Lakeland Industries (LAKE) to Post Q4 Earnings: What to Expect?

Lakeland Industries, Inc. LAKE is scheduled to release fourth-quarter fiscal 2021 (ended January 2021) results on Apr 15, after the closing bell.

The personal protective equipment provider delivered better-than-expected results in the last three reported quarters. Its earnings were $1.14 per share in third-quarter fiscal 2021, surpassing the Zacks Consensus Estimate of 57 cents.

In the past three months, shares of the company decreased 4.3% compared with the industry’s growth of 9.2%.

Key Factors & Estimates for Q4

The pandemic-induced demand for personal protective products has been benefiting Lakeland Industries for the past three-four quarters of fiscal 2021. Notably, COVID-related sales accounted for 35% of the company’s fiscal third-quarter sales. The continuation of such a trend might get reflected in the company’s fourth-quarter results. Growing demand for chemical and disposable apparel in developing countries, the United States, Europe and others are likely to have acted as tailwinds.

Also, the company’s commitment to invest in technology, personnel and processes is expected to have benefited the to-be-reported quarter’s performance. Notably, investments to boost manufacturing capabilities across the globe, especially in Vietnam, Mexico and India, are other tailwinds.

Further, the traditional industrial business, including FR garments, woven and high-visibility apparel, has been seeing demand improvement as the economy gears up. This, in turn, is expected to have helped the company’s quarterly performance. On the flip side, weakness in any end market like oil & gas and automotive as well as high compensation or commissions on sales is anticipated to get reflected in the company’s results.

The Zacks Consensus Estimate for fiscal fourth-quarter revenues is pegged at $36 million, suggesting an increase of 28.6% from the year-ago reported figure. However, the estimate suggests a decline of 12.2% from the previous quarter’s reported number. The estimate for earnings is pegged at 72 cents per share, suggesting an increase of 380% from the year-ago quarter’s reported figure but a 36.8% decline from the last reported quarter.

Earnings Whispers

Our proven model does not suggest an earnings beat for Lakeland Industries this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Lakeland Industries has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 72 cents.

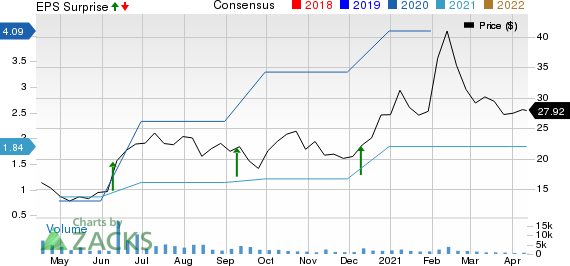

Lakeland Industries, Inc. Price, Consensus and EPS Surprise

Lakeland Industries, Inc. price-consensus-eps-surprise-chart | Lakeland Industries, Inc. Quote

Zacks Rank: Lakeland Industries currently carries a Zacks Rank #3.

Stocks to Consider

Here are some companies that you may want to consider as according to our model, these have the right combination of elements to beat on earnings:

Rockwell Automation, Inc. ROK currently has an Earnings ESP of +5.03% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Middleby Corporation MIDD presently has an Earnings ESP of +4.13% and a Zacks Rank of 2.

II-VI Incorporated IIVI currently has an Earnings ESP of +9.09% and a Zacks Rank #2.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IIVI Incorporated (IIVI) : Free Stock Analysis Report

The Middleby Corporation (MIDD) : Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance