Lancaster Colony Corp (LANC) Posts Record Q3 Sales, Earnings Per Share Exceed Estimates

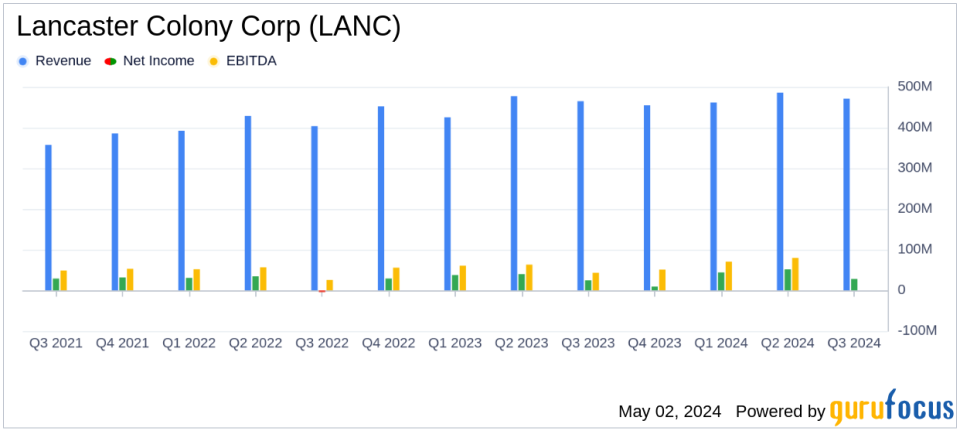

Revenue: Reported $471.4 million, up 1.4% year-over-year, surpassing estimates of $468.07 million.

Net Income: Achieved $28.4 million, up from $24.6 million last year, falling short of estimates of $37.97 million.

Earnings Per Share (EPS): Recorded at $1.03 per diluted share, falling short of the estimated $1.38.

Gross Profit: Increased by 10.9% to $104.5 million, driven by favorable pricing net of commodity costs and cost savings initiatives.

Operating Income: Grew to $35.1 million, up $5.7 million, despite $14.7 million in costs from exiting bakery product lines.

Retail Segment Sales: Slightly increased by 0.3% to $248.1 million, with volume growth in licensed dressings and sauces.

Foodservice Segment Sales: Rose by 2.6% to $223.4 million, with a volume increase of 3.9%, driven by demand from national chain restaurant customers.

Lancaster Colony Corp (NASDAQ:LANC) released its 8-K filing on May 2, 2024, revealing a notable increase in third-quarter sales and earnings. The company reported a record consolidated net sales of $471.4 million, up 1.4% from the previous year, and earnings per share (EPS) of $1.03, surpassing the analyst estimate of $1.38 for the quarter.

Company Overview

Lancaster Colony Corp, a prominent player in the specialty food products sector, operates primarily through its Retail and Foodservice segments. The company's diverse portfolio includes brands like Cardini's, Girard's, Marzetti in salad dressings and sauces, New York Brand Bakery and Mamma Bella in frozen garlic breads, and Sister Schubert's and Mary B's in frozen rolls, among others.

Financial and Operational Highlights

The third-quarter performance was driven by several factors including favorable pricing net of commodity costs (PNOC), ongoing cost savings initiatives, and volume growth. Notably, the Retail segment saw a modest sales increase of 0.3% to $248.1 million, while the Foodservice segment grew by 2.6% to $223.4 million. The company's gross profit margin improved by 190 basis points to 22.2%, despite a $2.6 million inventory write-down related to the exit from perimeter-of-the-store bakery product lines.

Operational challenges included $14.7 million in costs associated with the exit from certain bakery product lines, including $12.1 million in restructuring and impairment charges. These strategic exits were aimed at optimizing the company's product portfolio and focusing on core growth areas.

Strategic Decisions and Future Outlook

CEO David A. Ciesinski highlighted the strategic decision to discontinue the Flatout and Angelic Bakehouse brands, which will allow the company to concentrate resources on more profitable segments. Looking forward, Lancaster Colony anticipates continued growth in its Retail segment through its licensing program and expects ongoing volume growth in the Foodservice segment, albeit with potential headwinds from deflationary pricing.

Year-to-Date Performance

For the nine months ending March 31, 2024, Lancaster Colony reported a net sales increase of 3.7% to $1.42 billion and a net income of $123.8 million, or $4.50 per diluted share, up from $3.71 per diluted share in the prior year. These results reflect the company's effective management of operational costs and strategic initiatives.

Investor and Analyst Perspectives

The company's performance, particularly its ability to exceed EPS estimates and achieve record sales, has been well-received in the market. Analysts may view the strategic exits from less profitable segments positively, as these moves are expected to enhance operational efficiency and profitability in the long term.

Lancaster Colony's consistent focus on innovation and market adaptation, combined with its strategic portfolio optimization, positions it well for sustained growth. Investors and stakeholders are likely to keep a close watch on the company's progression in aligning with consumer trends and managing operational efficiencies.

Conclusion

Despite some strategic challenges, Lancaster Colony Corp's robust third-quarter performance underscores its resilience and strategic foresight in navigating market complexities. With a clear focus on enhancing shareholder value and capitalizing on growth opportunities, LANC remains a key player in the specialty foods industry.

Explore the complete 8-K earnings release (here) from Lancaster Colony Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance