LabCorp's (LH) Q2 Earnings Beat Estimates, Margins Fall

Laboratory Corporation of America Holdings LH or LabCorp reported second-quarter 2019 adjusted earnings per share (EPS) of $2.93, down 1.7% from the year-ago quarter. However, the bottom line edged past the Zacks Consensus Estimate by 1%.

On a reported basis, net earnings came in at $1.93 per share, declining 14.9% from the year-earlier figure.

Revenues in the quarter under review edged up 0.5% year over year to $2.88 billion. However, the top line lagged the Zacks Consensus Estimate of $2.90 billion.

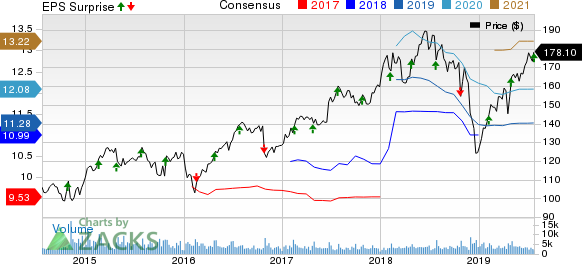

Laboratory Corporation of America Holdings Price, Consensus and EPS Surprise

Laboratory Corporation of America Holdings price-consensus-eps-surprise-chart | Laboratory Corporation of America Holdings Quote

This marginal year-over-year improvement was primarily led by 1.4% growth from acquisitions and organic growth of 1.7% (which includes the negative impact from Protecting Access to Medicare Act or PAMA of 0.9%), partially offset by a 1.9% negative impact from the disposition of businesses and an adverse foreign currency translation of approximately 0.7%.

Quarter Under Review

LabCorp reports under two operating segments: LabCorp Diagnostics and Covance Drug Development.

In the second quarter, LabCorp Diagnostics reported revenues of $1.76 billion, reflecting a 2.9% dip year over year. This downside was primarily due to a 2.8% headwind from the disposition of businesses and 0.3% lower organic revenues (including a 1.5% negative impact from the implementation of the PAMA). In addition, unfavorable foreign currency translation reduced revenues by approximately 0.2%. Growth from acquisitions was 0.4% in the quarter.

Excluding the disposition of businesses, the company reported a 0.9% slip in total volume (measured by requisition) and a 1% rise in revenue per requisition in the quarter under consideration.

Covance Drug Development’s revenues improved 6.8% to $1.13 billion in the second quarter. This upside was primarily attributed to 3.3% growth from acquisitions and organic growth of 5.5%, partially offset by the 1.6% adverse impact of foreign currency translation and a business disposition of 0.3%.

Gross margin contracted 51 bps to 28.6% in the reported quarter. Also, adjusted operating income was down 6.9% year over year to $410 million. Moreover, adjusted operating margin contracted 114 bps from the year-ago quarter to 14.2%.

LabCorp exited the second quarter with cash and cash equivalents of $265.4 million compared with $348.8 million at the end of the first quarter. Further, year to date, operating cash flow was $419.3 million, down from $567.1 million in the year-ago period. Additionally, free cash flow came in at $239.9 million in the period, down from $407.4 million a year ago.

In the quarter under discussion, the company returned $199.9 million to shareholders via share repurchases. LabCorp currently has $1.05 billion of authorization remaining under its existing share buyback plan.

Outlook

LabCorp has updated its 2019 guidance.

Revenue growth expectation has been tightened to the band of 1-2% from 2018 (earlier projected band was 0.5-2.5%). This includes a projected adverse impact from the disposition of businesses of around 1.5% and a negative foreign currency movement of roughly 0.5%. The Zacks Consensus Estimate for current-year revenues is pegged at $11.46 billion.

Adjusted EPS estimate for 2019 has been narrowed to a range of $11.10-$11.40 from the earlier band of $11.05-$11.45. The consensus mark of $11.28 for the metric is within this guided range.

Free cash flow is predicted from $950 million to $1.05 billion (unchanged).

Our Take

LabCorp exited the second quarter on a mixed note with earnings ahead of the Zacks Consensus Estimate but revenues lagging the mark. While increasing acquisitions and a favorable mix contributed to LabCorp’s Diagnostics business in the quarter, the disposition of certain businesses and the implementation of PAMA dented the company’s growth.

However, Covance Drug Development delivered year-over-year growth. Here too, the strength from acquisitions and organic growth were partially negated by the hostile impact of foreign currency translation.

Zacks Rank & Other Key Picks

LabCorp currently carries a Zacks Rank #2 (Buy). A few other top-ranked stocks in the broader medical space are Hologic Inc. HOLX, DENTSPLY SIRONA Inc. XRAY and Teleflex Inc. TFX.

Hologic is scheduled to release second-quarter 2019 results on Jul 31. The Zacks Consensus Estimate for the quarter’s adjusted EPS is pegged at 61 cents and for revenues, stands at $834.6 million. The stock carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DENTSPLY SIRONA is scheduled to release second-quarter 2019 results on Aug 2. The Zacks Consensus Estimate for its adjusted EPS is pinned on 62 cents and for revenues, stands at $1.03 billion. The stock sports a Zacks Rank #1.

Teleflex is expected to release second-quarter 2019 results on Aug 1. The Zacks Consensus Estimate for its adjusted EPS is $2.59 and for its top line, $636.7 million. The stock has a Zacks Rank of 2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance