The Labour threat that could cost you £108,000 in pension savings

Have you accessed your pension by taking a tax-free lump sum? We’re looking for readers to tell us how they spent it for a new regular feature. Email rob.white@telegraph.co.uk if you’re interested in taking part.

A feared Labour raid on pensions tax relief would cost higher-rate taxpayers tens of thousands of pounds in their retirement savings, new analysis has revealed.

If tax relief was cut to a flat rate, millions of higher and top-rate pension savers could see five-figure losses, calculations from Hargreaves Lansdown show.

Labour has said changes to how relief on pensions contribution works is not party policy – but shadow chancellor Rachel Reeves said in 2016 that she supported calls for a flat rate of relief. In 2016 former chancellor George Osborne was believed to be on the brink of announcing a similar move, which would save huge sums for the Treasury, but changed his mind at the eleventh hour.

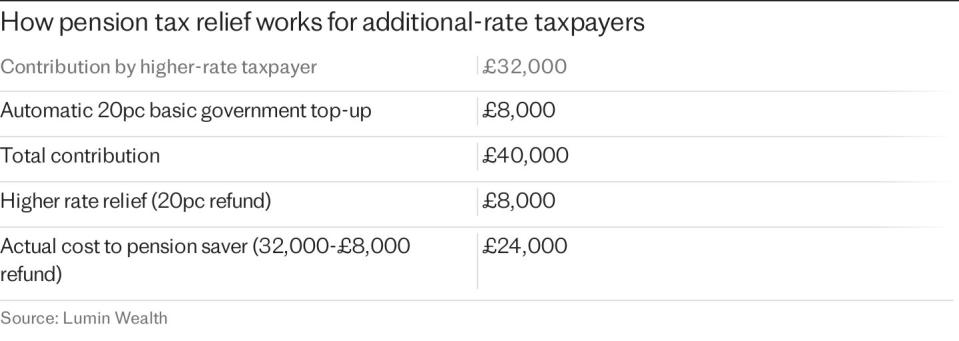

Pension savers currently receive tax relief on contributions at their marginal or highest rate of income tax. It means everyone receives 20pc relief, but higher rate taxpayers are entitled to 40pc and additional rate payers get 45pc.

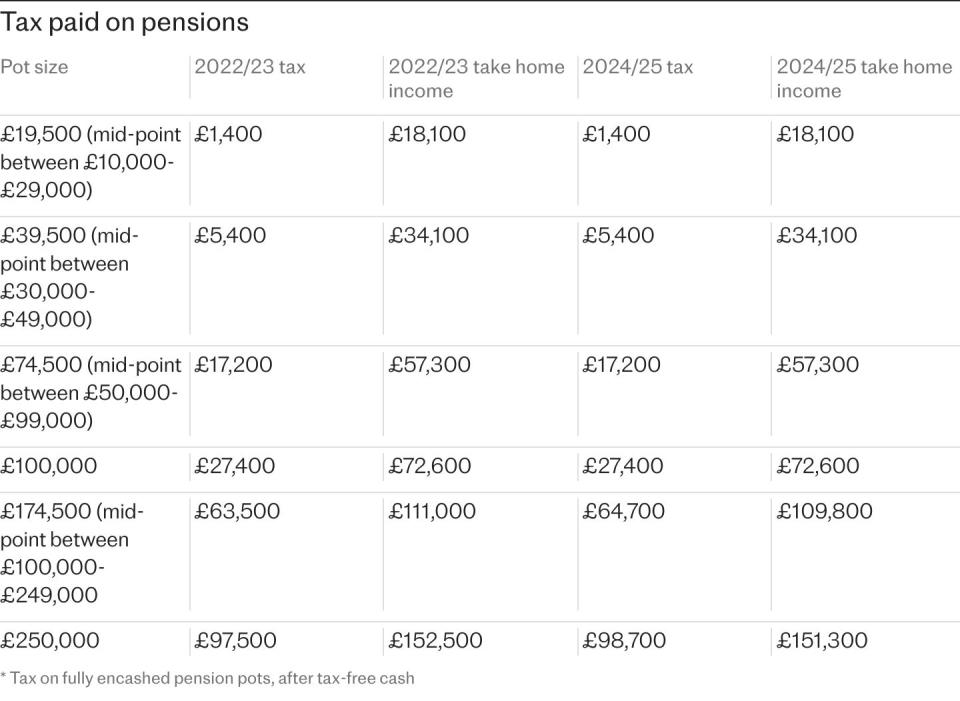

HMRC figures for the last financial year projected there were 5.6 million higher rate and 862,000 additional rate taxpayers. Saving into a pension would become far less lucrative for these groups, particularly if they were higher or top-rate payers in retirement.

A worker earning £100,000 a year and contributing 10pc of their salary into a pension would lose £700 a year, according to Hargreaves Lansdown.

Someone earning £200,000 a year would lose £2,400, while someone on £300,000 would lose £3,600.

Over a 30-year career, the same people would lose at least £21,000, £72,000 and £108,000 respectively. Once you factor in salary increases and investment returns, the total lost would be far higher over decades of savings.

When asked by the Telegraph to rule out attacks on pension tax relief, Labour did not respond. Retirement experts warned how uncertainty can affect workers’ ability to plan for their future.

Helen Morrissey, of Hargreaves Lansdown, said: “Governments looking to raise money are all too often tempted to tuck into pension tax relief as the gift that keeps on giving, resulting in years of fiddling at the edges without considering the full impacts on saving behaviours.

“Constant speculation about changes undermines the predictability people need in order to make informed long-term retirement decisions.”

Rob Morgan, of Charles Stanley, a wealth manager, said: “A higher-rate taxpayer could end up obtaining relief at the flat rate and then paying a higher rate of income tax when they withdraw money. This potentially creates a disincentive to make pension contributions, especially if the future rules surrounding tax-free cash are uncertain.

“Another problem is many individuals only pay higher rate tax towards the end of their careers, when pension saving is often highest. This creates problems for those playing pension catch-up in their peak earnings years, who in good faith expected pension tax relief at their highest marginal rate.

“People that planned with the current rules in mind, especially the self-employed, could lose out, and the net result is likely to be smaller pension pots across society as a whole.

“It’s imperative that people have confidence in the pension system and that there are no knee-jerk changes that undermine the plans of those prudently trying to provide for their later years.”

Labour says a flat rate of pension tax relief is not current policy and it’s understood to no longer be Ms Reeves’s view.

However, the party still hasn’t ruled it out, despite Ms Reeves saying there will be no increases to income tax, National Insurance and VAT if it wins power.

Previously, a Labour spokesman said: “This is not Labour policy and this is a reference to remarks made almost 10 years ago.

“Labour will always protect pensioners who have worked hard and paid into the system. We will guarantee the triple lock and we won’t stand by as the Tories rip apart National Insurance contributions and risk the state pension or the NHS.”

Speaking in The Telegraph at the weekend, Chancellor Jeremy Hunt expressed concerns that Labour will “go for back-door taxes on pensions.”

He also said that people will “never forget” Gordon Brown’s £118bn raid on pension funds shortly after Labour won a landslide victory in 1997, which was not in the party’s election manifesto.

Mr Hunt added: “Labour betrayed pensioners before. We will never allow it to happen again.”

Yahoo Finance

Yahoo Finance