Koninklijke Vopak NV's Dividend Analysis

Assessing the Sustainability and Growth of Koninklijke Vopak NV's Dividend

Koninklijke Vopak NV (VOPKY) recently announced a dividend of $1.63 per share, payable on 2024-05-17, with the ex-dividend date set for 2024-04-26. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Koninklijke Vopak NV's dividend performance and assess its sustainability.

What Does Koninklijke Vopak NV Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

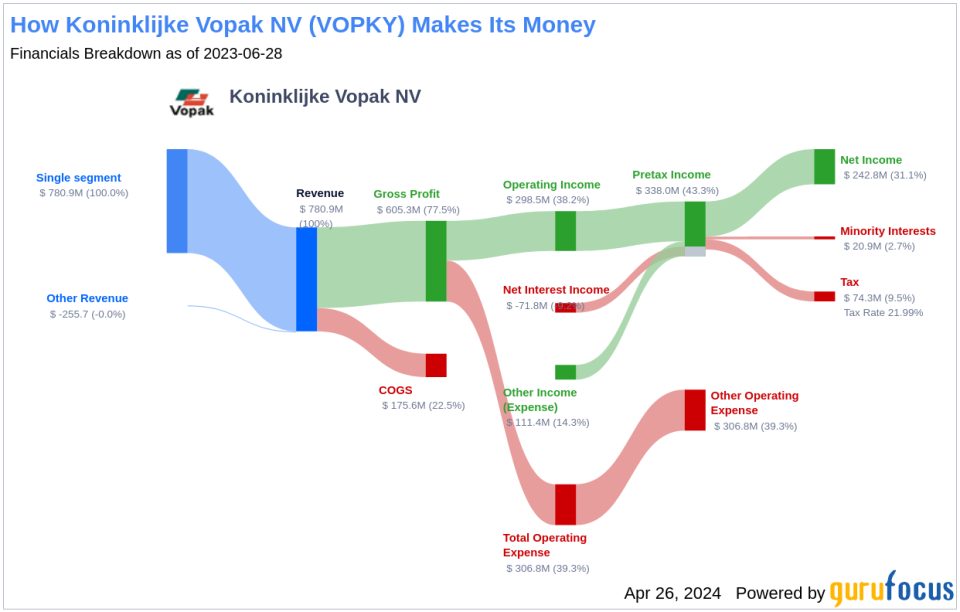

Koninklijke Vopak NV is a prominent tank storage provider for the oil and chemical industry. The company offers a range of services including storage facilities and handling for a diverse array of products such as oil, chemicals, gases, liquefied natural gas, and biofuels. It operates through six geographic segments, with the Netherlands being the most significant contributor to its revenue. This strategic positioning allows Koninklijke Vopak NV to cater to a global clientele with specialized storage needs.

A Glimpse at Koninklijke Vopak NV's Dividend History

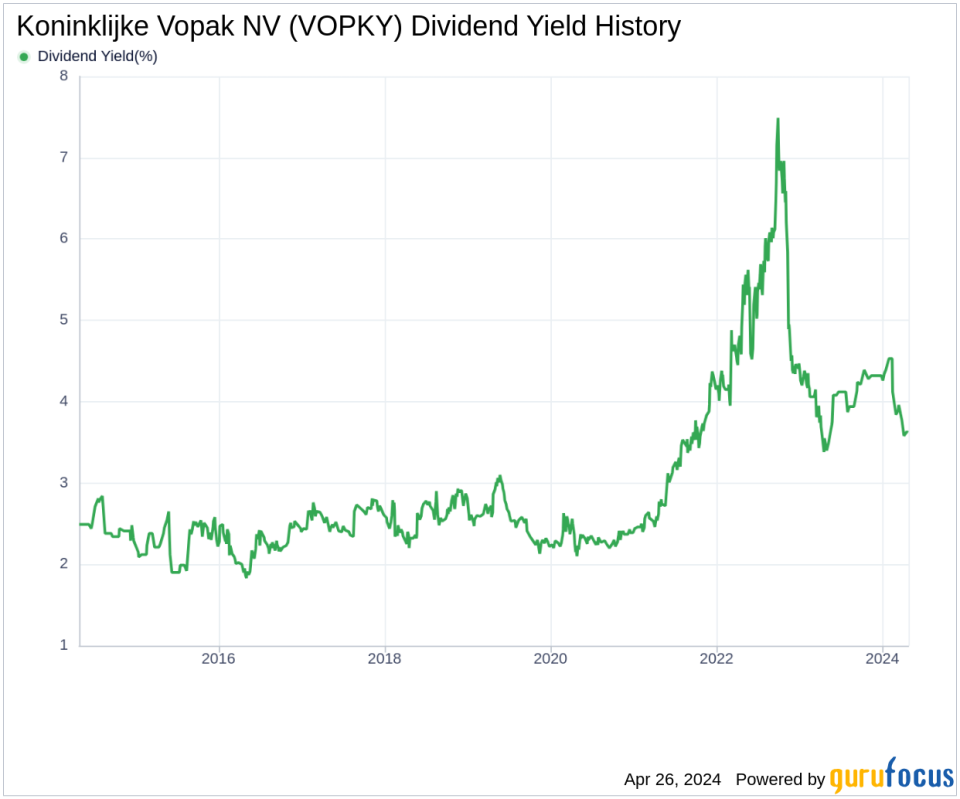

Koninklijke Vopak NV has demonstrated a robust commitment to returning value to its shareholders through consistent dividend payments since 2014. The company has chosen an annual distribution frequency for its dividends. Below is a chart illustrating the historical trends of the company's annual Dividends Per Share.

Breaking Down Koninklijke Vopak NV's Dividend Yield and Growth

Koninklijke Vopak NV's current 12-month trailing dividend yield stands at 3.62%, with a 12-month forward dividend yield of 4.12%. This forward-looking metric indicates an anticipated increase in dividend payments over the next year. Over the past three years, the annual dividend growth rate was 4.20%, which further increased to 4.40% over a five-year span. The long-term trend is also positive, with a decade-long annual dividends per share growth rate of 4.10%. Consequently, the 5-year yield on cost for Koninklijke Vopak NV stock is approximately 4.49%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a crucial indicator of dividend sustainability. Koninklijke Vopak NV's ratio of 0.39 as of 2023-12-31 implies that the company retains a healthy portion of its earnings, which bodes well for future growth and financial resilience. Additionally, the company's profitability rank of 7 out of 10 underscores its competitive earnings capacity. The company's track record of net profit in 9 out of the past 10 years reinforces its financial stability.

Growth Metrics: The Future Outlook

The future sustainability of dividends is anchored in a company's growth metrics. Koninklijke Vopak NV's growth rank of 7 out of 10 suggests a promising growth trajectory. However, its average annual revenue growth rate of 6.50% lags behind approximately 67.48% of global competitors. Moreover, the company's 3-year EPS growth rate of 11.60% per year also underperforms relative to approximately 60.6% of global competitors. Additionally, the 5-year EBITDA growth rate of 3.80% underperforms compared to approximately 68.59% of global competitors. These figures highlight areas where Koninklijke Vopak NV may need to focus to enhance its growth and ensure long-term dividend sustainability.

Engaging Conclusion

In conclusion, Koninklijke Vopak NV's dividend payments and growth rates reflect a company with a history of consistent shareholder returns. The favorable payout ratio and profitability rank suggest a sound financial base for sustaining dividends. However, the growth metrics indicate that while Koninklijke Vopak NV is performing well, there is room for improvement to stay competitive. Investors should consider these factors in their overall assessment of the stock's dividend attractiveness. Will Koninklijke Vopak NV's strategic initiatives enable it to outpace its growth metrics and continue its dividend legacy? For those interested in high-dividend yield stocks, GuruFocus Premium offers a comprehensive High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance