY, with PYLARIFY alone generating $258.9 million, up 32.4% year-over-year. The company's GAAP net income showed a dramatic turnaround to $131.1 million, compared to a net loss of $2.8 million in the same quarter last year. This translates to a GAAP fully diluted net income per share of $1.87, significantly higher than the estimated $1.54.

Adjusted net income also saw a healthy increase, reaching $118.3 million, up from $102.2 million in Q1 2023, with adjusted fully diluted net income per share rising 15.2% to $1.69.

Operational and Strategic Developments

Lantheus has continued to advance its operational capabilities and expand its product pipeline. Notably, the company's Phase 3 SPLASH trial of PNT2002 met its primary endpoint, demonstrating a 29% reduction in the probability of radiographic progression or death in certain cancer patients. Additionally, the FDA accepted an ANDA for Lutetium Lu 177 Dotatate, positioning Lantheus as a potential first mover in this market pending litigation outcomes.

The company's financial position remains strong, with $718.3 million in cash and cash equivalents as of March 31, 2024. Lantheus also maintains access to a $350 million revolving line of credit, further bolstering its liquidity to support ongoing operations and future growth initiatives.

Looking Ahead

Lantheus has raised its full-year 2024 guidance, now expecting revenue between $1.50 billion and $1.52 billion and adjusted fully diluted EPS between $7.00 and $7.20. This updated guidance reflects the company's confidence in its continued growth trajectory and operational success.

CEO Brian Markison emphasized the strategic investments and commercial excellence driving these robust results. "Our market-leading commercial portfolio, fully integrated capabilities, and strong financial position provide a foundation for continued growth," Markison stated.

Lantheus' performance in Q1 2024 not only demonstrates its resilience and strategic acumen but also underscores its potential for sustained growth in the dynamic healthcare sector, particularly in radiopharmaceuticals.

Investor and Analyst Perspectives

Analysts and investors may find further details and discuss these results during the company's conference call and webcast, scheduled for May 2, 2024. This event promises to provide deeper insights into the company's strategies and financials, ensuring stakeholders are well-informed of Lantheus' growth trajectory and market positioning.

For more detailed financial information and future updates, stakeholders are encouraged to visit the Investors section of Lantheus' website and consult their financial filings.

Explore the complete 8-K earnings release (here) from Lantheus Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance